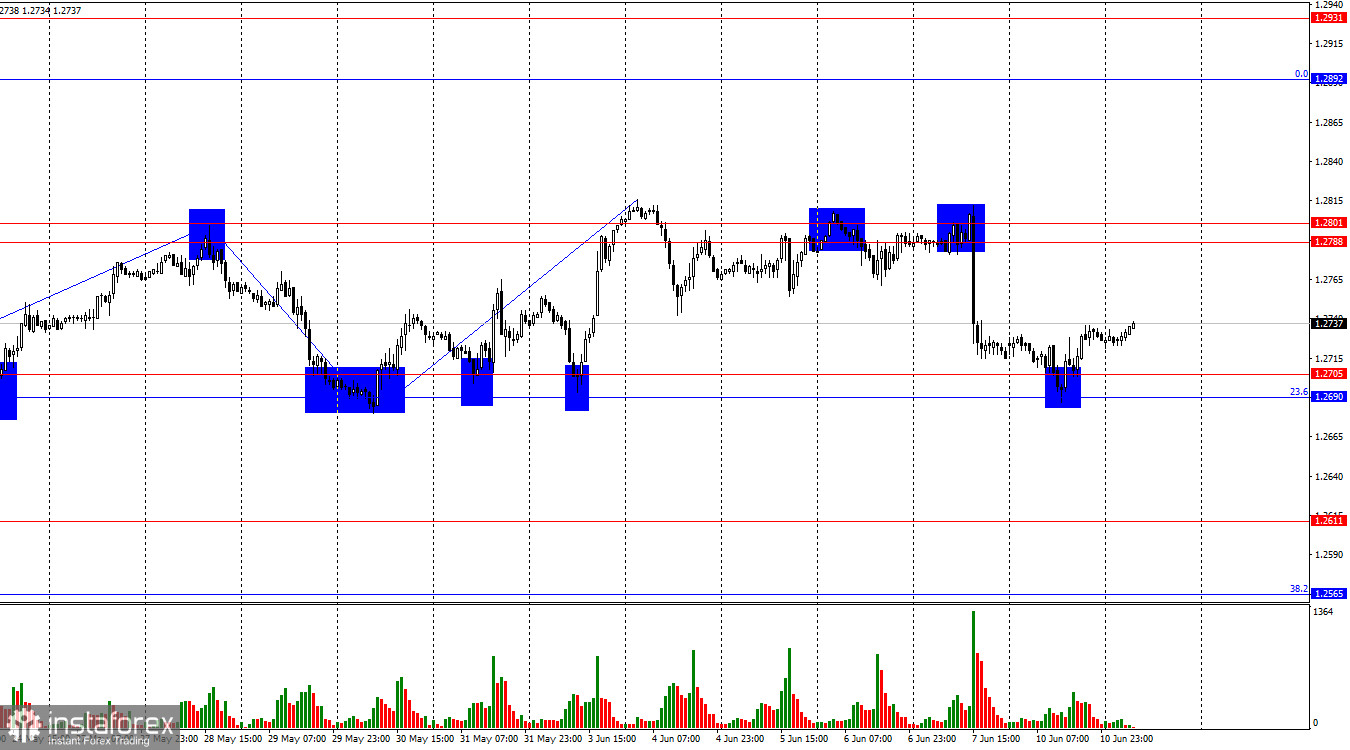

On the hourly chart, the GBP/USD pair rebounded from the 1.2690–1.2705 support zone on Monday, leading to a reversal in favor of the pound and a slight increase. Today, the pair may return to the 1.2690–1.2705 zone and make a new attempt to break below it. If successful, the decline in quotes may continue towards the next level of 1.2611. Another rebound would allow for a new rise towards the 1.2788–1.2801 resistance zone.

The wave situation remains unchanged. The last upward wave broke the peak of May 28 by only a few pips. The new downward wave could not break the low of the wave from May 30. Thus, the trend for the GBP/USD pair remains bullish, with the bulls having a significant advantage, but in recent weeks, we have seen horizontal movement—wave peaks and lows are not breaking previous extremes. In the current circumstances, I believe it is best to focus on two zones: 1.2690–1.2705 and 1.2788–1.2801. Breaking either will indicate the further direction of the pound.

