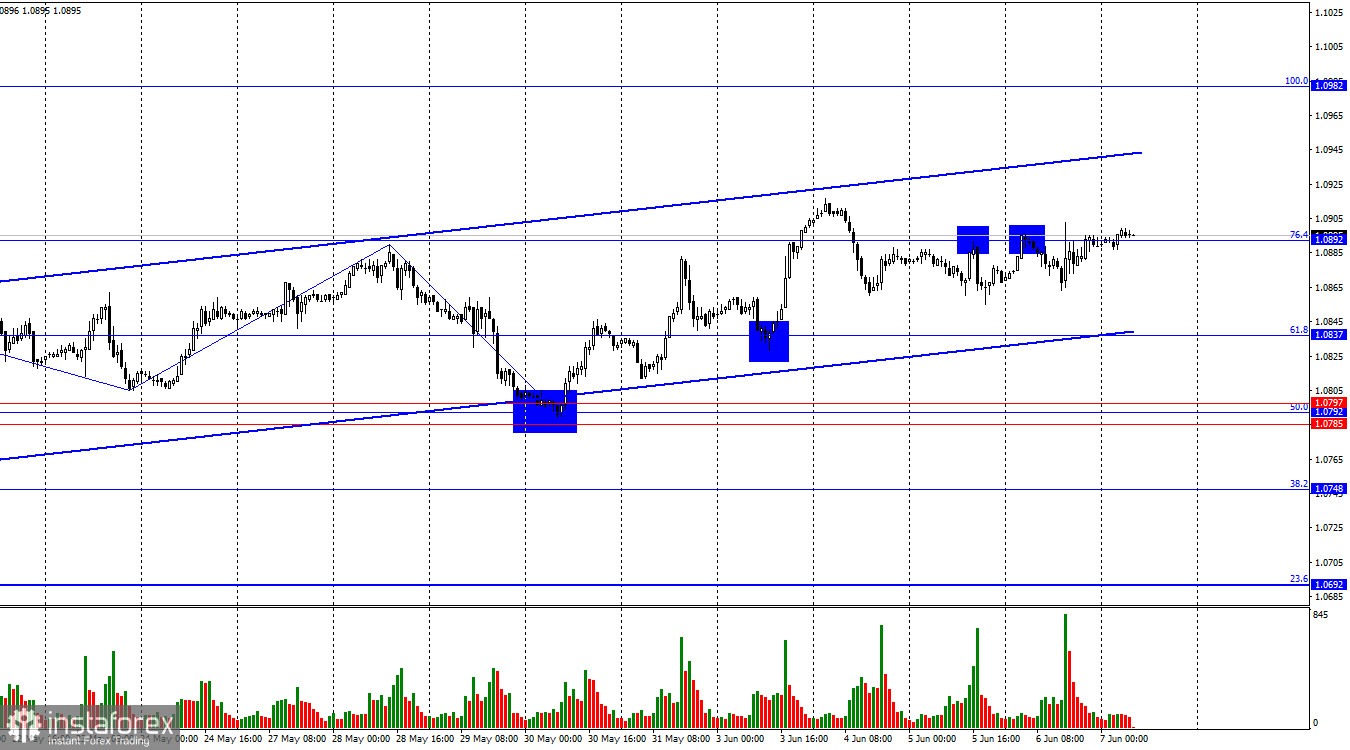

On Thursday, the EUR/USD pair made its third or fourth return to the 76.4% retracement level at 1.0892. Another rebound from this level will favor the US dollar and lead to a slight decline towards the 61.8% Fibonacci level at 1.0837. Securing the pair above 1.0892 will increase the likelihood of further growth towards the next 100.0% retracement level at 1.0982. It should also be noted that despite the strong and abundant news background this week, traders' activity remains quite weak.

