USD/JPY

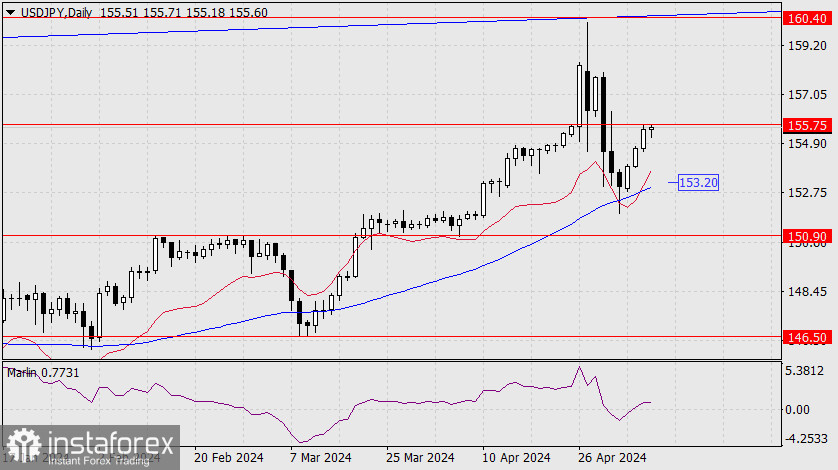

The USD/JPY pair started a significant correction after a sharp drop due to the Bank of Japan's currency intervention. The pair reached the target level of 155.75. If the price consolidates above this mark, it may rise to the 160.40 level, and numerous reports about how recent interventions are futile may prove to be well-founded and accurate.

However, for now, we will follow the main scenario, which implies a deeper decline towards the target levels of 150.90 and 146.50 (March lows). The first intermediate level is represented by the MACD line at 153.20. We can confirm this scenario once the Marlin oscillator signal line returns to negative territory. In fact, it is already turning downwards. The price must overcome yesterday's low of 154.57 in order for this to work.

On the 4-hour chart, the price is experiencing a narrow consolidation between the MACD line and the target level of 155.75. A prolonged consolidation works in favor of the bulls and increases the chances of realizing the alternative scenario. The Marlin oscillator is reluctantly falling. Market participants are likely assessing further prospects in the fight against the BOJ. We are awaiting further developments.