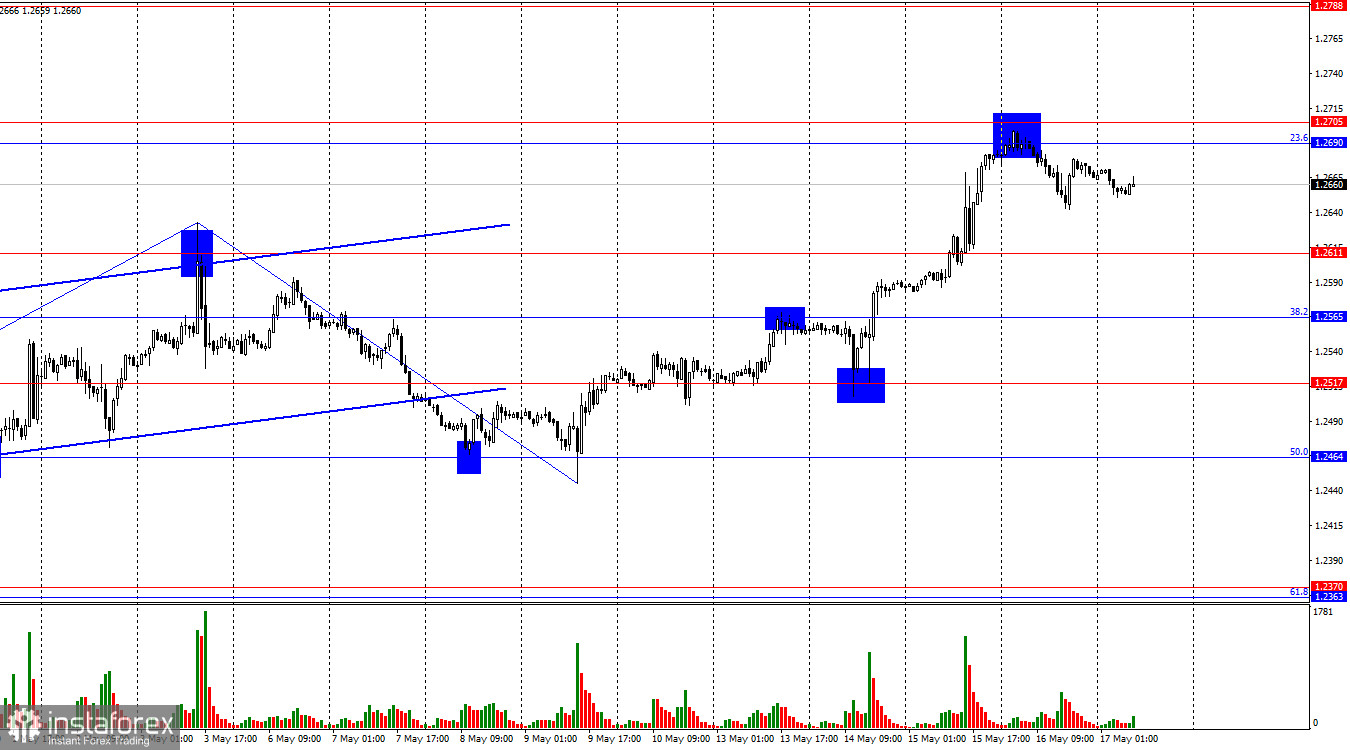

The wave situation remains unchanged. The last downward wave ended on May 9th without breaking the low of the previous wave, and the new upward wave broke the peak on May 3rd. Thus, the trend for the GBP/USD pair has turned bullish. However, this bullish trend might be short-lived, as the current information background does not seem strong enough for the pound to sustain several more upward waves. Nevertheless, the first sign of the end of the bullish trend will appear only when a new downward wave manages to break the low of the previous wave from May 9th. The pound must fall by 240–250 points from the current price.

The pound continues to bask in the limelight. Although not all of the information in the background supports the bulls, the bears cannot counter them. Yesterday, disappointing economic data came from America. Industrial production did not grow as traders had expected. The Philadelphia business activity index was below forecasts. And the number of building permits issued needed to meet market expectations. Thus, the bulls had another opportunity to attack yesterday, but they paused, having already pushed the pound up quite well. The bears undoubtedly may counterattack, but they might need more strength to form a large wave.

