Political life is raging all over the world. However, if the snap elections to the National Assembly in France caused the euro to collapse, then expectations of a victory for Labour in the parliamentary elections in Britain provide no less support for the pound than the slowness of the Bank of England in easing monetary policy. Only surprisingly strong statistics on American employment in May forced the GBP/USD bulls to retreat from a 3-month high.

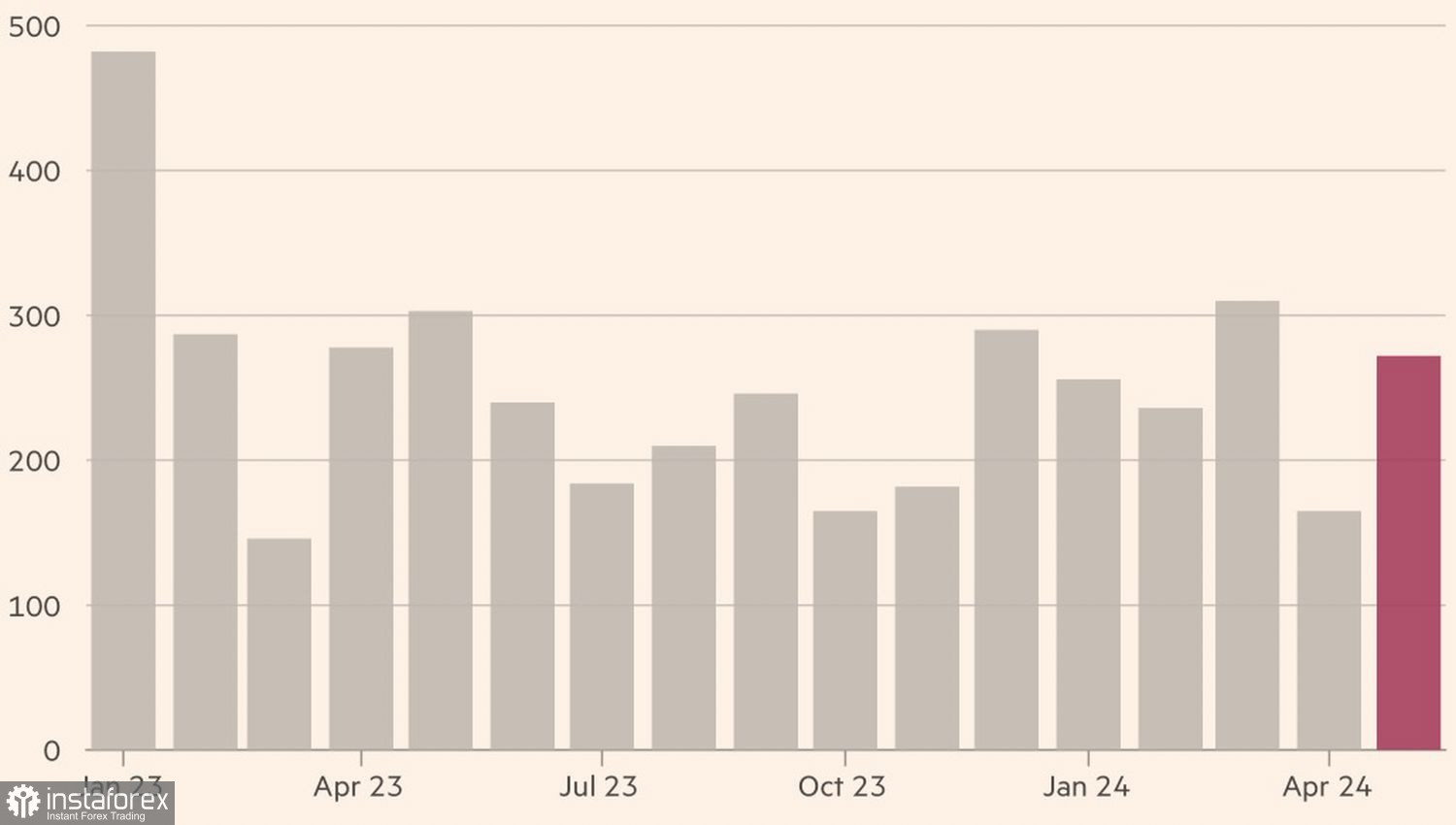

While Joe Biden's team emphasizes that finding unemployment at 4% and below for 30 months is a reflection of the successful economic policy of the Democrats, the rise of non-farm payrolls by 272 thousand struck the bulls in GBP/USD like lightning. Bloomberg experts expected +185 thousand, which would be proof of the cooling of the labor market and would allow them to count on a reduction in the federal funds rate in September. Now, the probability is fifty-fifty, having decreased from almost 70% to an important release.

