The euro managed to take the opponent's serve when the US dollar weakened against major global currencies following the release of US inflation data for April. Will the greenback be able to make a comeback? The FOMC meeting minutes are far from the key event of the week leading up to May 24. Reports on European wages and business activity are much more important. The serve is in the hands of the EUR/USD bulls, but will they be able to capitalize on it?

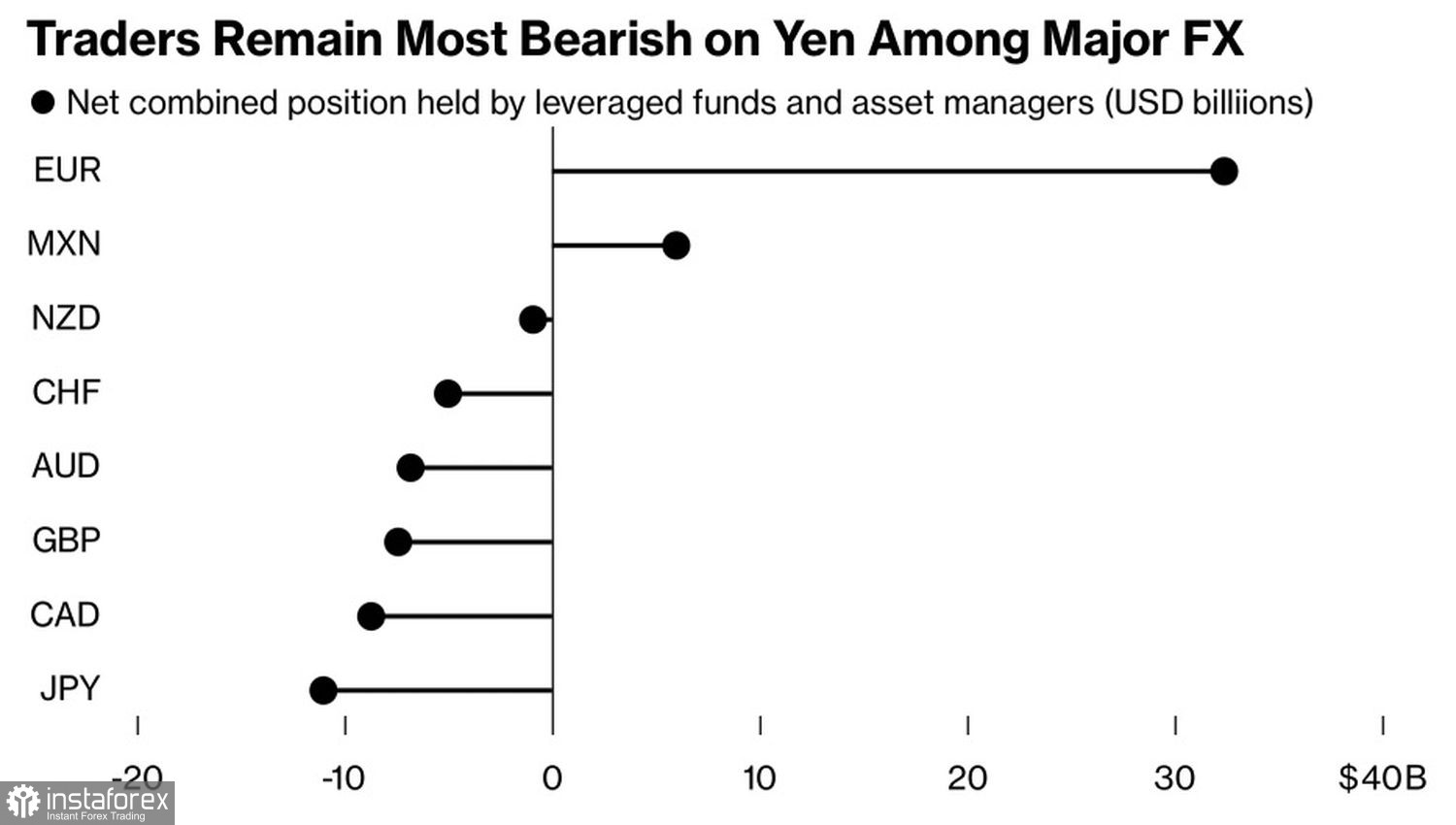

The flight of investors from the US dollar resulted in an increase in speculative long positions in other global currencies. One of the main beneficiaries has been the euro. Hedge funds and asset managers have been snapping up the regional currency like hotcakes, even faster than the super-peso from Mexico.

Speculator positions in Forex

It is clear that the European Central Bank's rate cut in June has been fully priced in. Moreover, Governing Council officials are not rushing to continue the cycle of monetary policy easing. The head of the Bank of Slovenia, Bostjan Vasle, noted that further actions will depend on data. German official Isabel Schnabel even stated that based on current data, a rate cut in July does not seem warranted. It is necessary to look at wage dynamics, productivity, and how higher costs are being passed on by companies to the economy.

In this regard, the data on harmonized wages in the eurozone could be a strong argument in favor of buying the euro or, conversely, might force the bulls to retreat. UniCredit forecasts that in the first quarter, the figure will slow from 4.5% to 4.2%. If this does not happen, a rate cut in July will become problematic.

