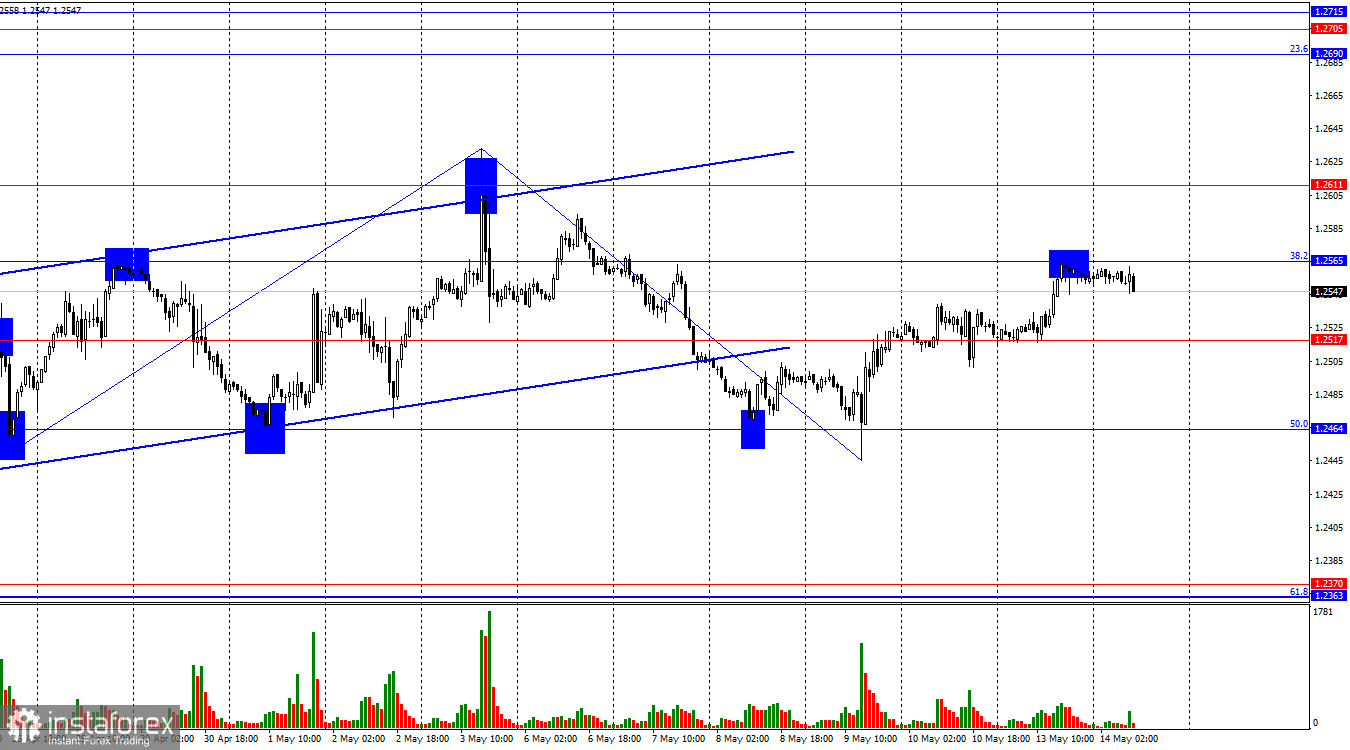

On the hourly chart, the GBP/USD pair on Monday saw a rise to the corrective level of 38.2% (1.2565), followed by a rebound from it. Thus, a reversal in favor of the US dollar was executed, which suggests a potential decline towards the level of 1.2517. Consolidation of the pair's rate above the level of 1.2565 will increase the probability of further growth towards the next level of 1.2611.

