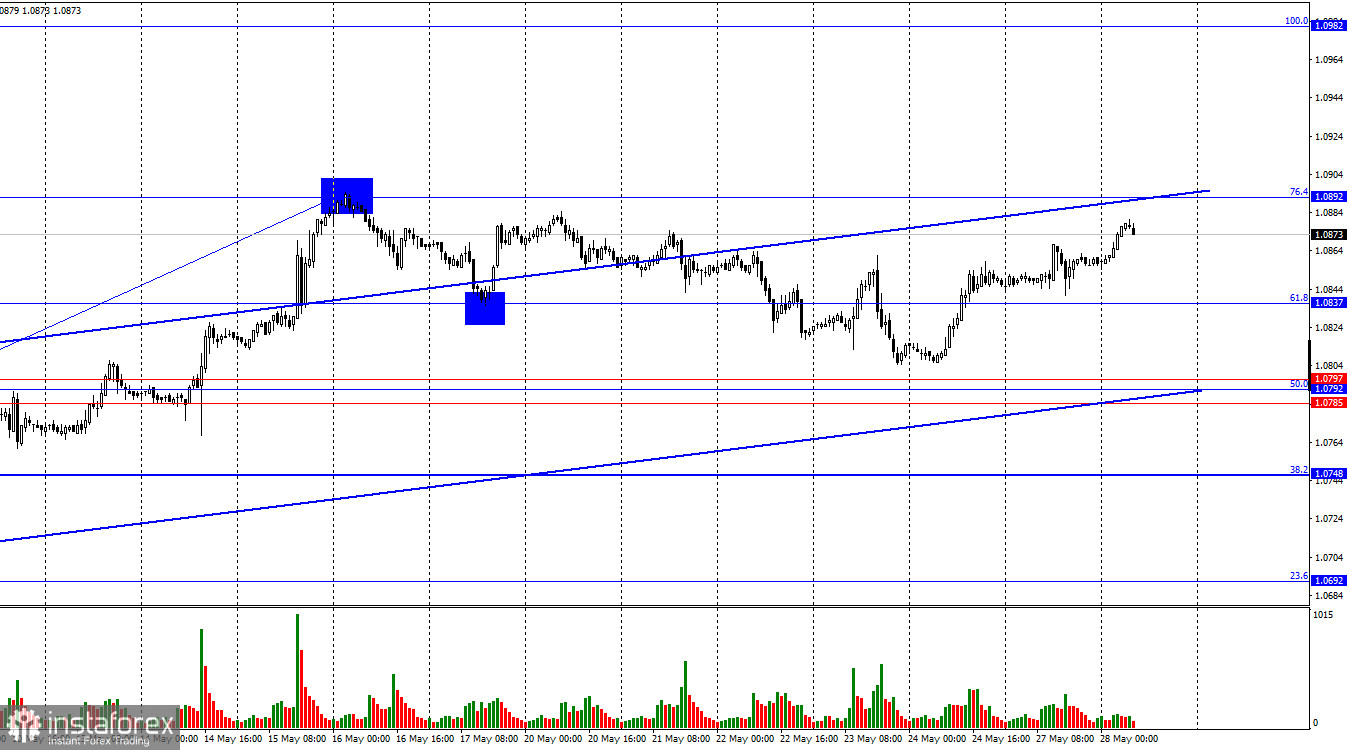

On Monday, the EUR/USD pair continued to rise within the ascending trend channel towards the corrective level of 76.4% (1.0892). A rebound from this level would favor the US dollar and lead to some decline towards the Fibonacci level of 61.8% (1.0837). Consolidation above 1.0892 will increase the likelihood of continued growth towards the next Fibonacci level of 100.0% (1.0982). Bulls have full control of the market.

The wave pattern remains clear. The last upward wave broke the previous wave's peak, and the last downward wave (from May 16 to May 23) was not even close to the previous wave's low. Thus, the "bullish" trend persists. I consider this trend quite unstable and believe it will only continue briefly. However, the price has been rising for over a month, and the bears have been unable to push the pair down to the lower line of the corridor. There are no signs of the "bullish" trend ending now. Such a sign will appear if the new upward wave does not break the May 16 peak.

There was no significant news background on Monday. Nevertheless, bullish traders continued to attack and raised the euro's exchange rate by another 25 pips. I believe bullish traders are so strong now that they do not need supportive information. The euro is growing well even without it. If news this week supports the euro, we could see it rise to 1.0982. Since the bulls are on the move, this target looks likely. As for the bears, they are so weak that they cannot even form a corrective wave. Regardless of the news from the US, they cannot counter the bulls at this time. Even news about the upcoming ECB rate cut does not help the US dollar. It all points to the euro continuing to rise this week.

