As expected, the U.S. economy cools, and with it, interest in the dollar is declining. The American exceptionalism, where the U.S. significantly outpaced other major world economies in growth rates, is a thing of the past, which led to a EUR/USD rally. It is unclear what the bulls were more excited about: the inflation data matching forecasts or the disappointing retail sales report.

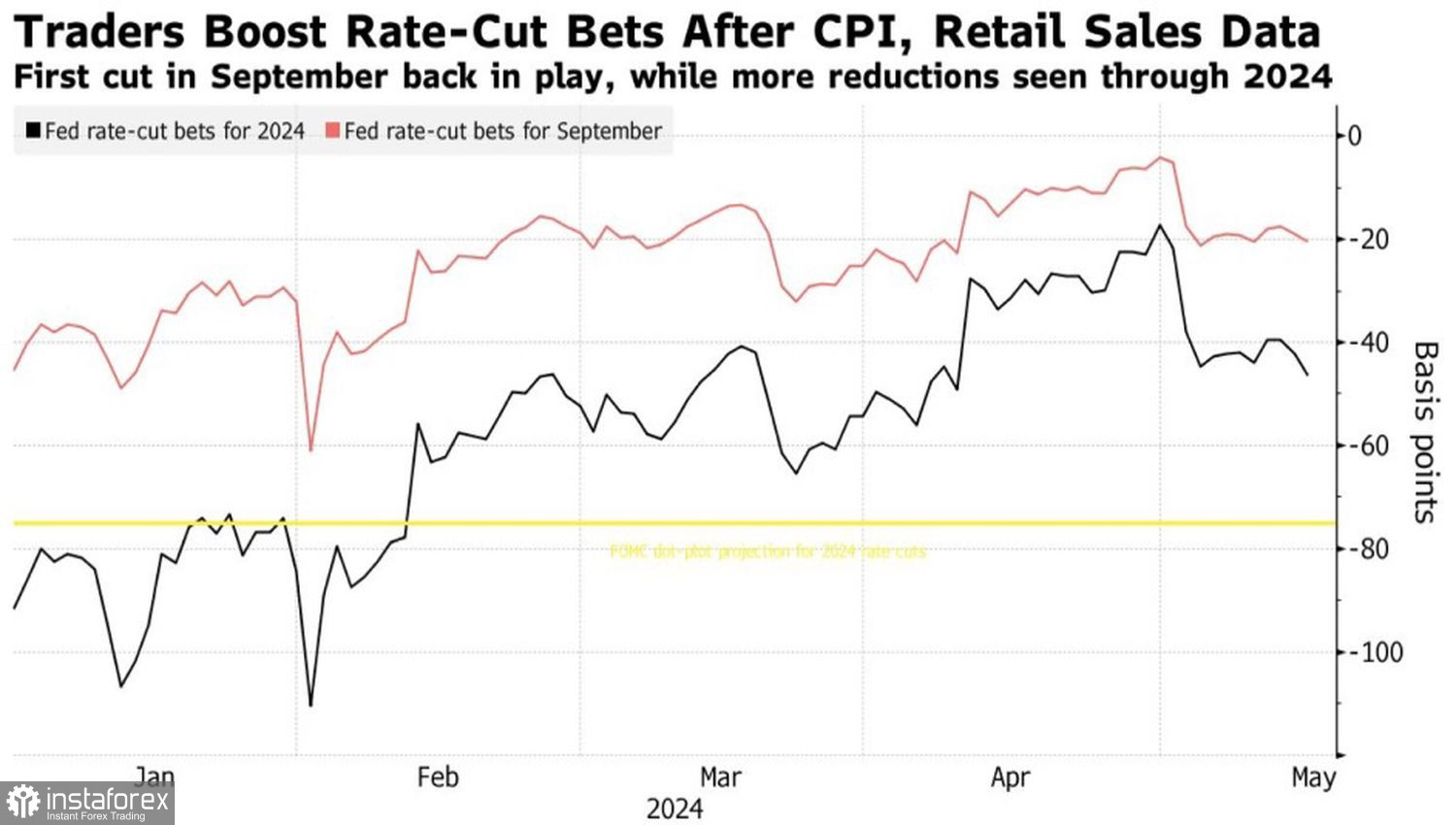

The Consumer Price Index (CPI) rose 0.3% over the previous month and 3.4% over the prior year in April, while core CPI gained 0.3% in April from the previous month, and it climbed 3.6% from year-ago levels. The latter was the lowest since April 2021, making it possible for the Federal Reserve to breathe a sigh of relief. After three months of accelerating CPI, US consumer inflation resumes its downward trend. This provides an opportunity to move away from the policy of patience that Fed Chairman Jerome Powell talked about the other day and return to the idea of lowering the federal funds rate. The futures market suggests an 80% probability that this will happen in September. Derivatives predict that the Fed will lower rates by nearly 50 basis points in 2024.

Market expectations for the federal funds rate are evolving

In a strong economy, inflation should be high; in a cooling one, it should slow down. The cooling trend in the U.S. is indicated by the decline in retail sales, excluding gasoline and automobiles, by 0.1% in April. The main indicator remained at the same level, contrary to the forecasted growth of 0.4%. Consumers are tightening their wallets in the face of high interest rates, even with a strong labor market. But this cannot last indefinitely. The U.S. economy is cooling on all fronts, leading to a U.S. dollar sell-off against major world currencies.

