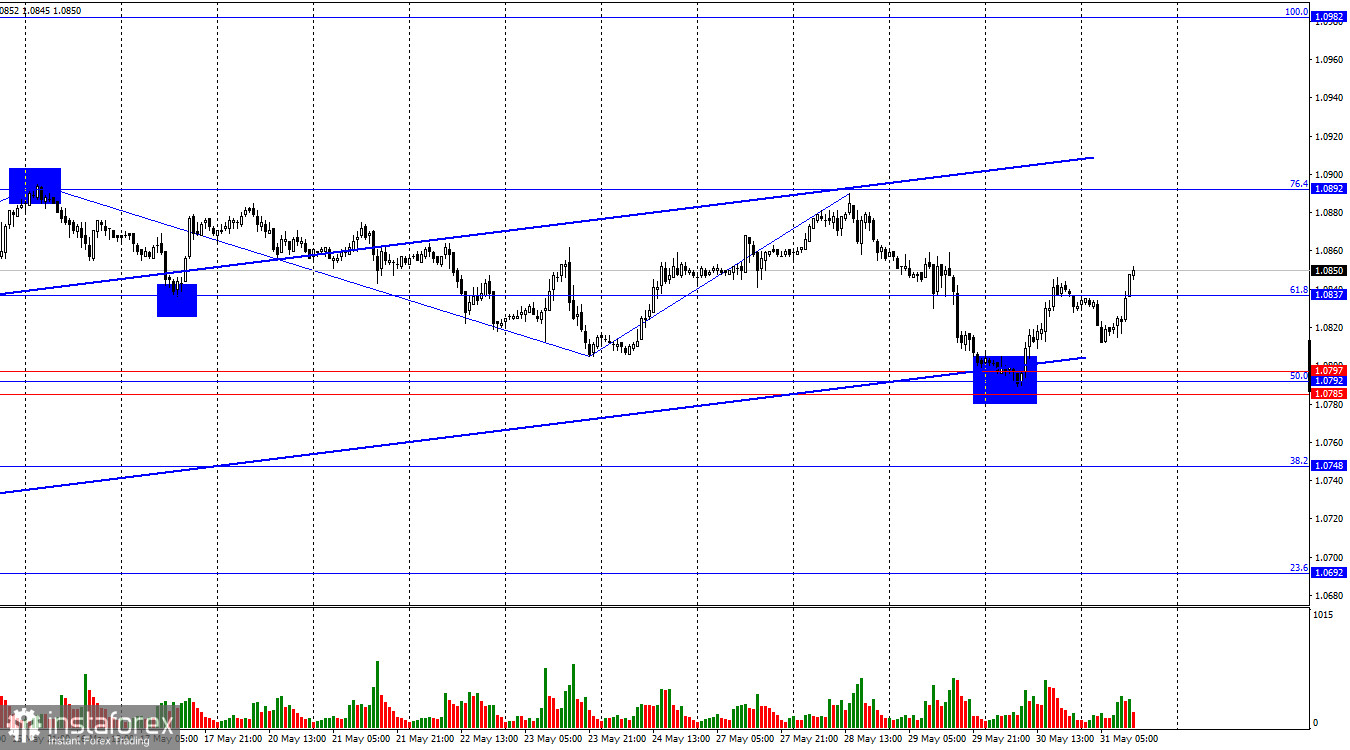

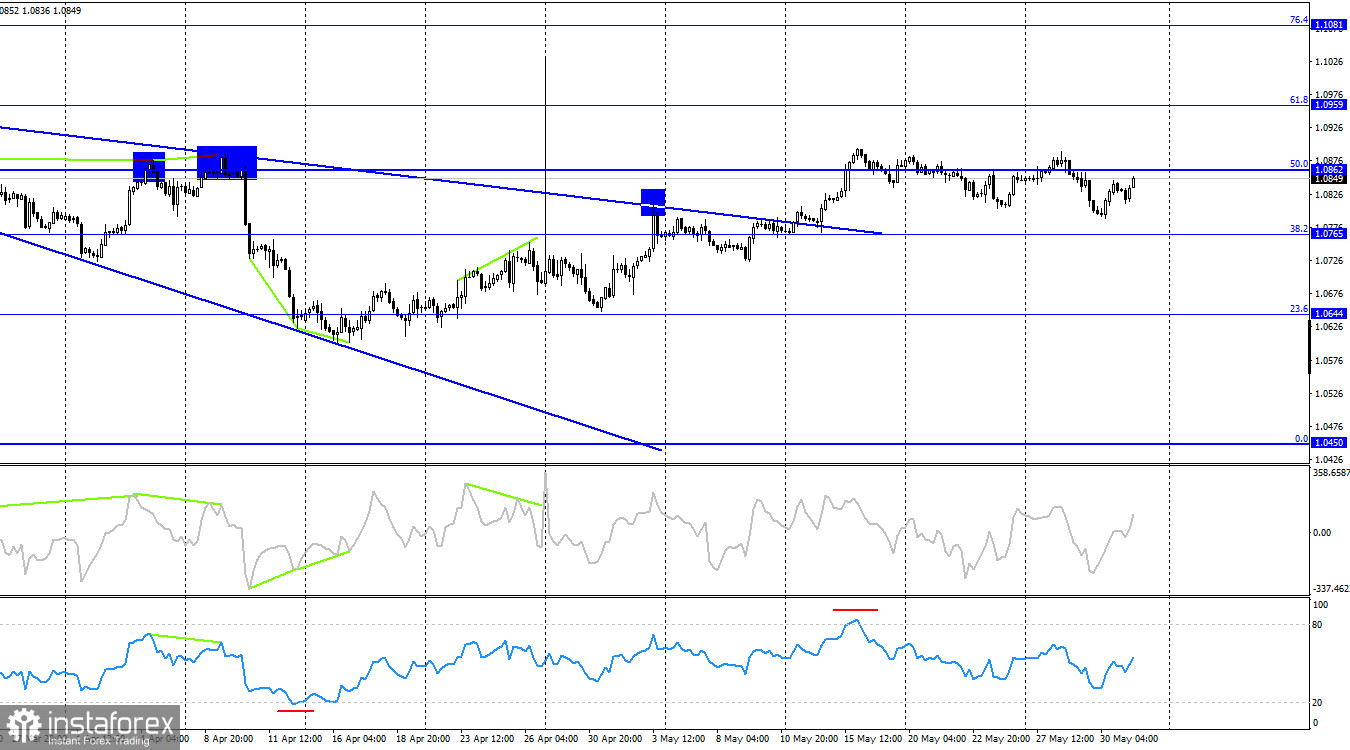

On Thursday, the EUR/USD pair rebounded from the support zone of 1.0785–1.0797, reversed in favor of the euro, and rose. On Friday, it reversed in favor of the euro again, consolidating above the 61.8% retracement level at 1.0837, which allows for continued growth toward the next Fibonacci level of 76.4% at 1.0892. Although the "bullish" trend seemed to have ended this week, the bulls are attacking again.

The wave situation remains clear. The last completed upward wave did not break the peak of the previous wave, while the new downward wave broke the low from May 23. Thus, we first saw a trend shift from "bullish" to "bearish." Consolidation below the ascending trend channel will confirm the bears' advance. The market is undergoing a reversal, but it is very smooth and slow, without strong bear pressure. In my opinion, the new "bearish" trend could be quite strong, as there were many questions about the euro's growth in recent weeks. However, it needs to start first.

Thursday's news background was interesting and important for the euro. The main report of the day, the US GDP for the first quarter, turned out worse than traders expected and worse than the initial estimate. The US economy slowed to 1.3%, although it grew by 4.9% two quarters ago. As a result, the bears failed to consolidate below the strong support zone of 1.0785–1.0797. Today, the EU inflation report showed an increase in May to 2.6% instead of the expected 2.5%. A new rise followed this in the euro, as market participants reasonably decided that the ECB might now postpone the first easing of monetary policy from June to the next meeting. Strangely, the constant delays in the first easing by the Fed do not help the dollar grow.

On the 4-hour chart, the pair rebounded from the 50.0% Fibonacci level at 1.0862 and reversed in favor of the US dollar. Despite breaking out of the "wedge," I expect the formation of a "bearish" trend in the coming weeks and months, as the news background is quite contradictory and does not support only the bulls. I would not consider consolidations above the 1.0862 level as a signal to buy. There have already been two such consolidations in recent weeks.

