USD/JPY

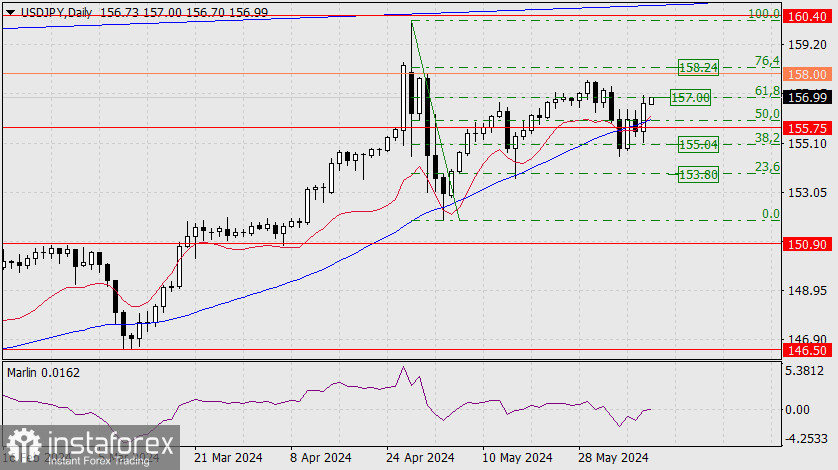

The USD/JPY pair rose by 115 pips on Friday, under the strong influence of the dollar's strength on the US jobs data. The 61.8% Fibonacci level was reached.

It seems that this bullish mood will not last long, as curry trade operations with yen pairs are gradually winding down, and the burgeoning risk-off sentiment will increase the market's interest in the yen. But for now, with overcoming the Fibonacci 61.8% level (157.00), the price may continue to rise to the target range of 158.00/24 - to the corrective level of 76.4%. The Marlin oscillator has moved into the bullish territory, which also helps the dollar in its fight against the yen.

On the 4-hour chart, the price took a short break above the MACD line, as it intends to climb above 157.00. Consolidating above this level paves the way for the price to trade in the range of 158.00/24. If the price doesn't consolidate above 157.00, and instead it consolidates below the MACD line at 156.64, the downward movement may resume with the first target at 155.75.