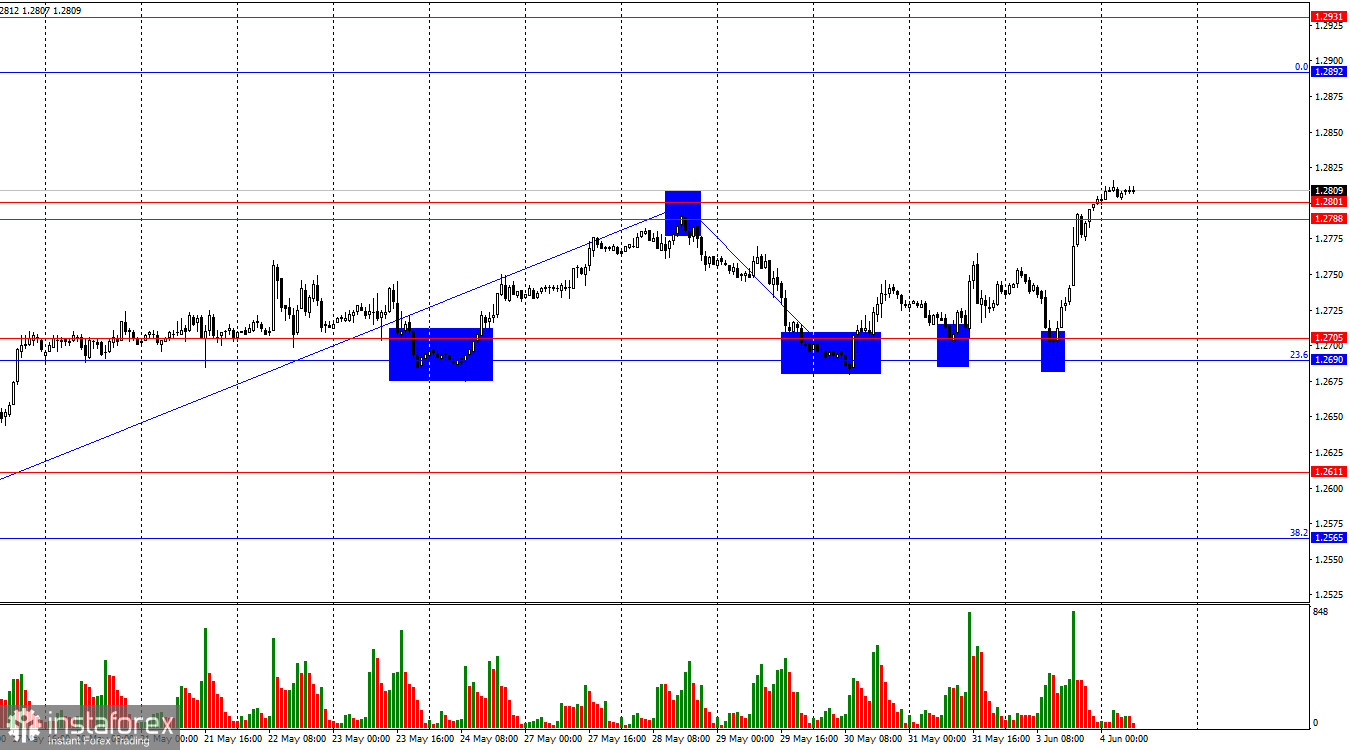

On the hourly chart, the GBP/USD pair performed a new rebound from the support zone of 1.2690–1.2705 on Monday. The bears did not have enough strength to continue attacking again. A new growth process has begun with consolidation above the resistance zone of 1.2788–1.2801, but today, the pair fell under this zone. Thus, we can expect a new return to the support zone of 1.2690–1.2705. And then bear traders will have a fifth attempt to break through this zone.

The situation with the waves has yet to change. The last wave up broke through the peak of May 3 easily, and the last completed wave down could not even break through the 1.2788–1.2801 zone. Thus, the trend for the GBP/USD pair remains "bullish," and the bulls' advantage is overwhelming. The first sign of the end of the "bullish" trend will appear only when a new downward wave manages to break through the low of the previous wave – from May 30. You need to be prepared for the fall of the pound sterling, but first, you need the bears to overcome at least the 1.2690–1.2705 zone.

The pound continues to feel the support of traders, statistics, graphical analysis and everything else. Yesterday, the growth of the British currency was supported by a weak ISM business activity index in the US manufacturing sector. Today, it can be found in a weak JOLTS report in the same USA. The information background in the last two months has rarely supported the dollar, and the market and the British actively use it. Traders no longer even remember the Fed's rates, which will not begin to decline. They were a little worried about this factor a few months ago, but now – no one cares when the American central bank starts easing the PREP. Several more important reports will be released in America this week. The bears may retreat further from the market if they show the same negative dynamics as the ISM index on Monday. They are already unable to do almost anything against the bulls, but new weak data from the United States will weaken them even more.