The dynamics of American employment

Strong statistics add fuel to the fire of talk about changing FOMC forecasts for the federal funds rate. In March, Fed officials expected three acts of monetary expansion in 2024. Now, they are likely to show up to one or two in the updated estimates.

That's how much derivatives are expected to receive, in fact. Before the release of the May employment data, the futures market was confident that the Fed would begin easing monetary policy in November. However, expectations have now shifted to December. This leads to an increase in Treasury bond yields and a strengthening of the US dollar against major world currencies.

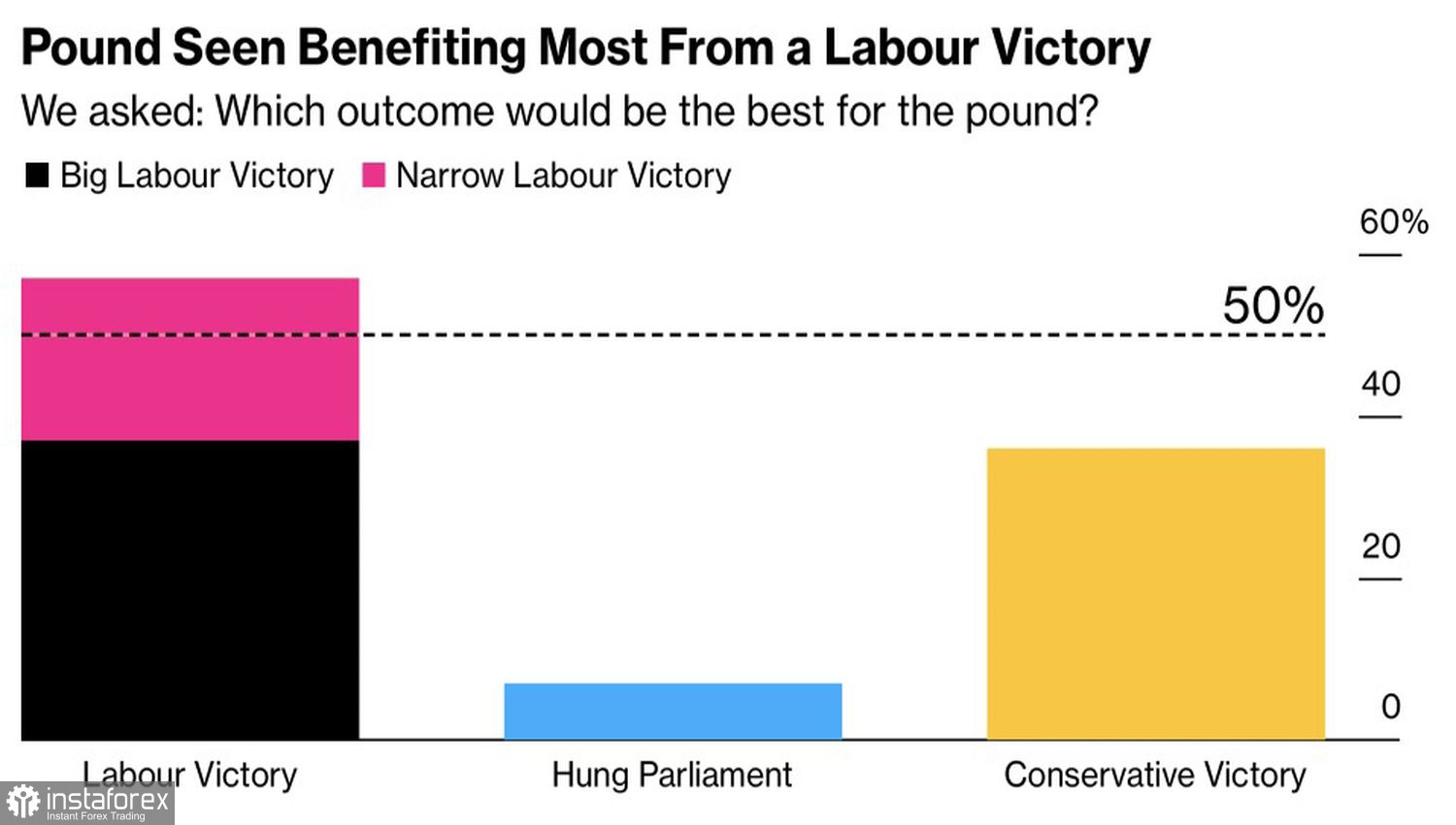

The pound was also among the victims, but investors' faith in the coming to power of the Labour Party in Britain supports the "bulls" in GBP/USD. Their party is less divided than the Tories. In addition, they advocate closer ties with the European Union, which will have a positive impact on foreign trade and the economy of the UK. More than half of the 268 investors surveyed by MLIV Pulse believe that Labor's victory is positive for sterling.