Dynamics of European wages and inflation

The dynamics of European business activity for May is equally intriguing. It provides insight not only into the GDP for the second quarter but also into the divergence in economic growth. It is no secret that the divergence has been the main driver behind the reversal of the downward trend in EUR/USD. If the actual data exceeds Bloomberg experts' expectations for PMI growth to 46.2 in the manufacturing sector and 53.4 in the services sector, the major currency pair will surge.

As for the minutes of the FOMC meeting from April 30 to May 1, these are lagging data. By that time, the Federal Reserve did not have figures for the labor market or April inflation. The central bank was concerned about accelerating consumer prices, so a hawkish tone is not out of the question. However, it is unlikely to scare financial markets. Much has changed since then.

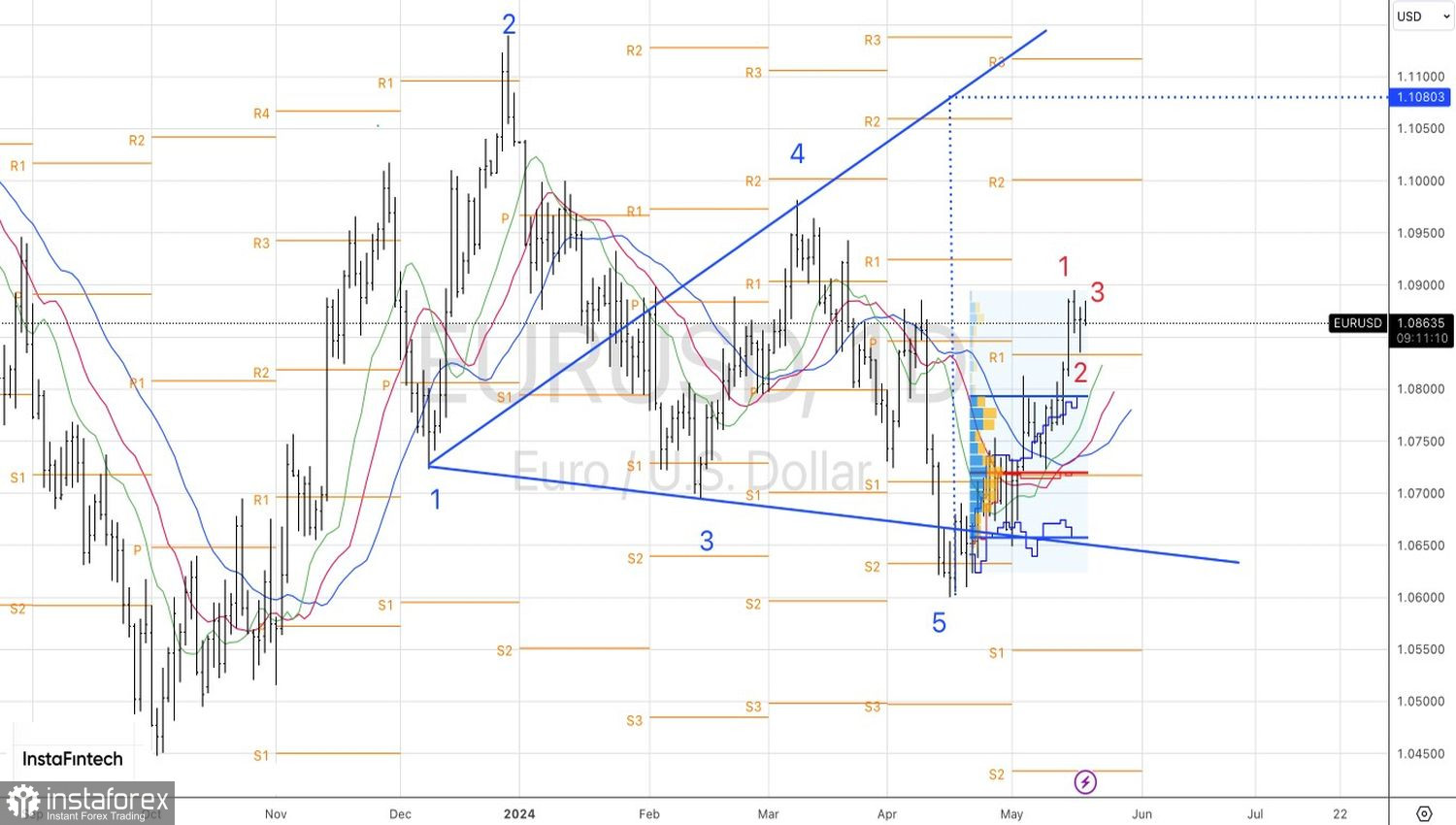

Technically, on the daily chart, the EUR/USD might activate the 1-2-3 reversal pattern, signaling the start of a corrective downward movement. The key point is a breakthrough of the support at 1.083. If the bears manage to do this, short-term short positions will become interesting. As long as the pair trades above this pivot level, we stick to a buying strategy with a target based on the Wolfe Wave pattern at 1.108.