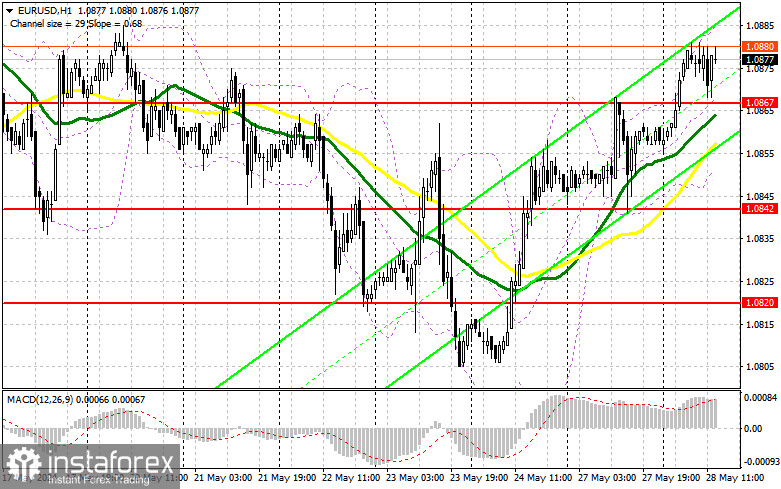

In my morning forecast, I paid attention to the 1.0867 level and planned to enter the market from it. Let's look at the 5-minute chart and figure out what happened there. The decline and the formation of a false breakdown led to a signal to buy the euro, which, at the time of writing, resulted in only a 13-point increase in the pair. In the afternoon, the technical picture still needed to be revised.

To open long positions on EURUSD, you need:

The low volatility against the background of the lack of statistics on the United States did not help euro buyers much. More precisely, it helped, but it has yet to reach the development of a new wave of growth. Now, everything will depend on the US data and on the figures for the consumer confidence indicator, which has not been particularly famous for good indicators lately. Even this year, there has not been a month for the indicator to grow compared to the past, so today, we can count on a downward trend, which will become a catalyst for growth for the European currency and put pressure on the dollar. The figures on the change in the housing price index in the 20 largest S&P/Case-Shiller cities in the USA are unlikely to have much effect on the pair. The optimal strategy will be to buy on a decline of around 1.0867, similar to what I discussed above. I will open long positions there only after the formation of a false breakout, which will be a suitable option to enter the market based on growth and a test of a new resistance of 1.0894. A breakout and a top-down update of this range will strengthen the pair with a chance of building a new uptrend and a breakthrough to 1.0918. The farthest target will be a maximum of 1.0942, where I will record profits. With the option of a decrease in EUR/USD and a lack of activity in the 1.0867 area in the afternoon, and there are also moving averages playing on the buyers' side, the pressure on the market will return, which will lead to a larger drop in the pair to the 1.0842 area. I will also enter there only after the formation of a false breakout. I plan to open long positions immediately for a rebound from 1.0820 with the aim of an upward correction of 30-35 points within the day.

To open short positions on EURUSD, you need:

Sellers have a chance to bring the market back under control, but first, it would be nice to declare themselves in the resistance area of 1.0894, where movement may occur in case of weak US data. Only a false breakout there will give an entry point into new short positions against the trend with the prospect of a decline in the euro and an update of support at 1.0867, which the bulls managed to hold during European trading. A breakout and consolidation below this range and a reverse bottom-up test will give another selling point, with the pair moving to the low of 1.0842, where I expect to see a more active manifestation of buyers. The farthest target will be a minimum of 1.0820, where I will record profits. In the event of an upward movement of EUR/USD in the afternoon and the absence of bears in the area of the monthly maximum of 1.0894, buyers will be able to regain the market. In this case, I will postpone sales until the test of the next resistance of 1.0918. I will also sell there, but only after an unsuccessful consolidation. I plan to open short positions immediately for a rebound from 1.0942 with the aim of a downward correction of 30-35 points.

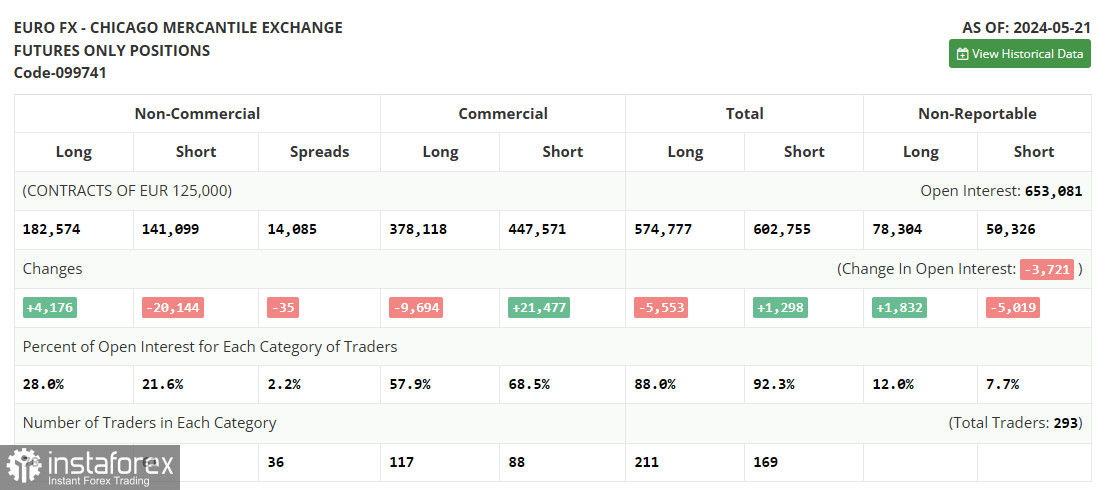

The COT report (Commitment of Traders) for May 21 showed an increase in long positions and a reduction in short ones. The more active reduction of short positions is due to statements by representatives of the European Central Bank and their desire to lower interest rates as soon as possible, giving the eurozone economy a chance to recover in the second half of the year. Buyers of risky assets will receive this despite the rather small chances of seeing several more rate cuts before the end of the year. The COT report indicates that long non-profit positions increased by 4,176 to 182,574, while short non-profit positions fell by 20,144 to 141,099. As a result, the spread between long and short positions fell by 35.

Indicator signals:

Moving averages

Trading is conducted above the 30 and 50-day moving averages, which indicates further pair growth.

Note: The author considers the period and prices of the moving averages on the hourly chart H1, which differs from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline, the indicator's lower limit, around 1.0845, will act as support.

Description of the indicators

• Moving average (moving average determines the current trend by smoothing volatility and noise). Period 50. It is marked in yellow on the chart.

• Moving average (moving average determines the current trend by smoothing volatility and noise). Period 30. It is marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period 26. SMA period 9

• Bollinger Bands. Period 20

• Non-profit speculative traders, such as individual traders, hedge funds and large institutions that use the futures market for speculative purposes and meet certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.