Sterling's alleged reaction to the results of the parliamentary elections in Britain

At the same time, if the Labor Party's victory turns out to be unconditional and it receives an overwhelming majority in the new parliament, this will become a risk factor for GBP/USD. 34% of the respondents think so. The worst result, according to 46% of respondents, is a divided parliament.

At the same time, investors do not believe that Labour will be able to return the pound to its levels before Brexit. 61% of MLIV Pulse respondents believe that it will take at least five years for it to trade near the 1.5 mark.

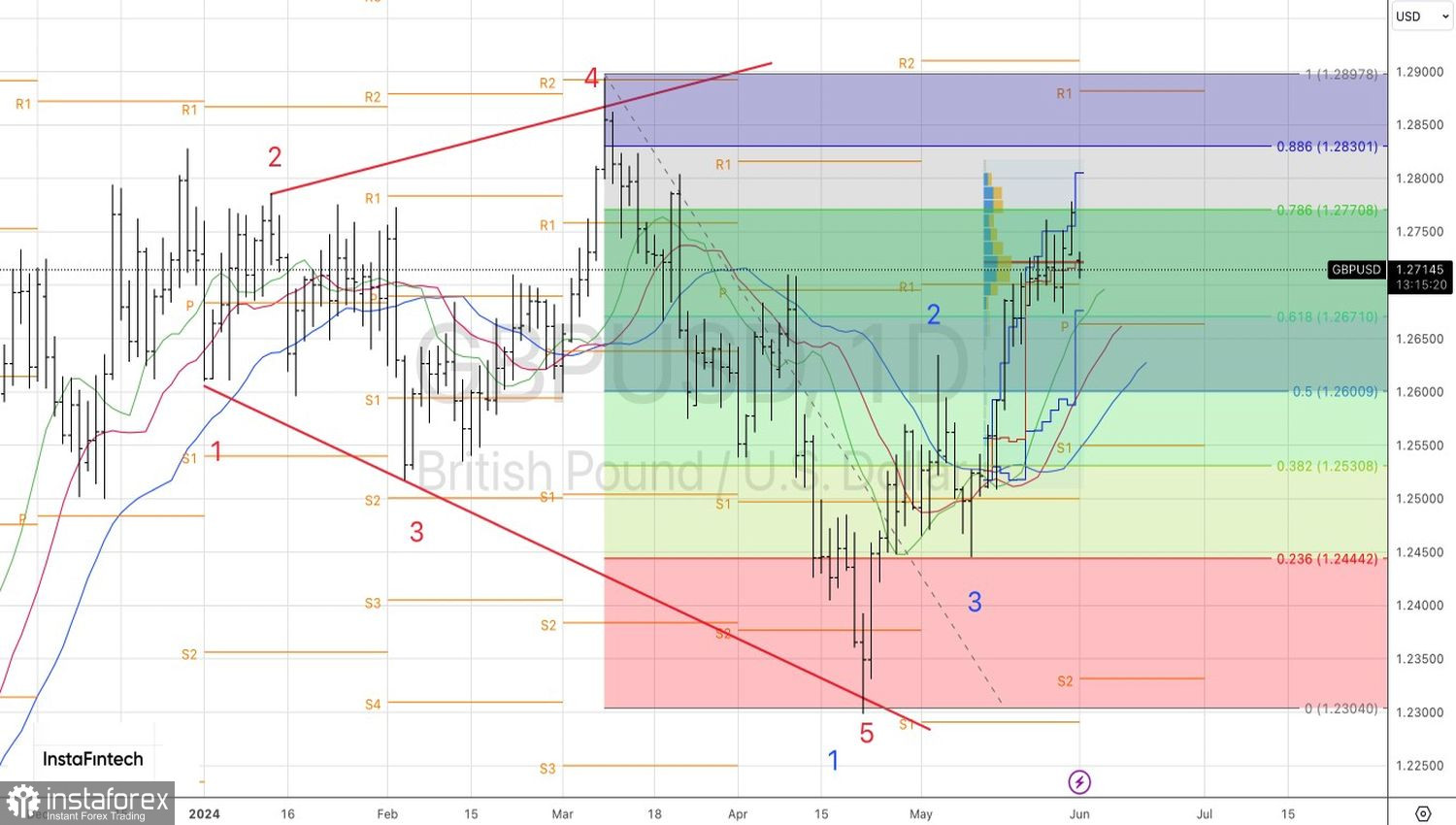

Technically, the GBP/USD daily chart shows a pullback to an uptrend. The pair is struggling for a fair value near 1.272. If the bulls win, the pair will consolidate. The bears' victory, followed by a successful test of support at 1.2695, will be a reason for sales.