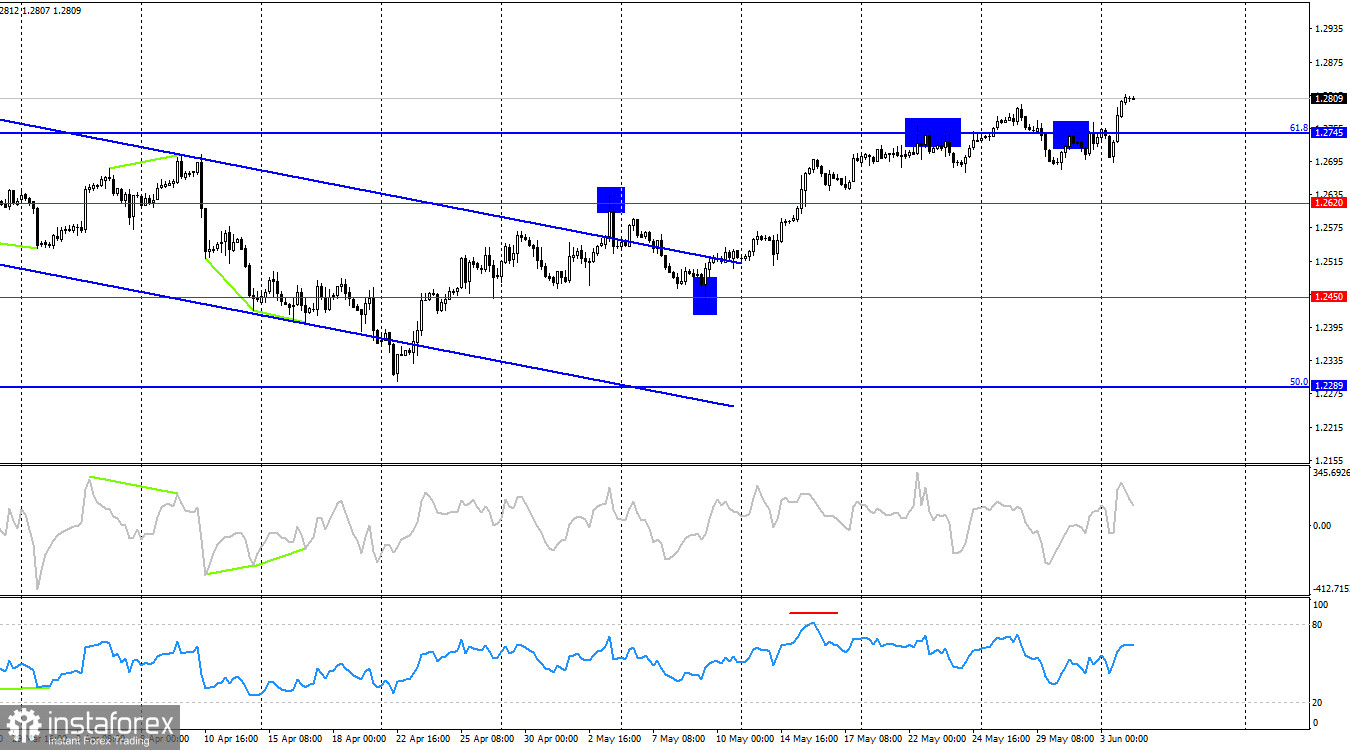

On the 4-hour chart, the pair reversed in favor of the British currency and consolidated above the corrective level of 61.8%—1.2745. Thus, the growth process can be continued. There are no emerging divergences in any indicator today. The levels and zones on the hourly chart are now stronger than on the 4-hour chart. I advise you to pay more attention to them.