The euro appears to be one of the main beneficiaries of a weak dollar. The market seems to have accepted the European Central Bank's decision to lower the deposit rate by 25 basis points to 3.75% in June. However, the ECB's future course of actions remain uncertain. Klaas Knot, the head of the Dutch Central Bank, calls for vigilance. He suggests that the U.S. example, where inflation began to accelerate again after several months of steady decline, should make the ECB take a cautious approach. In addition, low labor productivity forces companies to increase labor costs, which will keep prices at a high level.

Derivatives anticipate that the ECB will cut rates by 75 basis points and the Fed by 50 basis points in 2024. As a result, the gap will be 213 basis points. The last time the EUR/USD pair traded near parity, the gap was 238 basis points. However, this time might be different. The slowdown in the U.S. economy will reduce the difference in effective rates and push the EUR/USD pair upwards.

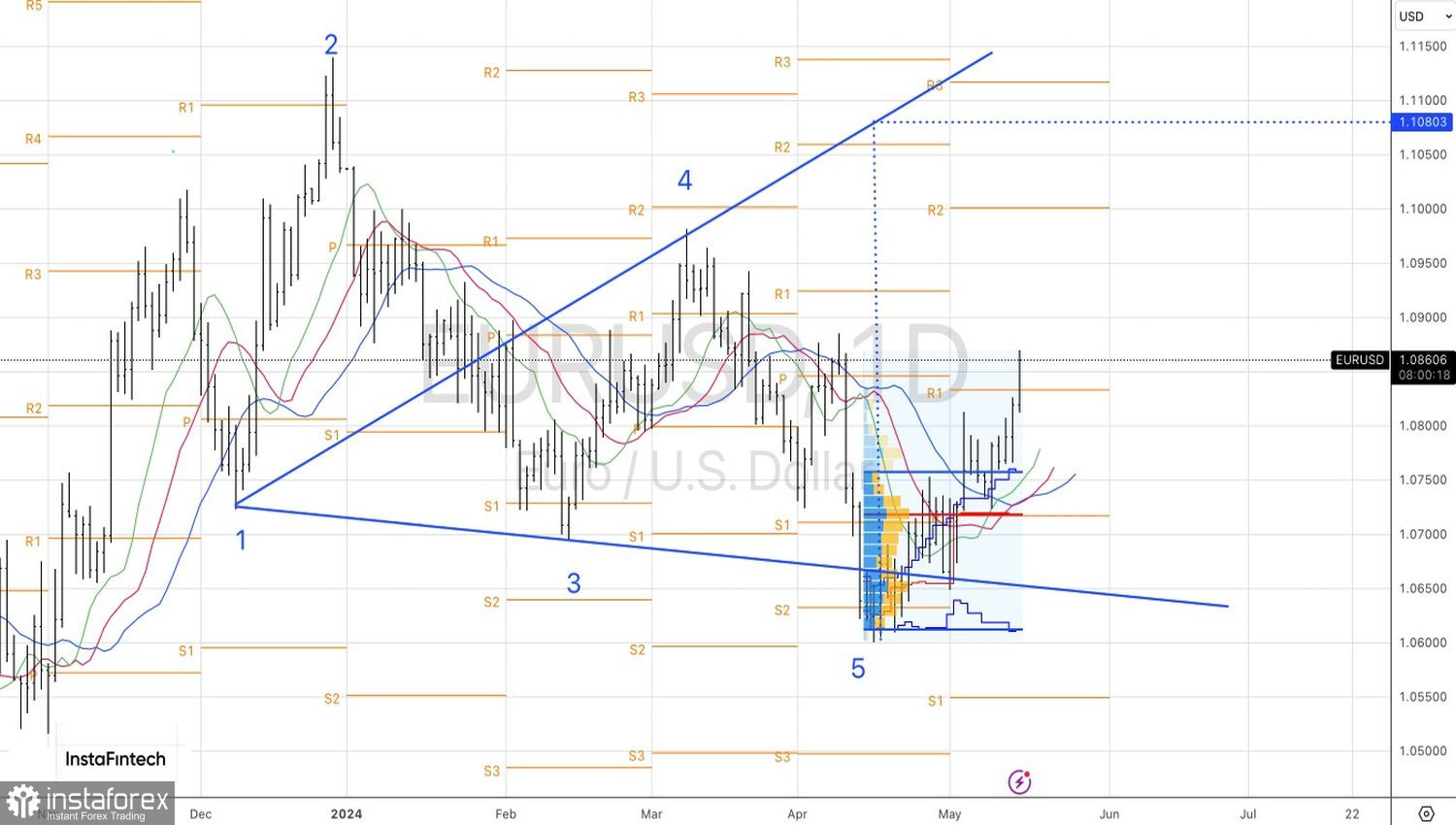

Technically, on the daily chart, the EUR/USD is gaining momentum in an upward trend. The price successfully breached the pivot level at 1.0835 on the first attempt. As long as the euro trades above this level, the focus should be on buying it against the U.S. dollar. The target is 1.108, based on the Wolfe Wave pattern.