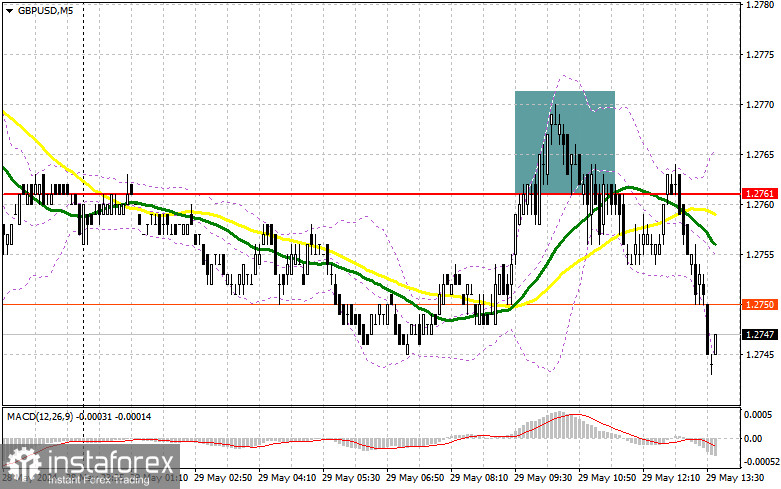

In my morning forecast, I paid attention to the 1.2761 level and planned to make decisions about entering the market from it. Let's look at the 5-minute chart and figure out what happened there. The growth and formation of a false breakdown in the area of 1.2761 led to a sell signal for the pound, which, at the time of writing, resulted in a drop of more than 20 points. In the afternoon, the technical picture was slightly revised.

To open long positions on GBP/USD, you need:

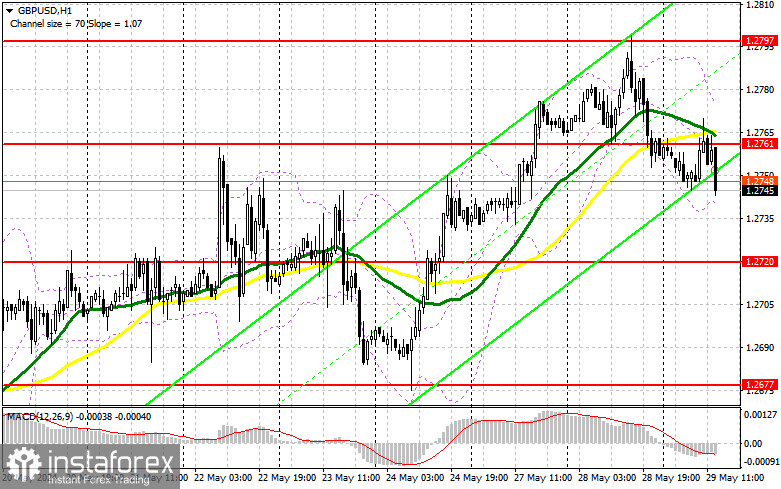

Buyers have problems, and while trading will be conducted below 1.2761, there can be no question of any purchases. In the current situation, when American statistics can further harm pound buyers, it is best to act cautiously. Ahead of us are the US Federal Reserve-Richmond manufacturing index figures and the Fed's economic survey by region. If the data turns out to be better than economists' forecasts, it may come to a larger correction of the pair in the area of 1.2720, which I will use. Only after forming a false breakout will it be possible to verify the presence of large players in the market. This will give a good entry point into long positions capable of breaking 1.2761, which the bulls still need to manage today. A rush and a top-down test of this range against the background of weak statistics will give a chance for GBP/USD growth with an update of 1.2797 – month high. In the case of an exit above this range, we can talk about a breakthrough to 1.2853, where I will fix profits. In the scenario of GBP/USD falling and no buyers at 1.2720 in the afternoon, the pressure on the pound will return, leading to a downward movement to the support area of 1.2677. Forming a false breakout will be a suitable option for entering the market. Opening long positions on GBP/USD immediately on a rebound from 1.2646 to correct 30-35 points within a day is possible.