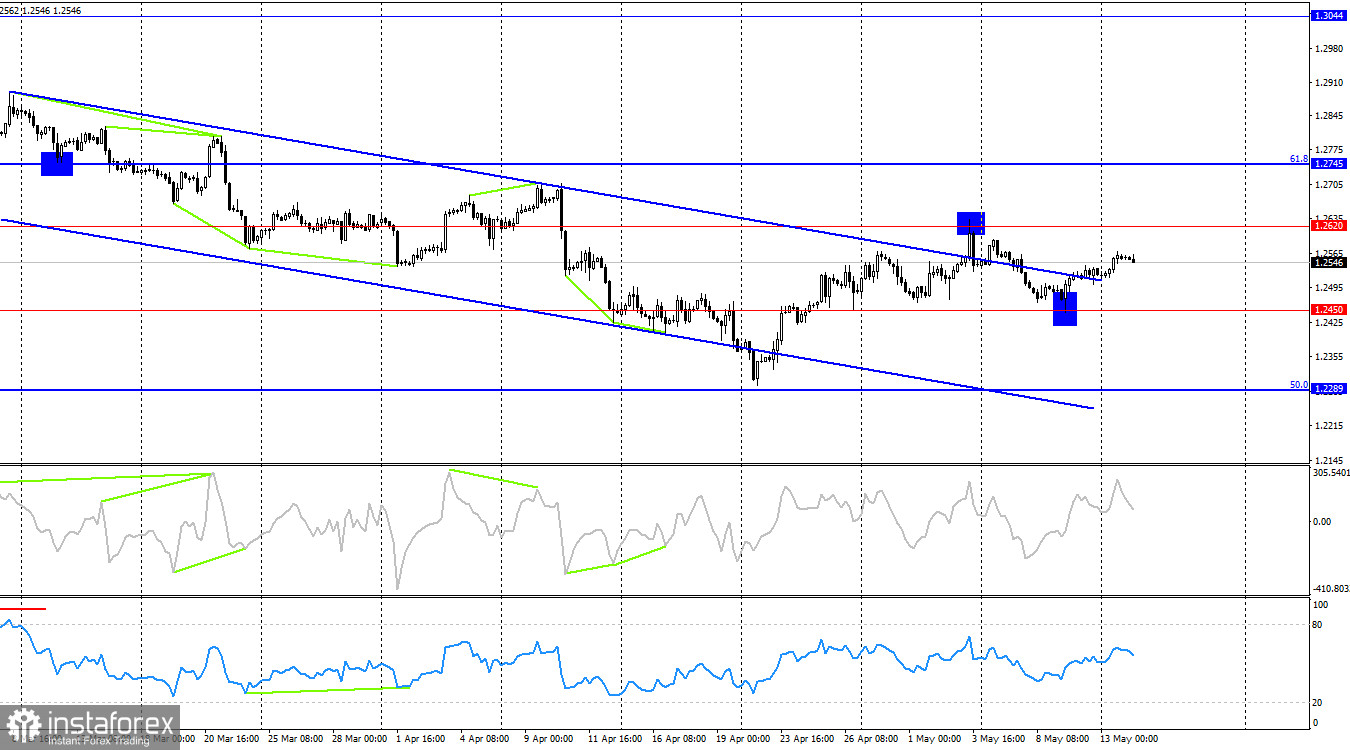

The wave situation remains unchanged. The last upward wave ended on May 3rd without surpassing the peak of the previous wave, and the new downward wave is likely already complete without breaking the low from April 22nd. Thus, the trend for the GBP/USD pair remains "bearish" (as strange as it may sound), with only one doubtful sign of its completion. If the new upward wave, which began on May 9th, surpasses the peak from May 3rd, then it will be possible to confirm the end of the "bearish" trend. However, the new upward wave may also turn out to be quite weak. In that case, doubts about the bulls' ability to continue attacking will remain.

In Britain this morning, the unemployment report was released. According to this report, the indicator rose to 4.3% in March. I don't consider this value too high, but unemployment has been rising for the third consecutive month. This is bad for the British economy, but the British pound and its sellers once again did not react to the negative report. The number of unemployed in Britain decreased by 85,000 in April, which is much better than traders' expectations. This report allowed the pound to maintain its position and the market to disregard the rise in unemployment in March. The latest report on wages showed a value of 5.7%, significantly higher than forecasts. Salaries are again increasing faster than expected, which could negatively impact the slowdown in headline and core inflation. This will allow the Bank of England to maintain its "restrictive" policy longer, which will support the British pound.

On the 4-hour chart, the pair rebounded from the level of 1.2450, which suggests a continuation of the upward movement towards the level of 1.2620. Trader activity in the market remains low, and it's difficult for me to imagine a news background that will continue to support the bulls. However, it cannot be denied that the pound may continue to rise as it has exited the descending trend channel.