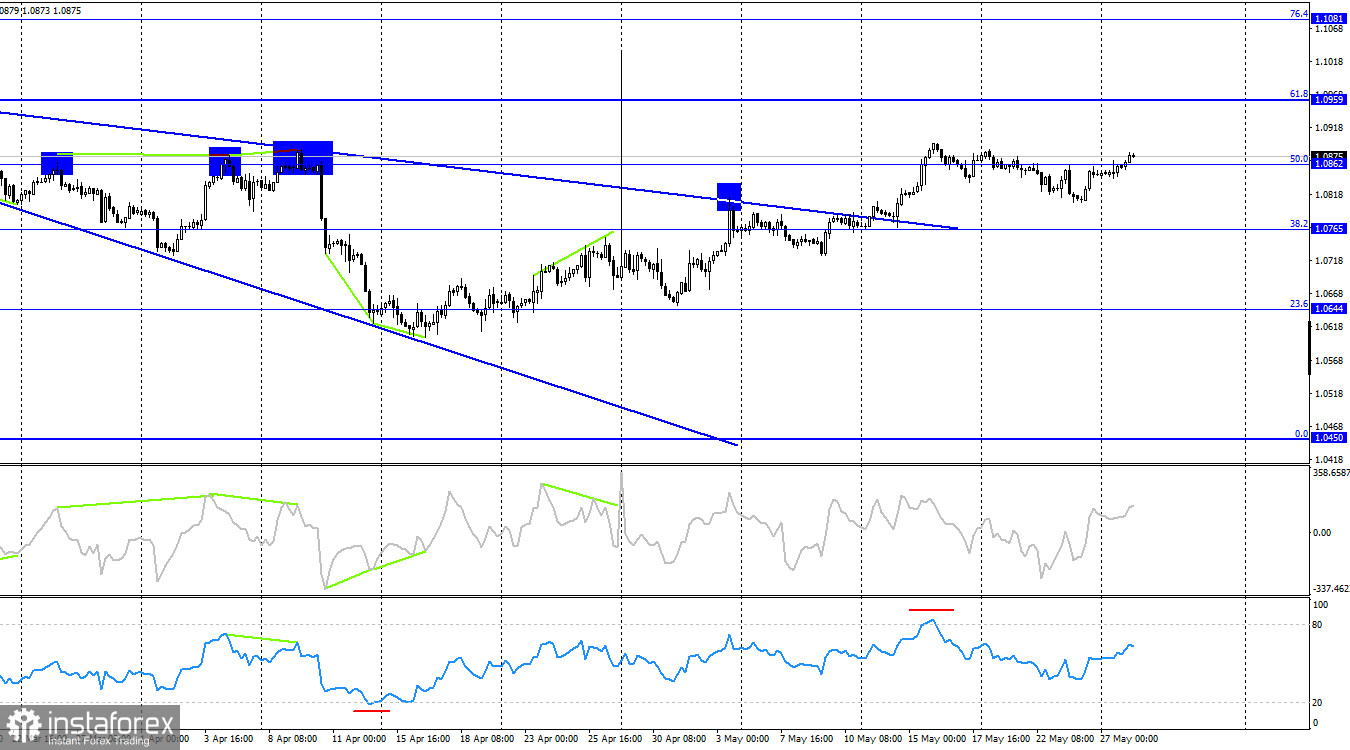

On the 4-hour chart, the pair consolidated above the "wedge" and rose to the 50.0% Fibonacci level at 1.0862. The latest segment of the euro's growth seems somewhat ambiguous, but graphical analysis supports the pair's growth. No emerging divergences are observed today. If it closes above 1.0862, the growth process may continue towards the next correction level at 61.8%—1.0959. It's better to monitor the pair's decline on the hourly chart.