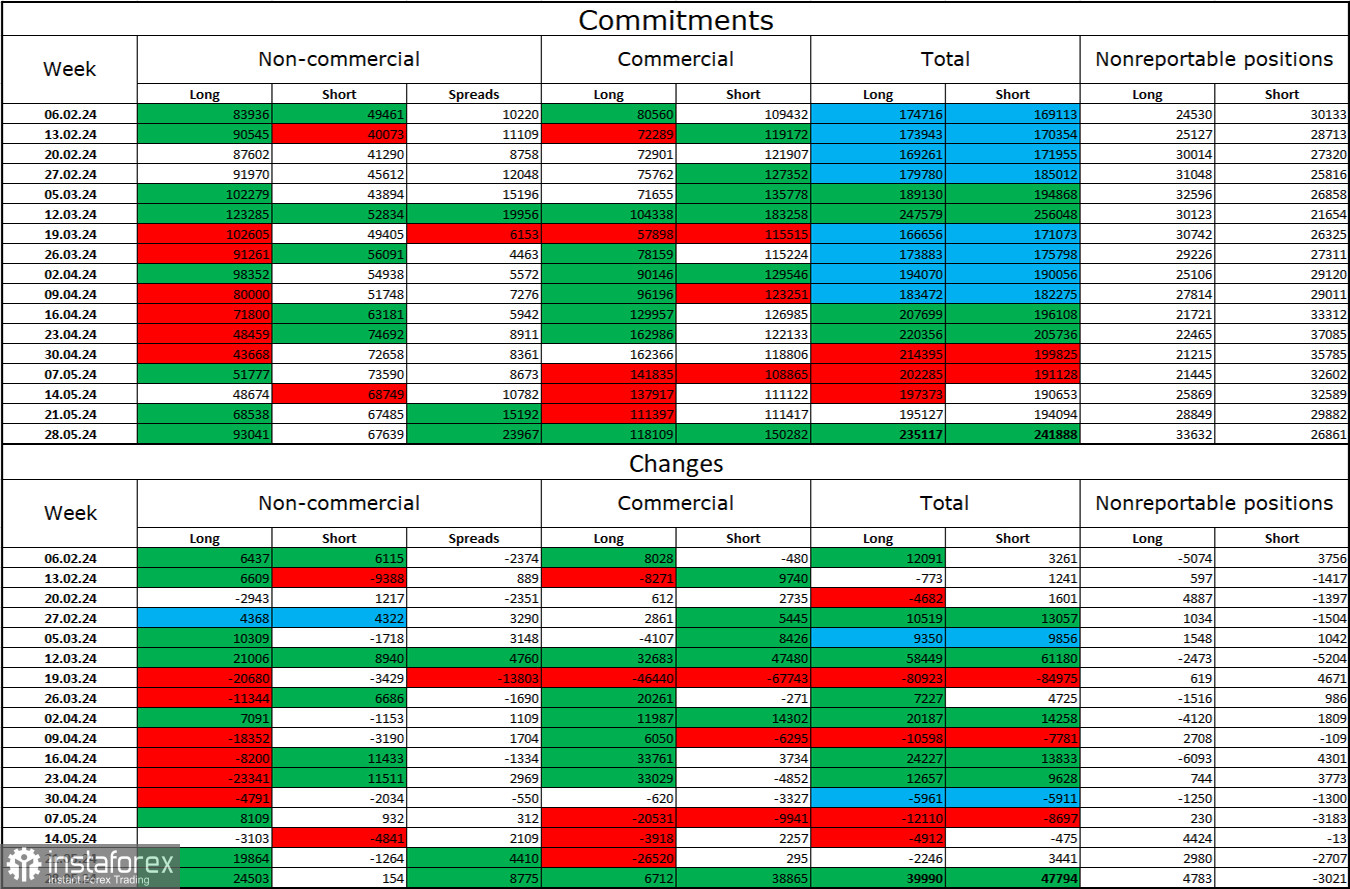

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has become more "bullish" over the last reporting week. The number of long contracts in the hands of speculators increased by 24,503 units, and the number of short contracts increased by 154. The general mood of the big players has changed again, and now the bulls have a solid advantage. The gap between long and short contracts is 26 thousand: 93 thousand versus 67 thousand.

The pound has good prospects of falling, but the bears are still not ready to attack. Over the past 3 months, the number of Long has grown from 83 thousand to 93 thousand, and the number of Short has grown from 49 thousand to 67 thousand. Over time, the bulls will continue to get rid of buy positions or increase sell positions since all possible factors for buying the British pound have already been worked out. However, the key factor will be the desire and capabilities of the bears rather than the background information or data from COT reports.

News calendar for the USA and the UK:

USA – The number of open JOLTS vacancies (14-00 UTC).

The economic events calendar contains only one entry on Tuesday, which is very important. The information background's influence on the market mood today may be average in strength.

GBP/USD forecast and tips for traders:

Sales of the British dollar are possible if they close below the zone on the hourly chart of 1.2788–1.2801 with a target of 1.2690–1.2705. Purchases could be opened yesterday at a rebound from the 1.2690–1.2705 zone with a target of 1.2788–1.2801. This goal has been achieved.