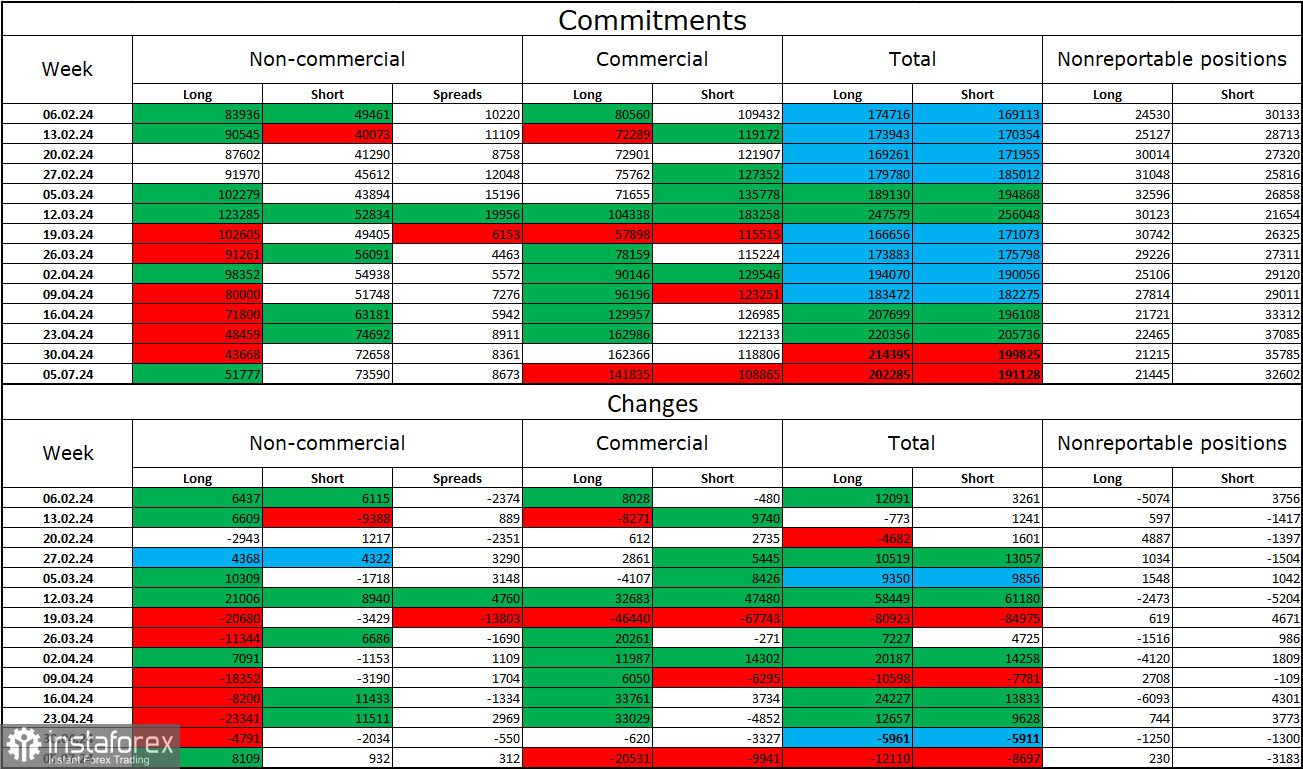

Commitments of Traders (COT) report:

The sentiment of the "non-commercial" trader category became less "bearish" over the past reporting week. The number of long contracts held by speculators increased by 8,109 units, while the number of short contracts increased by 932 units. The overall sentiment of major players has changed, and now the bears are dictating terms in the market. The gap between the number of long and short contracts stands at 22,000: 51,000 versus 73,000.

There are still prospects for a decline in the pound. Over the last three months, the number of long positions has decreased from 83,000 to 51,000, while the number of short positions has increased from 49,000 to 73,000. Over time, bulls will continue to liquidate buy positions or increase sell positions, as all possible factors for buying the British pound have already been worked out. Bears have demonstrated their weakness and complete reluctance to advance in the past few months, but I still expect the pound to start a stronger decline.

News Calendar for the US and UK:

UK - Unemployment Rate (06:00 UTC).

UK - Change in Unemployed (06:00 UTC).

UK - Change in Average Earnings (06:00 UTC).

US - Producer Price Index (12:30 UTC).

US - Speech by Federal Reserve Chairman Jerome Powell (14:00 UTC).

Tuesday's economic calendar contains several interesting reports, most of which are already available to traders. The impact of the news background on market sentiment for the remainder of the day will be moderate or weak.

Forecast for GBP/USD and Trader Advice:

Sales of the pound are possible on a rebound from 1.2565 on the hourly chart, with targets at 1.2517 and 1.2464. Purchases could have been considered on a rebound from the level of 1.2464 on the hourly chart, with targets at 1.2517 and 1.2565. Both targets have been achieved. New purchases are possible on a close above the level of 1.2565 with targets at 1.2611 and 1.2690.