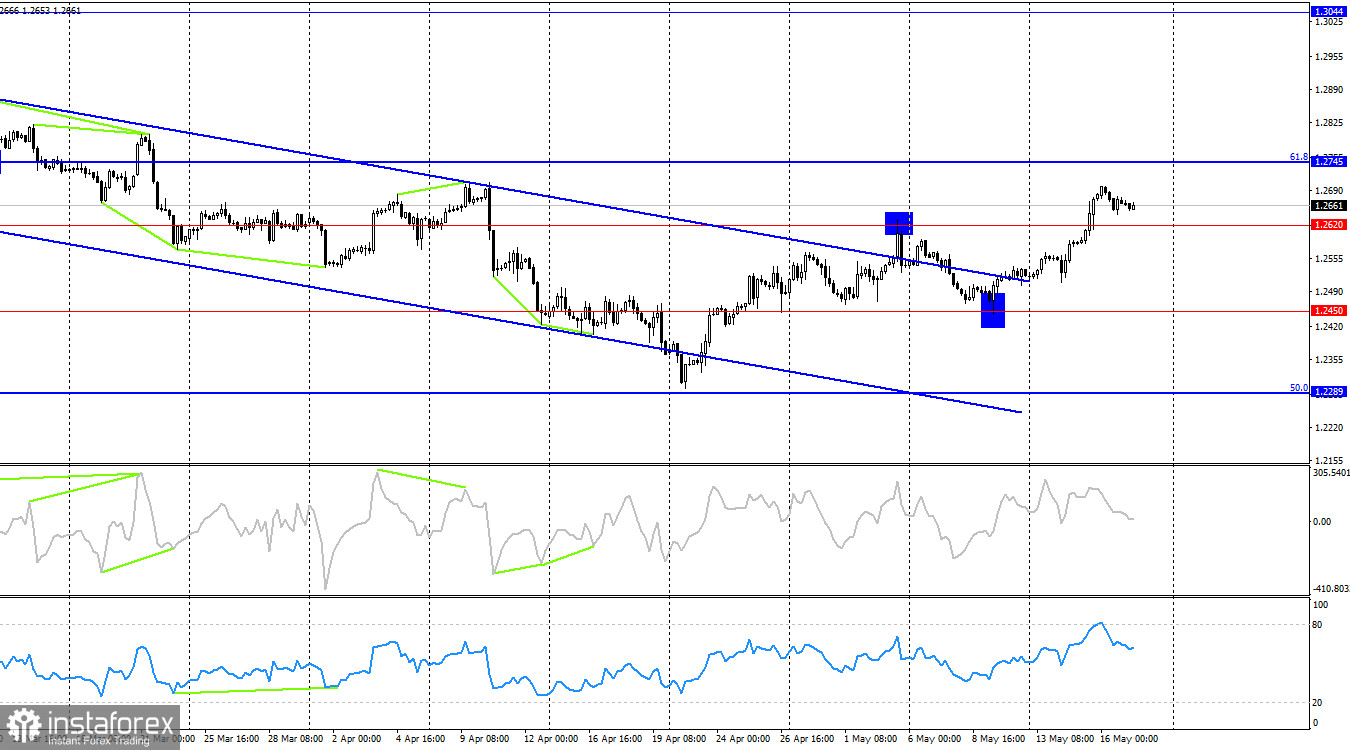

On the 4-hour chart, the pair consolidated above the level of 1.2620, which suggests the possibility of continued growth towards the corrective level of 1.2745. I need help to imagine an information background that will continue to support the bulls. However, it cannot be denied that the pound may continue to rise, given the breakout from the downward trend corridor. A rebound from the 1.2745 level might cool the bulls' ardor, which has been running high lately.