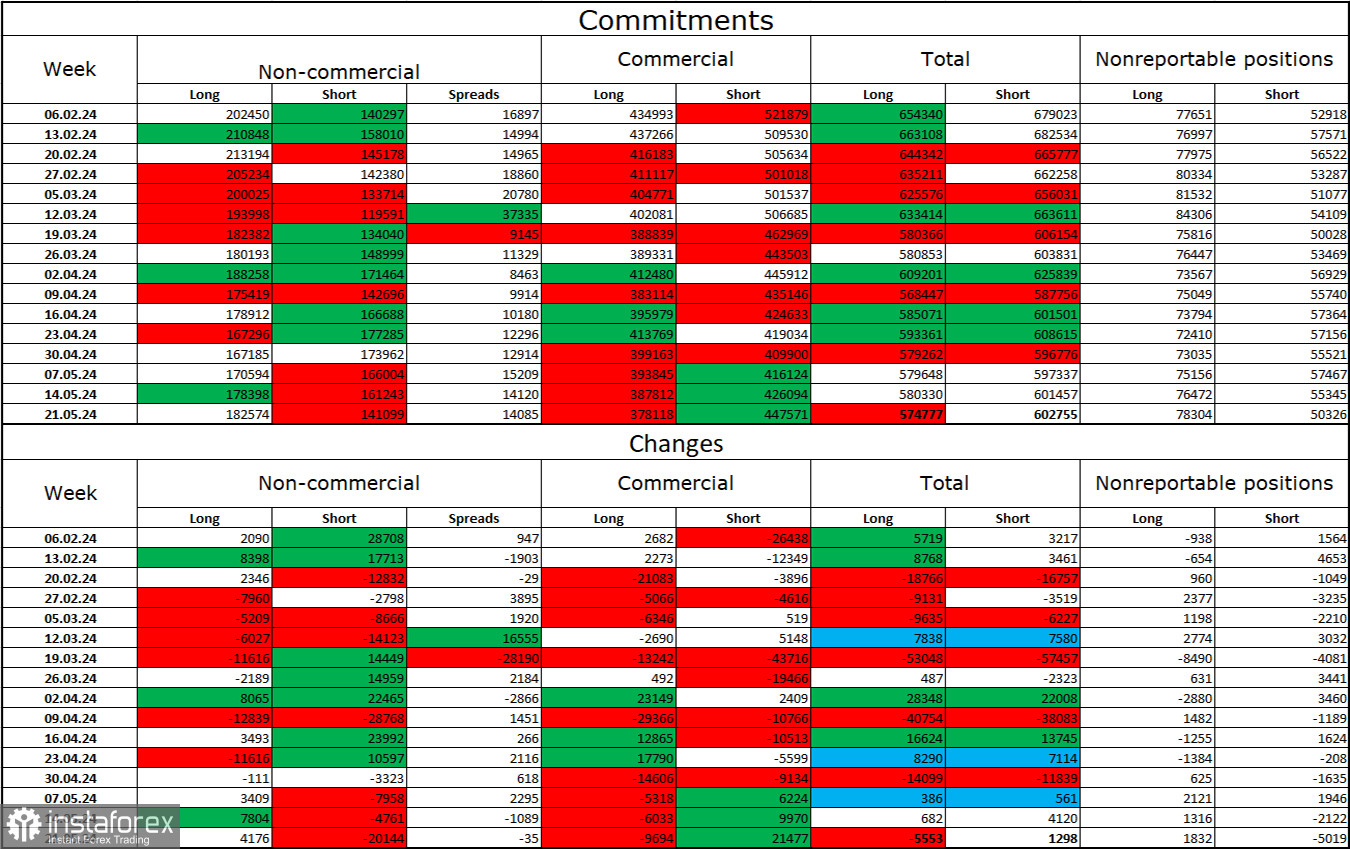

Commitments of Traders (COT) Report:

During the last reporting week, speculators opened 4,176 Long contracts and closed 20,144 Short contracts. The sentiment of the "Non-commercial" group turned "bearish" a few weeks ago, but now the bulls have the advantage again. The total number of Long contracts speculators hold is 182,000, while Short contracts are 141,000. The gap is widening in favor of the bulls.

However, the situation will continue to shift in favor of the bears. I see no long-term reasons to buy the euro, as the ECB is ready to start easing monetary policy, which will lower the yield on bank deposits and government bonds. In the US, yields will remain high, making the dollar more attractive to investors. However, at this time, it is important to respond to graphical analysis and COT reports, which indicate a persistent "bullish" sentiment.

Economic Calendar for the US and the Eurozone:

The economic events calendar contains no interesting entries on May 28. Therefore, the impact of the news background on trader sentiment will be absent today.

Forecast for EUR/USD and Trading Tips:

Sales of the pair were possible upon closing below the level of 1.0837 with a target of 1.0785. This target has yet to be achieved. New sales are possible on a rebound from the level of 1.0892 with a target of 1.0837. Purchases of the euro were possible upon closing above 1.0837 on the hourly chart with a target of 1.0892.