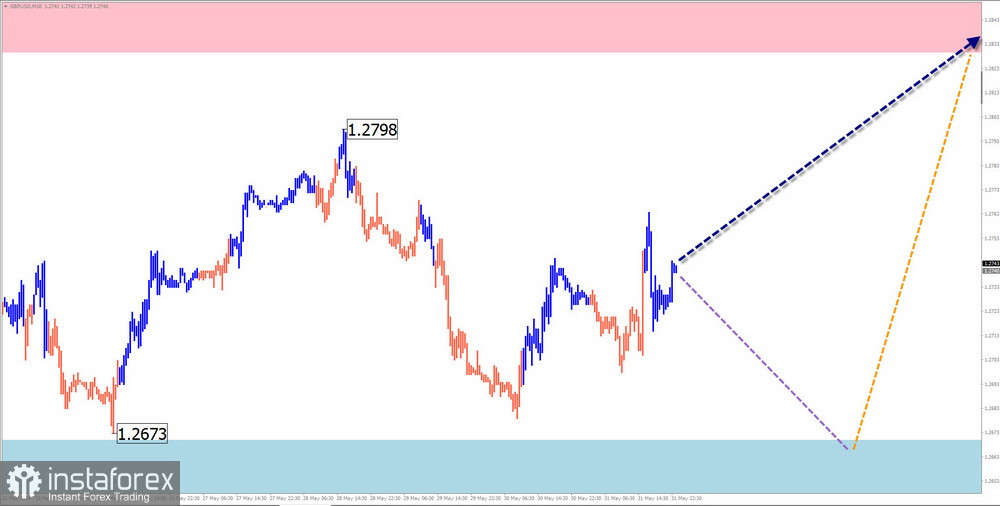

GBP/USD

Analysis:

Since October last year, the dominant ascending wave of the main British pound pair has been developing its final part (C) since April. This wave is developing as an impulse and needs to be completed as of the analysis time. The pair's price has entered the boundaries of a broad potential reversal zone, broken through strong resistance, and consolidated above it.

Forecast:

The price of the British pound is expected to move from the current zone to the area of calculated resistance throughout the upcoming week. In the first days, a sideways trend is expected, with a possible downward shift. The pair's highest volatility is anticipated in the second half of the week.

Potential Reversal Zones

Resistance:

- 1.2830/1.2880

Support:

- 1.2670/1.2620

Recommendations:

Sales: Risky with low potential.

Purchases: Could become the main direction for trading if signals appear on your trading systems.

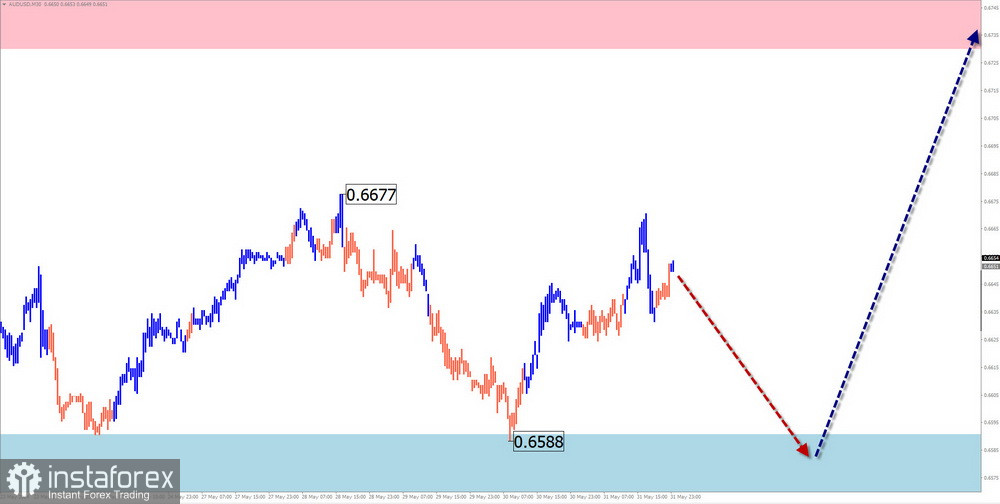

AUD/USD

Analysis:

Since April this year, an ascending wave algorithm has dictated the direction of the short-term trend for the Australian dollar pair. Over the last two weeks, a counter-correction has been forming in the wave structure, which still needs to be completed as of the analysis. After breaking through strong support two weeks ago, the price has consolidated above its boundaries.

Forecast:

After likely pressure on the support zone in the next couple of days, a reversal and resumption of the pair's price growth can be expected. The calculated resistance is at the upper edge of the preliminary target zone of the current bearish wave.

Potential Reversal Zones

Resistance:

- 0.6730/0.6780

Support:

- 0.6590/0.6540

Recommendations:

Purchases: Premature until corresponding reversal signals appear in the support area on your trading systems.

