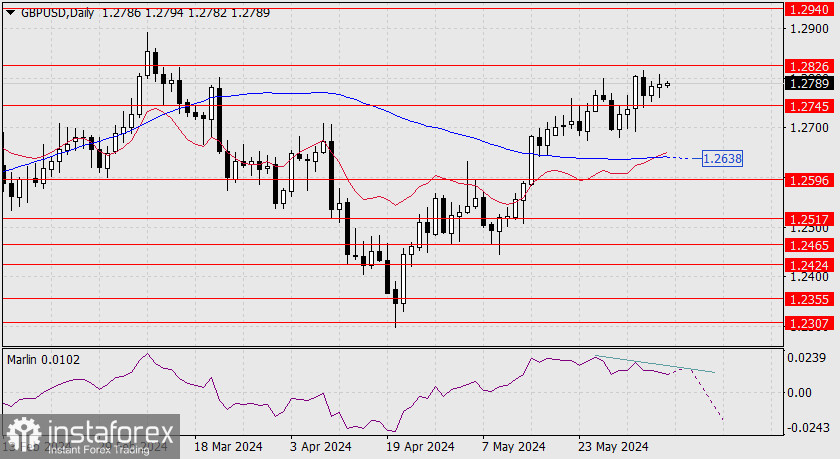

GBP/USD

As of yesterday, the British pound rose by 4 points. It seems intent on forming a double divergence with the Marlin oscillator, which needs to reach the target level of 1.2826. If the pound fails to achieve this, a drop below 1.2745 will signal the beginning of further weakening towards the daily MACD line at 1.2638. Consolidation above 1.2826 will delay the reversal indefinitely, potentially leading to growth toward the resistance at 1.2940.

On the four-hour chart, the price has pierced the support of the MACD line for the third time (checkmarks) but has once again settled above it. The signal line of the Marlin oscillator has exited its consolidation but failed to overcome the boundary of the downward trend. The situation appears neutral, with a tendency towards an upward movement when considering the daily timeframe.

If the pound develops a medium-term downward trend, it will signal this by consolidating below the MACD line, beneath the 1.2778 mark. This will be the first signal, followed by a break below 1.2745. The pound's intention to grow will be indicated by surpassing yesterday's high of 1.2808.