GOLD

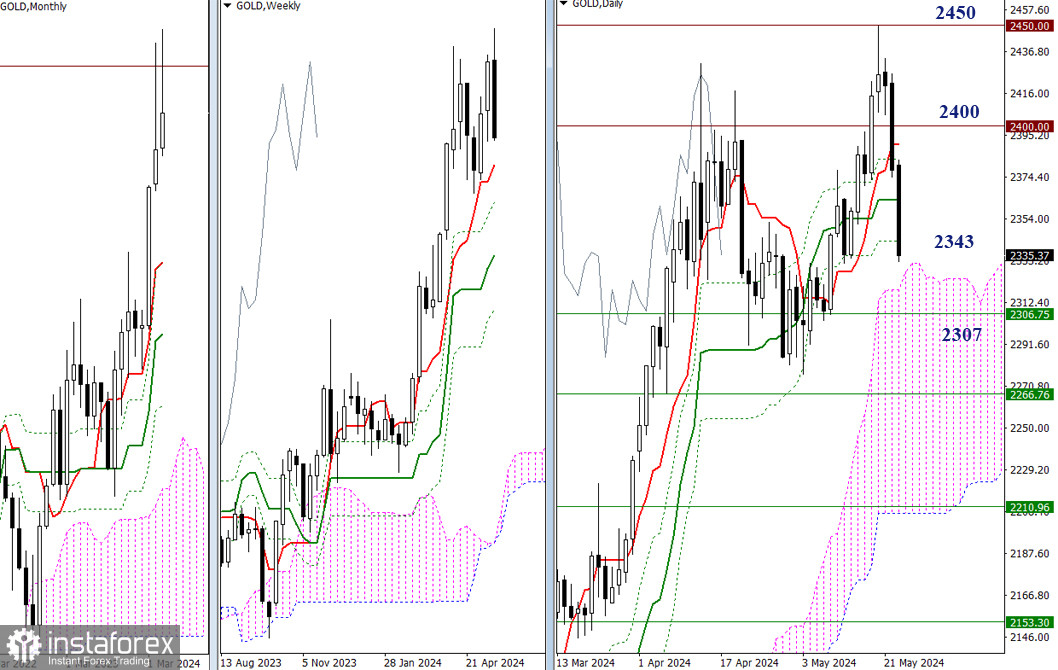

Gold has been actively declining for the second consecutive day, forming a weekly rebound from an important level (2450) that was tested on Monday. If this distinct rebound is confirmed and continues to progress next week, then May will likely exhibit a bearish bias, which could significantly reshape the trend. The bears' task is to break through and eliminate the daily Ichimoku dead cross (final level at 2343). The next target is the daily cloud (2319-27), reinforced by the weekly short-term trend (2307). The result will determine market development in this area.

H4 - H1

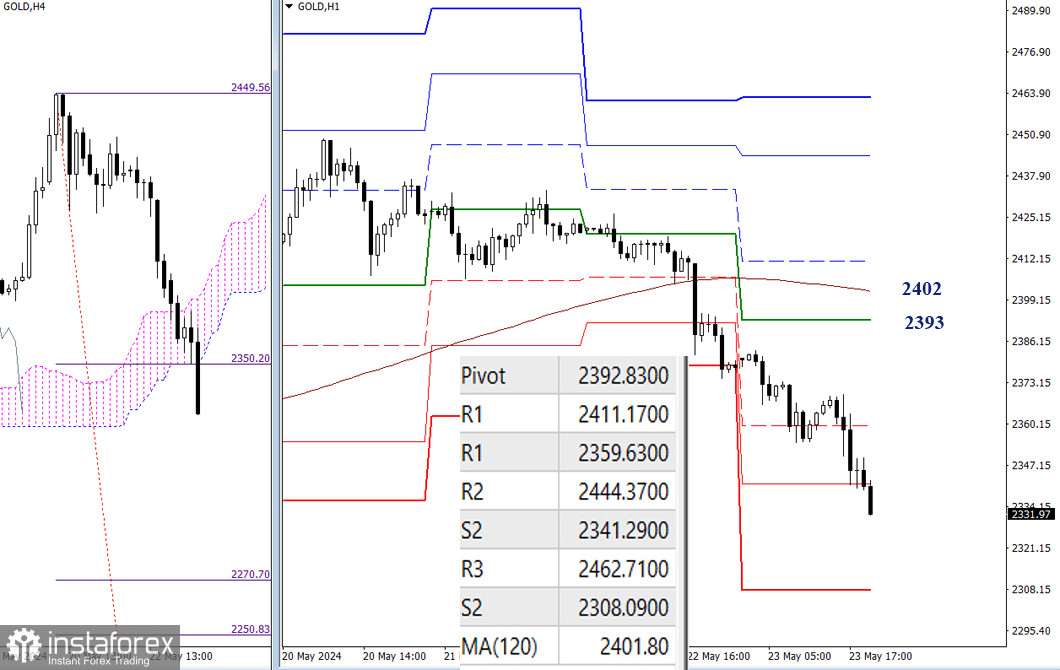

Yesterday's breakthrough of the weekly long-term trend led to a reversal of the moving average, so now the bears have the main advantage. This has been confirmed, and the instrument continued to fall. Another bearish target is forming – aiming to break through the H4 cloud. By now, two supports have been breached on the daily timeframe, with the third level of the classic Pivot points S3 (2308) as a bearish target. Key levels responsible for the current balance of power on the lower timeframes are now acting as resistance, consolidating their efforts in the narrow range of 2393 (central daily Pivot level) and 2402 (weekly long-term trend). If priorities change once again, the bulls will need to reclaim these key levels and reverse the long-term trend (2402).

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)