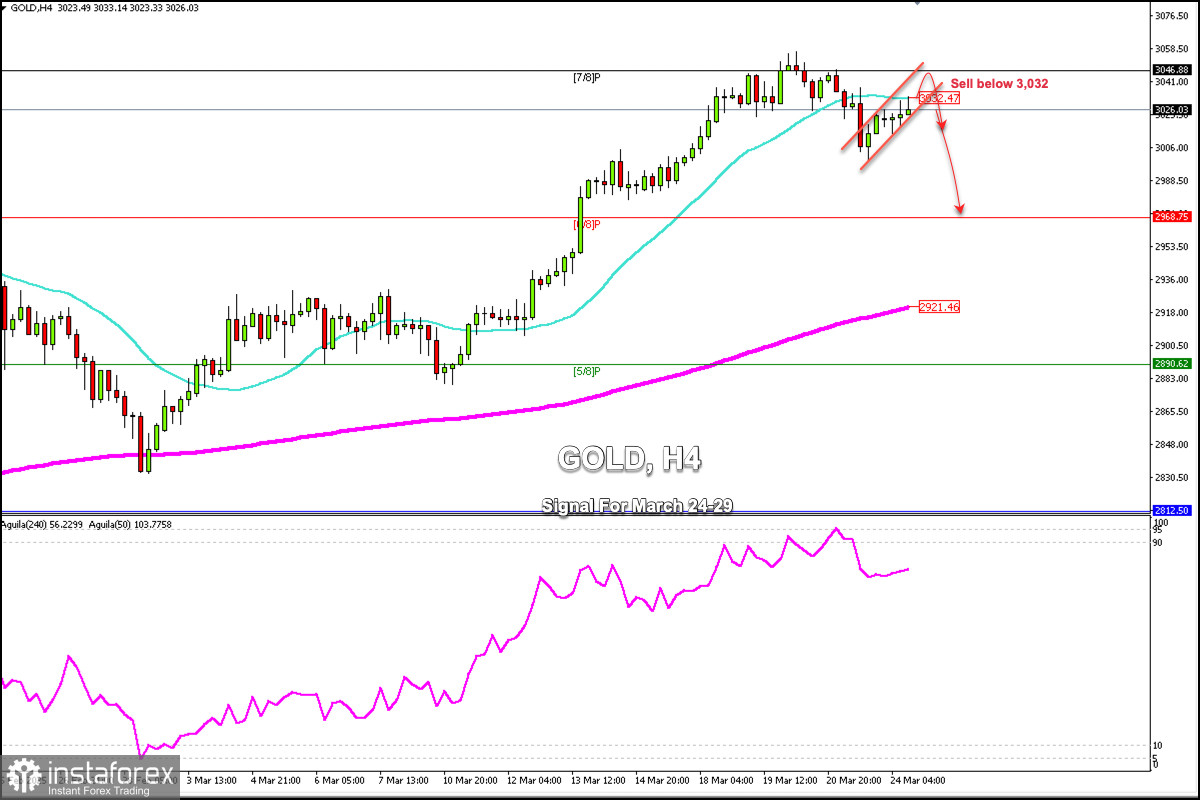

Early in the American session, gold is trading at 3,026, below the 21st SMA and below the 7/8 Murray level. We expect consolidation below this area in the coming hours.

After reaching a high of $3,058 and following a technical correction toward the psychological level of $3,000, gold has rebounded and is now consolidating below the 21st SMA, forming a bearish continuation pattern.

If there is a drop below 3,025, the outlook could be negative, and we could sell and expect gold to reach 6/8 Murray at 2,968 in the coming days.

The weekly pivot point is around 3,027. So, we believe that if the gold price consolidates below this area in the coming days, it could have a bearish sequence. We could then expect a technical correction to occur until the weekend.

On the other hand, if gold consolidates above 3,032, we could expect it to reach the last resistance around 3,046 (7/8 Murray), which will also be seen as an area to sell.

The eagle indicator is reaching overbought levels, so we believe a technical correction could occur in the coming days, before resuming its bullish cycle.