EUR/USD attempted to continue its downward movement on Thursday, which had started the previous day. However, market participants "woke up" and started to buy the euro once again. Yesterday, we warned you that the US dollar only fell for a day so we shouldn't expect the pair to start a new trend. It might be the start of a brewing downtrend, but one day is too short to make such bold conclusions. Thus, the upward trend, which is still a correction, remains intact for now. The euro continues its illogical rise. The fact that the price is below the moving average means nothing. Last week, the pair crossed the moving average five times.

There was a macroeconomic background on Thursday, but we believe that the euro didn't have any compelling reasons to strengthen. At first glance, it might seem that reports from the EU and the US triggered the dollar's fall and the euro's rise, but we believe the market simply used these reports as a formal excuse to buy the single currency. Let's break it down. The Eurozone unemployment rate decreased to 6.4% against the forecast of 6.5%. This is a good result, but this wasn't a crucial report. The market usually ignores it. The second estimate of US Q1 GDP was revised lower to 1.3% below 1.6% in the advanced estimate, but it fully matched market expectations. The number of jobless claims also matched the forecasts. Therefore one report supported the euro, while the other two were just neutral.

Traders had a right to sell the dollar, as the US economy grew more slowly for the second consecutive quarter. However, let's remind ourselves that the Eurozone economy has been stagnant for about a year and a half, and the euro hasn't shown any disappointment over it. The European Central Bank is preparing to lower rates in a week, and the market shows no dismay over this either. Therefore, we believe the euro has risen for no reason.

Today, the Eurozone will release a crucial report on inflation. Consumer price growth is expected to accelerate to 2.5%. We have no doubt that the market will manage to interpret this report in favor of the euro. If inflation is rising, the formal probability of the ECB easing monetary policy in June decreases, regardless of whether that's actually the case. And if May's inflation exceeds 2.5%, there's no doubt the euro will soar again. Therefore, the euro might stop falling. Despite seeing no compelling arguments for the pair's rise, the market still seems ready to buy it under any circumstances.