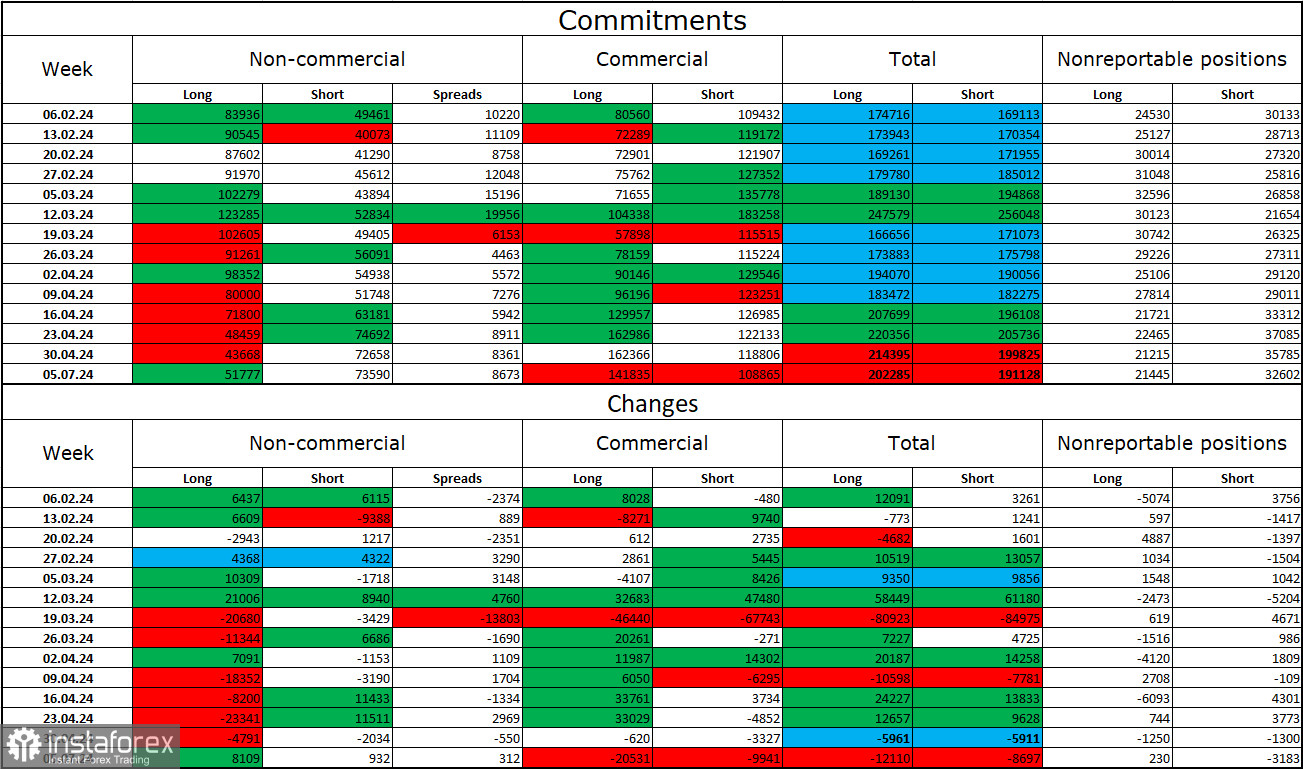

Commitments of Traders (COT) Report:

The sentiment of the "non-commercial" category of traders became less bearish over the past reporting week. The number of long contracts held by speculators increased by 8,109 units, while the number of short contracts increased by 932. The overall sentiment of large players has changed, and now the bears are dictating their terms in the market. The gap between the long and short contracts is 22 thousand: 51 thousand against 73 thousand.

The pound still has prospects for a decline. Over the past three months, the number of long contracts has decreased from 83 thousand to 51 thousand, while the number of short contracts has increased from 49 thousand to 73 thousand. Over time, the bulls will continue to reduce their buy positions or increase their sell positions, as all possible factors for buying the British pound have already been exhausted. The bears have shown weakness and complete reluctance to go on the offensive in recent months, but I still expect the pound to start a stronger decline.

News calendar for the US and the UK:

The economic events calendar does not contain any interesting entries for Friday. This background information will have no impact on market sentiment for the rest of the day.

Forecast for GBP/USD and trading tips:

Selling the pound was possible on a rebound from the resistance zone on the hourly chart at 1.2690–1.2705, with targets at 1.2611 and 1.2565. The pound cannot rise forever. Buying can be considered upon closing above the 1.2705 level, with targets at 1.2788–1.2801. Regarding rebounds from the levels of 1.2611 and 1.2565 on the hourly chart, the target is the 1.2690–1.2705 zone.