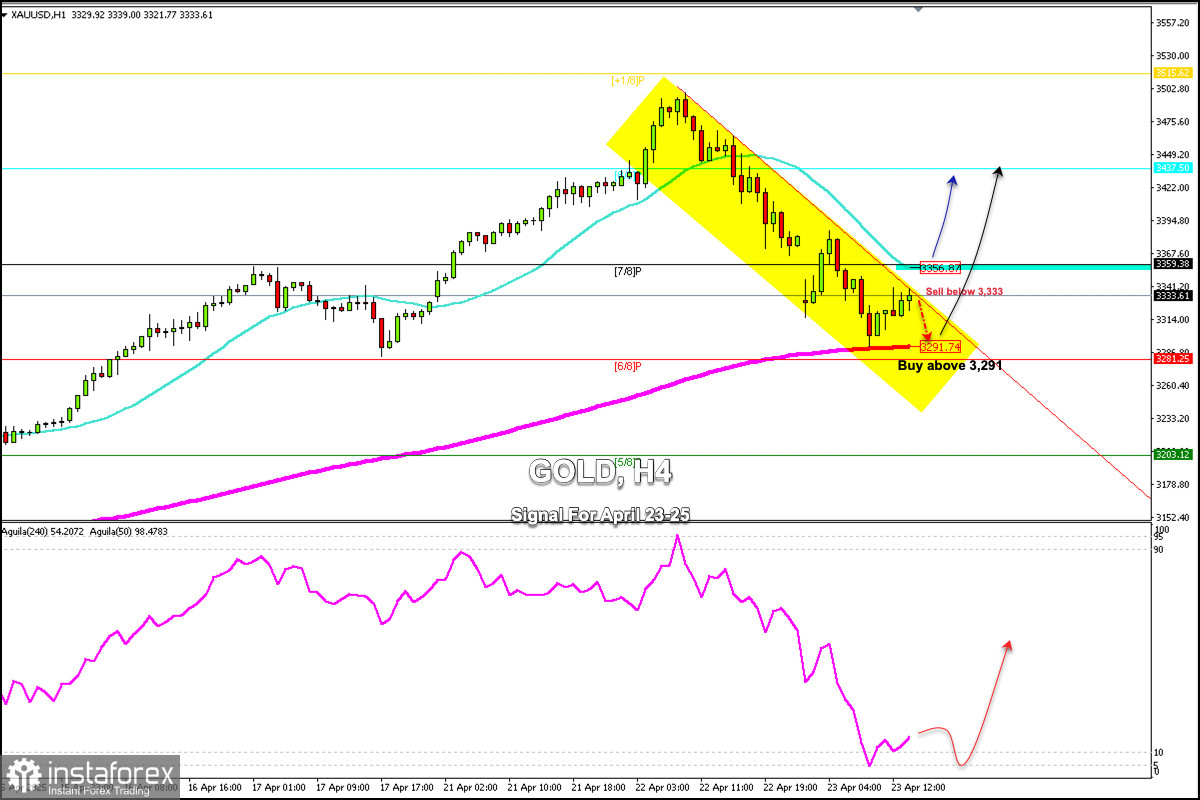

Early in the American session, gold was trading at around 3,333 within the downtrend channel formed on April 22. XAU/USD is showing signs of oversold and is bouncing after reaching the 6/8 Murray level and the 200 EMA area.

Gold could continue its bearish cycle if it falls below 3,333 (the top of the bearish channel) and could likely reach 3,291, even reaching the Murray 6/8 at 3,281.

Conversely, if it finds strong support around the 200 EMA, it could rebound again, as it technically shows signs of being oversold, and a recovery is expected to occur in the coming days.

On the other hand, if gold breaks and consolidates above $3,341, it could be positive, and we could look for buying opportunities with targets at $3,389 and eventually at about $3,437.

Having reached a high of $3,497, gold made a technical correction of more than $200, which means we could expect a correction in line with the Fibonacci indicator around $3,400 in the coming days. The key is to watch for the gold price to consolidate above $3,280.

Our trading plan for the next few hours is to sell gold below $3,333, with targets at $3,313 and $3,291. We can buy above $3,280 with short-term targets at $3,437.