To open short positions on GBP/USD, you need:

In the case of another growth of the pair, which is more likely, I will act only after the formation of a false breakdown in the resistance area of 1.2761, similar to what I discussed above. This will lead to an entry point into short positions to reduce GBP/USD to the support area of 1.2720. A breakout and a reverse test from the bottom up of this range will increase the pressure on the pair, giving the bears an advantage and another entry point to sell to update 1.2677, where I expect a more active manifestation of buyers. A longer-range target will be a minimum of 1.2646, negating all the bulls' efforts and the uptrend. I will record profits there. With the option of GBP/USD growth and the absence of bears at 1.2761 in the afternoon, which is more likely, buyers will regain the initiative, having the opportunity to update 1.2797. I will also serve there only on a false breakdown. Without activity there, I advise you to open short positions on GBP/USD from 1.2853, counting on the pair's rebound down by 30-35 points within the day.

Indicator Signals:

Moving AveragesTrading is conducted around the 30 and 50-day moving averages, indicating a sideways market.

Note: The author considers the period and prices of the moving averages on the H1 hourly chart and differ from the classical daily moving averages on the D1 daily chart.

Bollinger Bands

The lower boundary of the indicator, around 1.2747, will provide support in the event of a decline.

Indicator Descriptions

- Moving Average (MA): Smooths volatility and noise to indicate the current trend. Period 50, marked in yellow on the chart.

- Moving Average (MA): Smooths volatility and noise to indicate the current trend. Period 30, marked in green on the chart.

- MACD (Moving Average Convergence/Divergence): EMA periods 12 (fast), 26 (slow), and SMA period 9.

- Bollinger Bands: Period 20.

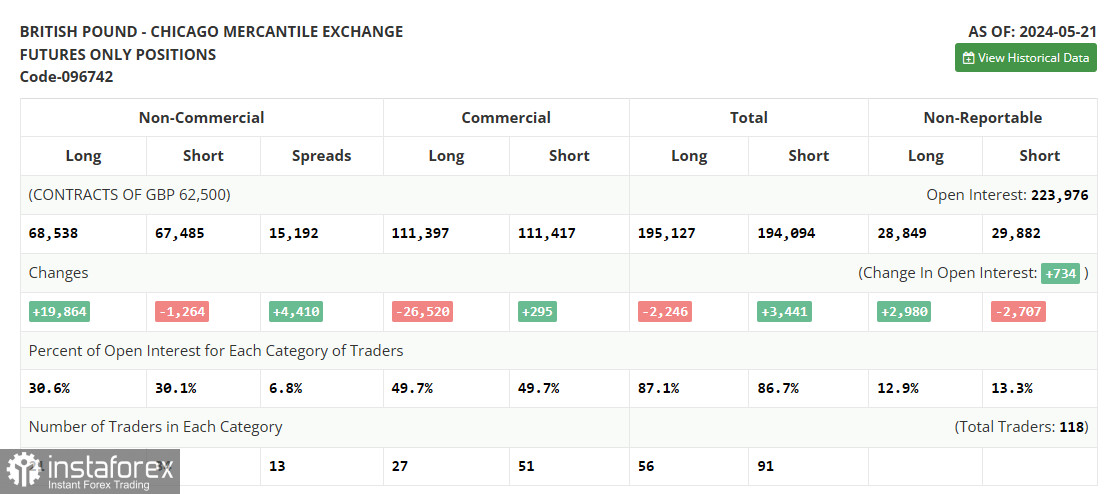

- Non-commercial Traders are speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain criteria.

- Long Non-commercial Positions: The total long open position of non-commercial traders.

- Short Non-commercial Positions: The total short open position of non-commercial traders.

- Total Non-commercial Net Position: The difference between the short and long positions of non-commercial traders.