There was no informational background on Monday, but three reports were released in the UK on Tuesday. The unemployment rate in April rose from 4.3% to 4.4% (forecast 4.3%), the number of unemployment claims increased by 50.4 thousand (forecast 10.2 thousand), and wages rose by 5.9% (forecast 5.7%). The first two reports can be considered negative for the pound, while the last one is positive. Wage growth increases the risk of slowing inflation. That is why wage growth means that the Bank of England may maintain a hawkish monetary policy longer, which is good for the pound. However, traders reacted very sluggishly to this set of statistics. The pound fell by 20 pips but aimed for the 1.2690–1.2705 zone to attempt to break through it on the sixth attempt.

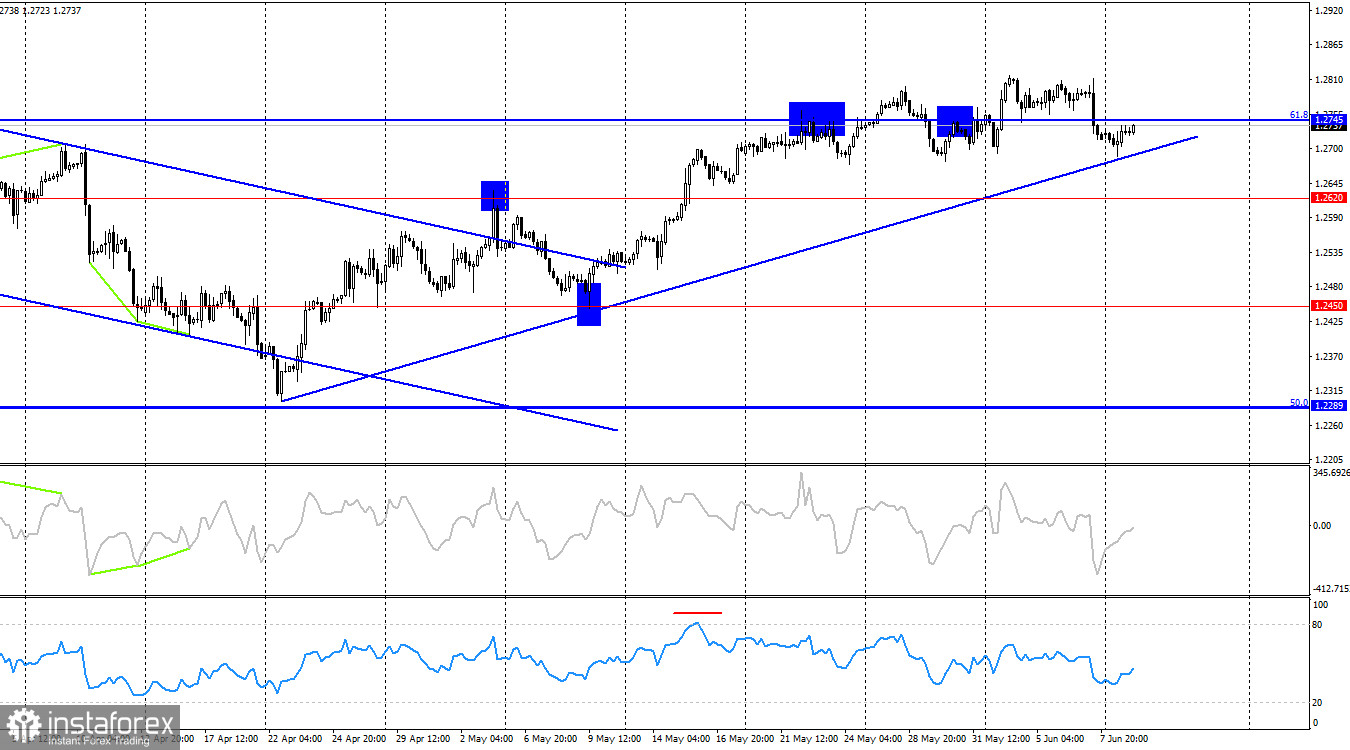

On the 4-hour chart, the pair turned in favor of the US dollar and began a process of falling towards the ascending trend line. It is better to determine the dynamics and trend now on the hourly chart. There, the horizontal corridor is clearly visible, which is currently the most important graphic formation. Also, two important zones are on the hourly chart. Securing below the trend line will indicate a strong fall in the pound towards the levels of 1.2620 and 1.2450.