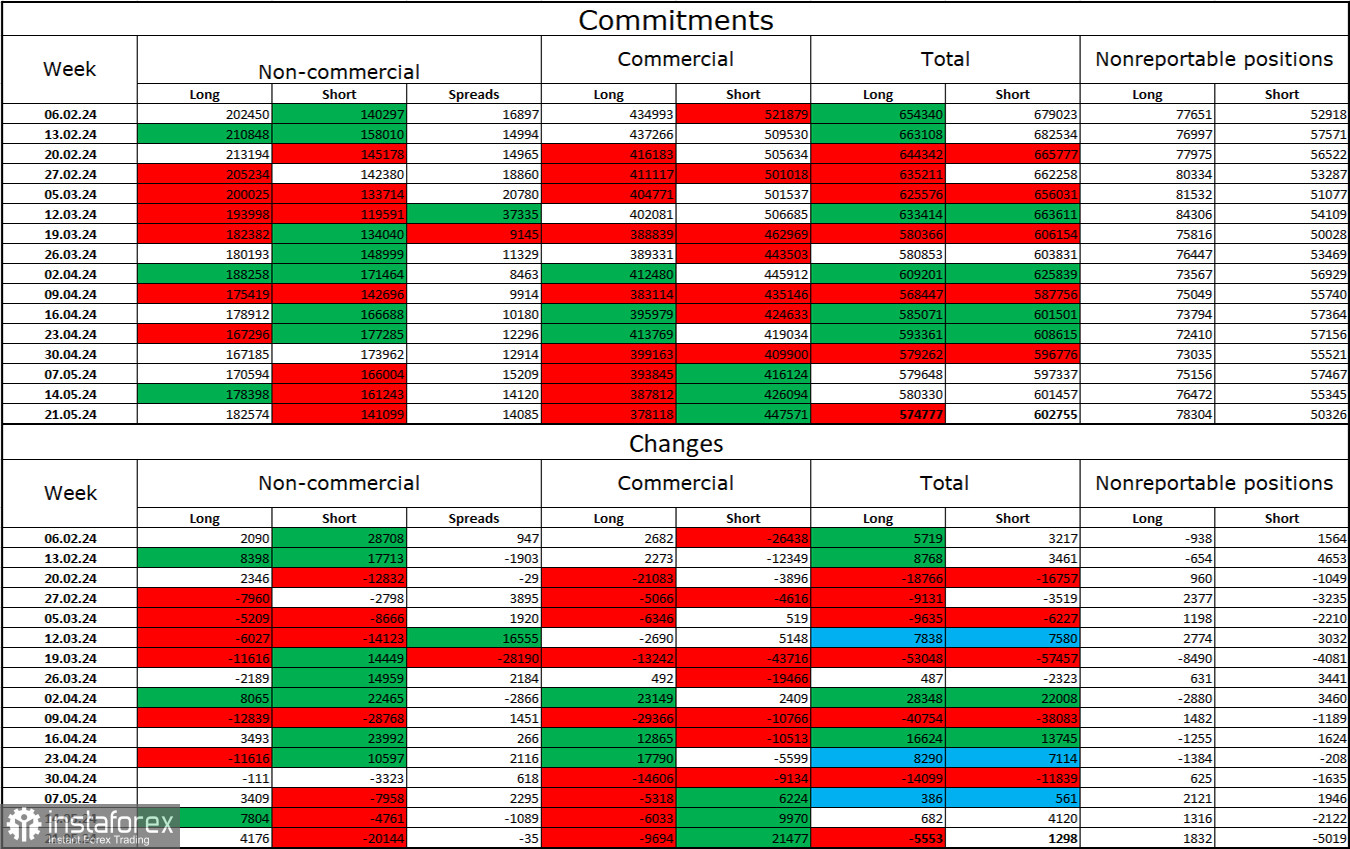

Commitments of Traders (COT) Report:

During the last reporting week, speculators opened 4,176 long contracts and closed 20,144 short contracts. The sentiment of the "Non-commercial" group turned "bearish" a few weeks ago, but now the bulls have the advantage again. The total number of long contracts held by speculators is now 182,000, while the number of short contracts is 141,000. The gap is widening again in favor of the bulls.

However, the situation will continue to shift in favor of the bears. I see no long-term reasons to buy the euro, as the ECB is ready to begin easing monetary policy, which will lower the yields on bank deposits and government bonds. In the US, yields will remain high, making the dollar more attractive to investors. However, we should respond to the data from graphical analysis and COT reports, which indicate a continued "bullish" sentiment.

Economic Calendar for the US and EU:

- EU – Change in German Retail Sales (09:00 UTC).

- EU – Consumer Price Index (12:00 UTC).

- US – Personal Consumption Expenditures Price Index (12:30 UTC).

- US – Change in Personal Spending and Income (12:30 UTC).

The economic events calendar contains several entries on May 31, half of which are already available to traders. The news background is expected to weaken market sentiment for the remainder of the day.

EUR/USD Forecast and Trading Advice:

Selling the pair was possible upon consolidation below the 1.0837 level, with a target of the support zone at 1.0785–1.0797. This target has been reached. New sales are possible upon consolidation below the 1.0785–1.0797 zone with targets of 1.0748 and 1.0692. Buying the euro was possible on a rebound from the 1.0785–1.0797 zone with a target of 1.0837. This target was reached yesterday. Today, buying was possible again after closing above 1.0837 with a target of 1.0892.