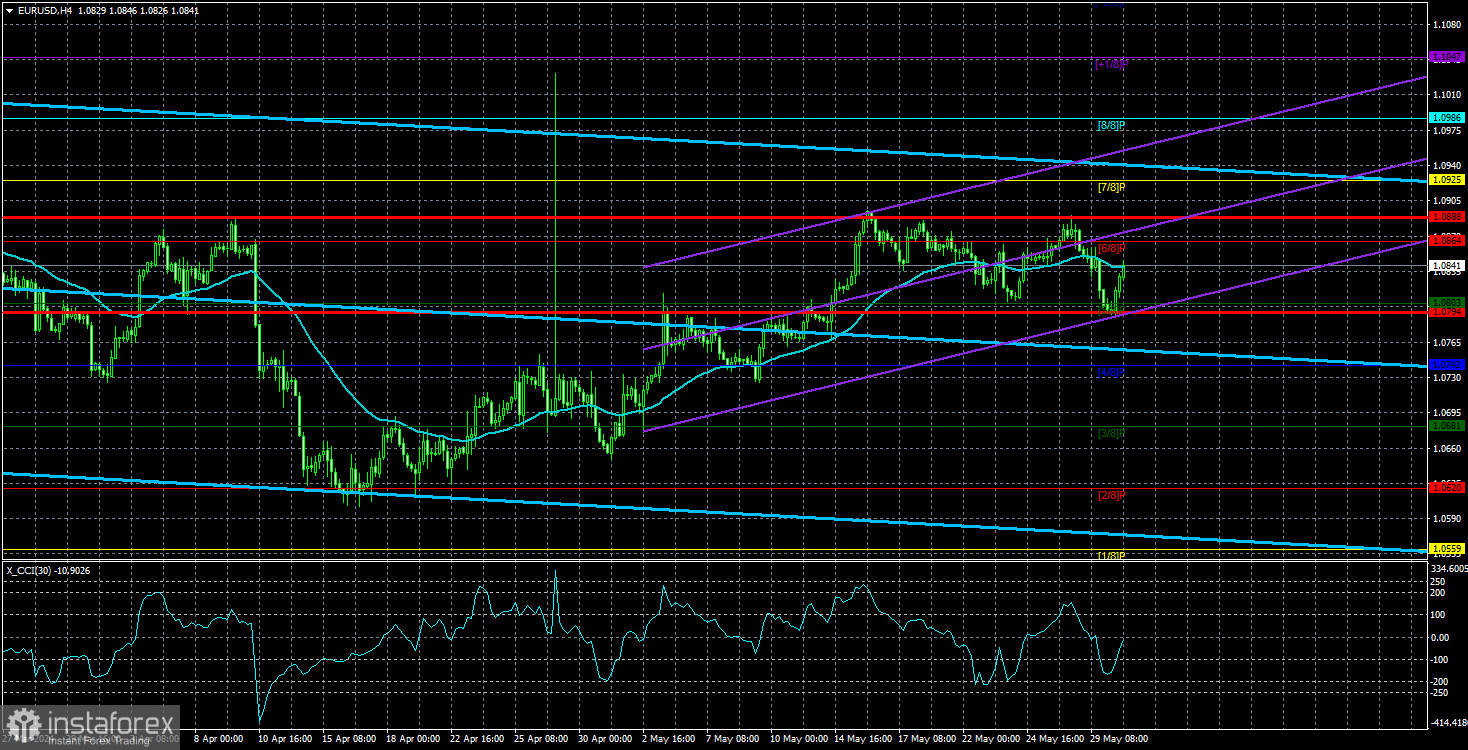

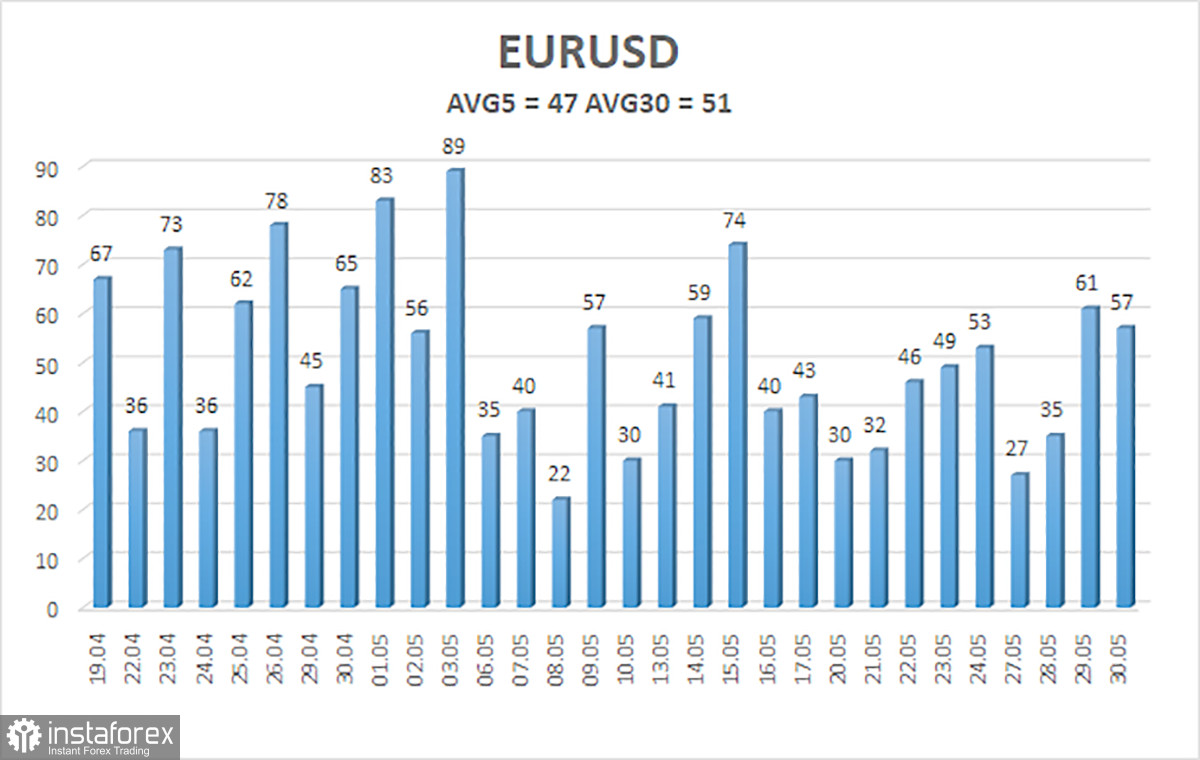

The average volatility of the EUR/USD pair over the last five trading days as of May 31 is 47 pips, which is considered low. We expect the pair to move between 1.0794 and 1.0888 on Friday. The higher linear regression channel is directed downward, so the global downward trend remains intact. The CCI indicator entered the oversold area last month, which triggered the upward movement. However, the bullish correction has lasted long enough so it's difficult to expect it to end anytime soon.

Nearest support levels:

S1 - 1.0803

S2 - 1.0742

S3 - 1.0681

Nearest resistance levels:

R1 - 1.0864

R2 - 1.0925

R3 - 1.0986

Trading Recommendations:

The EUR/USD pair maintains a downtrend, but the bullish correction remains intact. We cannot confirm that it has surely ended. The euro should resume its downward movement in the medium term, but the market continues to interpret almost every event against the dollar. The single currency often rises even in the absence of news and reports. We believe that this will not last forever. You may consider selling the euro since the price has consolidated below the moving average. If the price continues to fall, the euro could become much cheaper in the next few months, as the fundamental and macroeconomic background continues to support the dollar. A global downtrend also persists on the 24-hour TF.

Explanation of Illustrations:

- Linear Regression Channels – Helps determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

- Moving Average Line (settings 20.0, smoothed) – Determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels – Target levels for movements and corrections.

- Volatility Levels (red lines) – The probable price channel in which the pair will spend the next day, based on current volatility indicators.

- CCI Indicator – Its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is imminent.