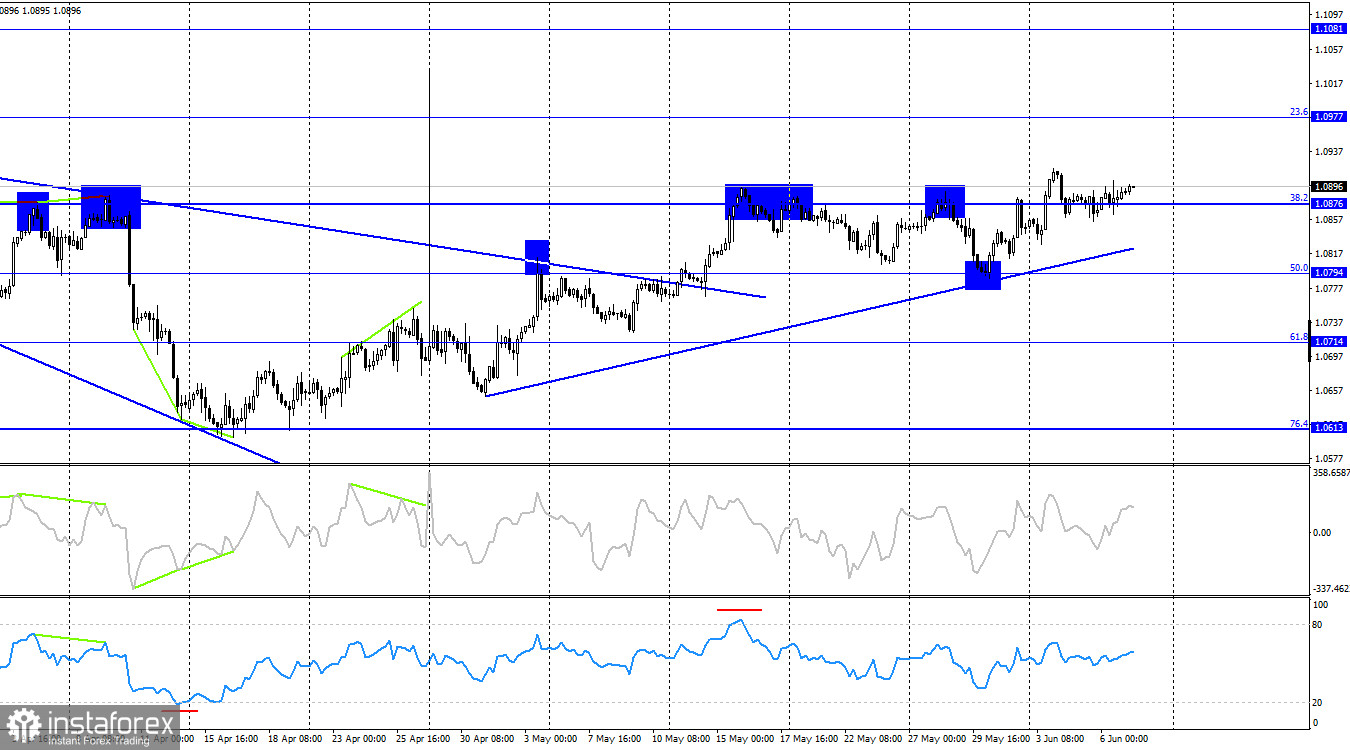

The wave situation remains clear. The last completed upward wave did not break the peak of the previous wave, while the last downward wave broke the low from May 23 but only by a few points. Thus, we have received the first sign of a trend change from "bullish" to "bearish," but it later became clear that we would not see any downward reversal for now. The new upward wave broke the peaks of the previous two waves. Therefore, for a prolonged fall in the European currency, we now need to wait for another sign of a trend change. Such a sign could be a close below the ascending channel.

The news background on Thursday was very important for the European currency, but traders didn't even notice it. An event like a rate cut was not significant. The ECB raises/lower rates at every meeting. I agree with the opinion that ECB members have long prepared the market for the start of monetary policy easing in June, but traders could have been more active yesterday. This is especially true for the bears, who had another excellent opportunity to go on the offensive but again did not use it. Previously, one could say that the bulls did not give the bears a single chance, and the news background often played against sellers, but yesterday, no one prevented the sale of the euro. The grounds for this were quite substantial.

On the 4-hour chart, the pair rebounded from the 50.0% Fibonacci level at 1.0794 and turned in favor of the European currency. A new "bullish" trend line has formed, so the growth process may continue toward the next retracement level at 23.6%–1.0977. Now, a decline in the European currency can be expected no earlier than a close below the trend line. No emerging divergences are observed in any indicator today.