Sales: Can be used in intraday trading with a reduced volume size.

USD/CHF

Analysis:

The incomplete wave on the Swiss franc major's chart has been directed upward since the end of December last year. The quotes have been forming a price pullback over the past month from the lower boundary of a strong potential reversal zone, which is still incomplete. Its potential does not exceed the correction level.

Forecast:

A decline and pressure on the support zone are likely in the coming days. Breaking the lower boundary is unlikely. The resumption of price growth can be expected in the second half of the week. Increased volatility may coincide with the release of important news blocks.

Potential Reversal Zones

Resistance:

- 0.9230/0.9280

Support:

- 0.8970/0.8980

Recommendations:

Sales: Carry a high risk, which can lead to deposit losses.

Purchases: These can be traded if corresponding reversal signals appear near the support zone.

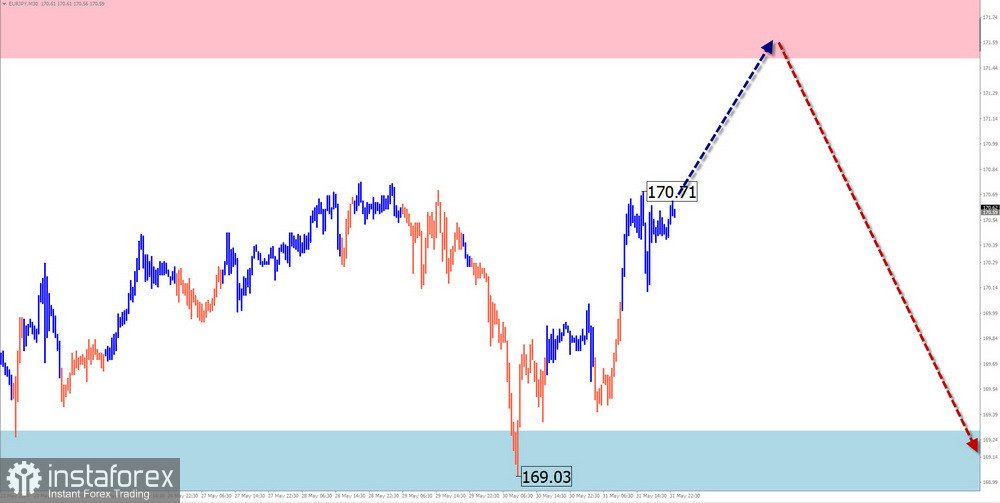

EUR/JPY

Analysis:

Within the dominant ascending trend of the EUR/JPY pair, an incomplete wave model from May 2 is forming a correction. The analysis of its structure shows the formation of a shifting plane. The wave lacks the final segment (C). The price is approaching the upper boundary of a broad potential reversal zone on the daily timeframe.

Forecast:

In the next couple of days, an upward price movement is likely. A brief puncture of the upper boundary of the calculated resistance cannot be ruled out. A reversal and resumption of the decline can be expected closer to the weekend. The support zone shows the lower boundary of the expected weekly pair movement.

Potential Reversal Zones

Resistance:

- 171.50/172.00

Support:

- 169.30/168.80

Recommendations:

Purchases: Have low potential and may need to be more profitable.

Sales: After confirmation by your trading system's reversal signals, sales can become the main trading direction for this pair.

EUR/GBP

Analysis:

Since September last year, the direction of price fluctuations of the EUR/GBP cross has been dictated by a bearish wave algorithm in the short term. The wave is forming as a horizontal plane. In its structure, the middle part (B) has been developing over recent months. The price is at the lower boundary of the formed corridor.

Forecast:

After likely pressure on the lower boundary of the support zone, the cross quotes are expected to change to an upward course in the coming days. The section of the calculated resistance zone is the most likely zone where the weekly movement will end.

Potential Reversal Zones

Resistance:

- 0.8670/0.8720

Support:

- 0.8500/0.8450

Recommendations:

Sales: Have no potential.

Purchases: Can be used in trading after confirmed reversal signals appear in the support area.

US dollar index

Analysis:

Since December last year, the direction of the USD index has been dictated by an upward trend. Within this framework, quotes have been correcting downward since April. After breaking through strong support over the past two weeks, dollar quotes have consolidated above it. The downward segment of the chart from May 30 has reversal potential.

Forecast:

In the upcoming week, an overall downward movement of the USD index is expected. In the first few days, a brief rise in the index rate is possible but within the resistance boundaries. The highest volatility is likely towards the end of the week.

Potential Reversal Zones

Resistance:

- 104.80/105.00

Support:

- 104.00/103.80

Recommendations:

The US dollar's weakening is expected to continue next week. Brief rises in major currency pairs can be anticipated in trading.

Explanations:

In simplified wave analysis (SWA), all waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed on each timeframe. Dotted lines indicate expected movements.

Note: The wave algorithm does not account for the duration of instrument movements over time!