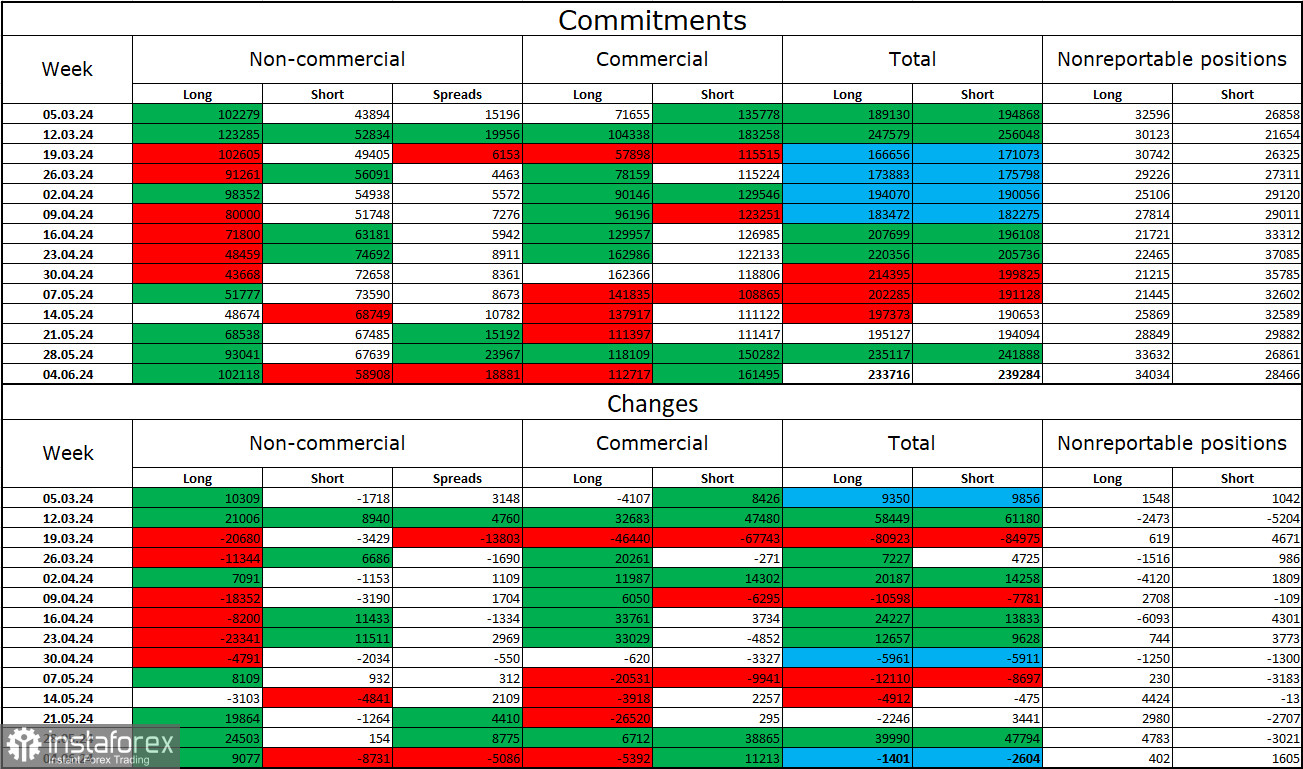

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category became more bullish over the last reporting week. The number of Long contracts held by speculators increased by 9,077, while the number of Short contracts decreased by 8,731. The overall sentiment of large players has changed again, and now the bulls have a solid advantage. The gap between the number of Long and Short contracts is 43 thousand: 102 thousand against 59 thousand.

The pound still has good prospects for a decline, but the bears are still not ready to advance. Over the last three months, the number of Long positions has not changed, while the number of Short positions has increased from 44 thousand to 59 thousand. Over time, the bulls will continue to shed Buy positions or increase Sell positions, as all possible factors for buying the pound have already been worked out. However, the key factor will be the willingness and ability of the bears rather than the informational background or COT report data.

News Calendar for the US and UK:

United Kingdom – Unemployment Rate (06:00 UTC)

United Kingdom – Change in Unemployment Claims (06:00 UTC)

United Kingdom – Change in Average Wages (06:00 UTC)

On Tuesday, the economic events calendar contains three entries, but all three have already been made available to the market. The impact of the informational background on market sentiment for the rest of the day will be absent.

Forecast for GBP/USD and Advice to Traders:

Selling the pound was possible upon a rebound from the 1.2788–1.2801 zone, aiming for the 1.2690–1.2705 zone. This target has been achieved. New sales are possible upon closing below the 1.2690–1.2705 zone, aiming for 1.2611. Purchases can be made upon a rebound from the 1.2690–1.2705 zone, aiming for the 1.2788–1.2801 zone.