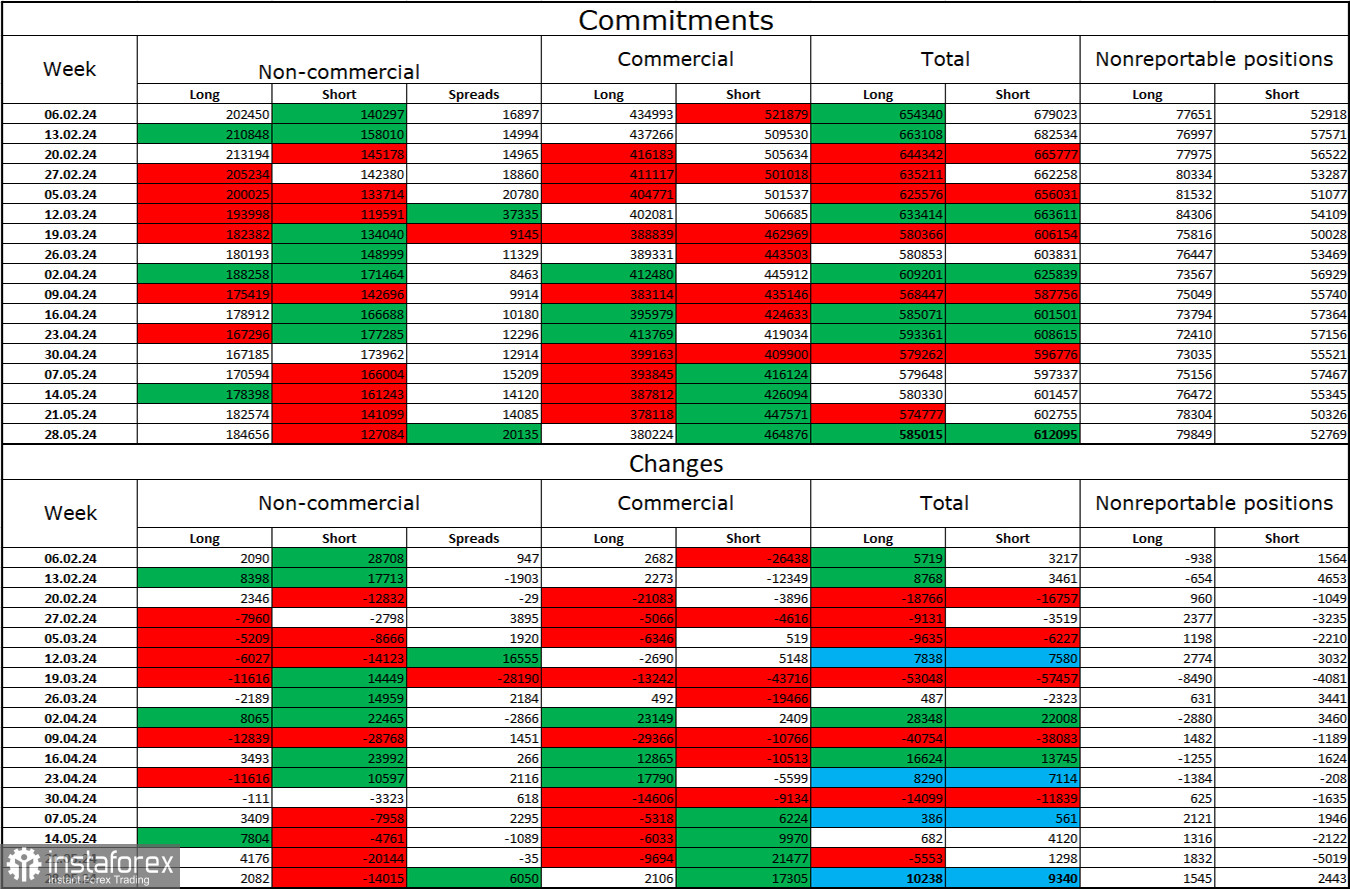

Commitments of Traders (COT) Report:

During the last reporting week, speculators opened 2,082 long contracts and closed 14,015 short contracts. The sentiment of the "Non-commercial" group changed to "bearish" a few weeks ago, but now the bulls are again in control and are increasing their advantage. The total number of long contracts held by speculators now stands at 184,000, while short contracts amount to 127,000. The gap is widening again in favor of the bulls.

However, the situation will continue to change in favor of the bears. I don't see long-term reasons to buy the euro, as the ECB is ready to start easing monetary policy, which will reduce the yield on bank deposits and government bonds. In America, they will remain at a high level, making the dollar more attractive to investors. However, at this time, one should respond to graphical analysis data and COT report analysis. They indicate a continuing "bullish" sentiment.

News Calendar for the USA and the European Union:

- European Union – German Industrial Production Change (06:00 UTC)

- European Union – GDP Change for Q1 (09:00 UTC)

- USA – Nonfarm Payrolls (12:30 UTC)

- USA – Unemployment Rate (12:30 UTC)

- USA – Average Hourly Earnings Change (12:30 UTC)

- European Union – ECB President Christine Lagarde Speech (14:15 UTC)

The economic events calendar contains many important entries on June 7. I can highlight the unemployment and Nonfarm Payroll reports. The news background could have a strong impact on trader sentiment today.

Forecast for EUR/USD and Tips for Traders:

Selling the pair was possible on rebounds from the 1.0892 level on the hourly chart with a target of 1.0837, but the bears are so weak that no decline occurred. Buying the euro is possible today if it secures above the 1.0892 level with a target of 1.0982. Much will depend on the news background today, so be cautious with any trades.