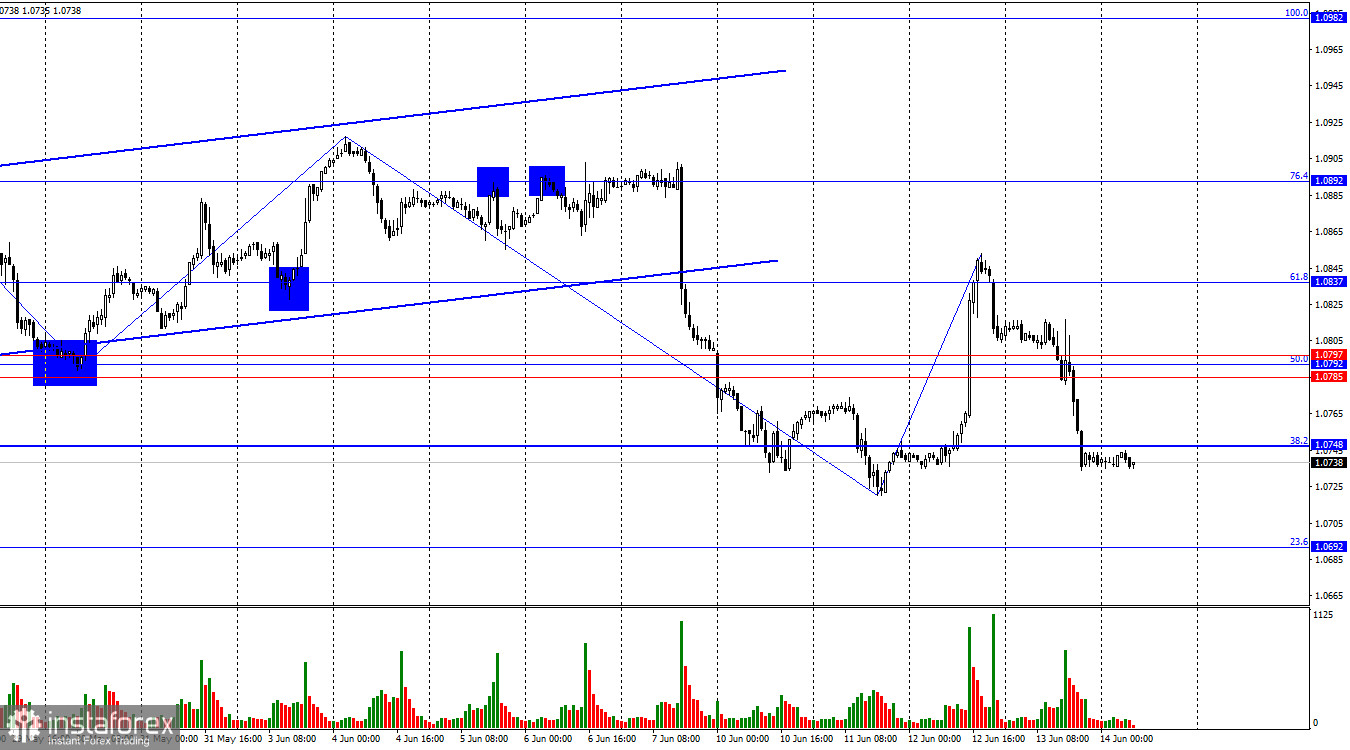

On Thursday, the EUR/USD pair continued declining, consolidating below the support zone of 1.0785–1.0797 and subsequently below the corrective level of 38.2% (1.0748). Therefore, the decline may continue towards the next Fibonacci level of 23.6% at 1.0692. Consolidation above 1.0748 could lead to a minor increase in the euro towards the 1.0785–1.0797 zone.

The wave situation remains clear. The last completed downward wave broke the low of the previous wave from May 30, while the last upward wave failed to break the peak of the previous wave. Thus, the bearish trend continues and is still forming. In the near future, the informational backdrop should not prevent the bears from continuing their attack. The first sign of the bearish trend ending would be the absence of a break below the low of the June 11 wave. In this case, we can expect a new upward wave towards the level of 1.0837.

Thursday's information backdrop was mixed. The morning report on industrial production in the Eurozone was weak. In April, production volumes decreased by 0.1% month-over-month and 3% year-over-year. Traders expected much more positive values and euro sales began almost immediately in the morning. The US Producer Price Index was released in the second half of the day, showing a 0.2% decrease in May, which temporarily stunned dollar bulls. If inflation decreases faster than expected, the Federal Reserve might move more quickly to ease monetary policy. However, the last Fed meeting (held on Wednesday) indicated that a rate cut is not on the agenda, and inflation needs to be lowered to discuss easing monetary policy. Thus, the dollar continued its logical growth, later supported by the graphic signal of closing below the 1.0785–1.0797 zone.

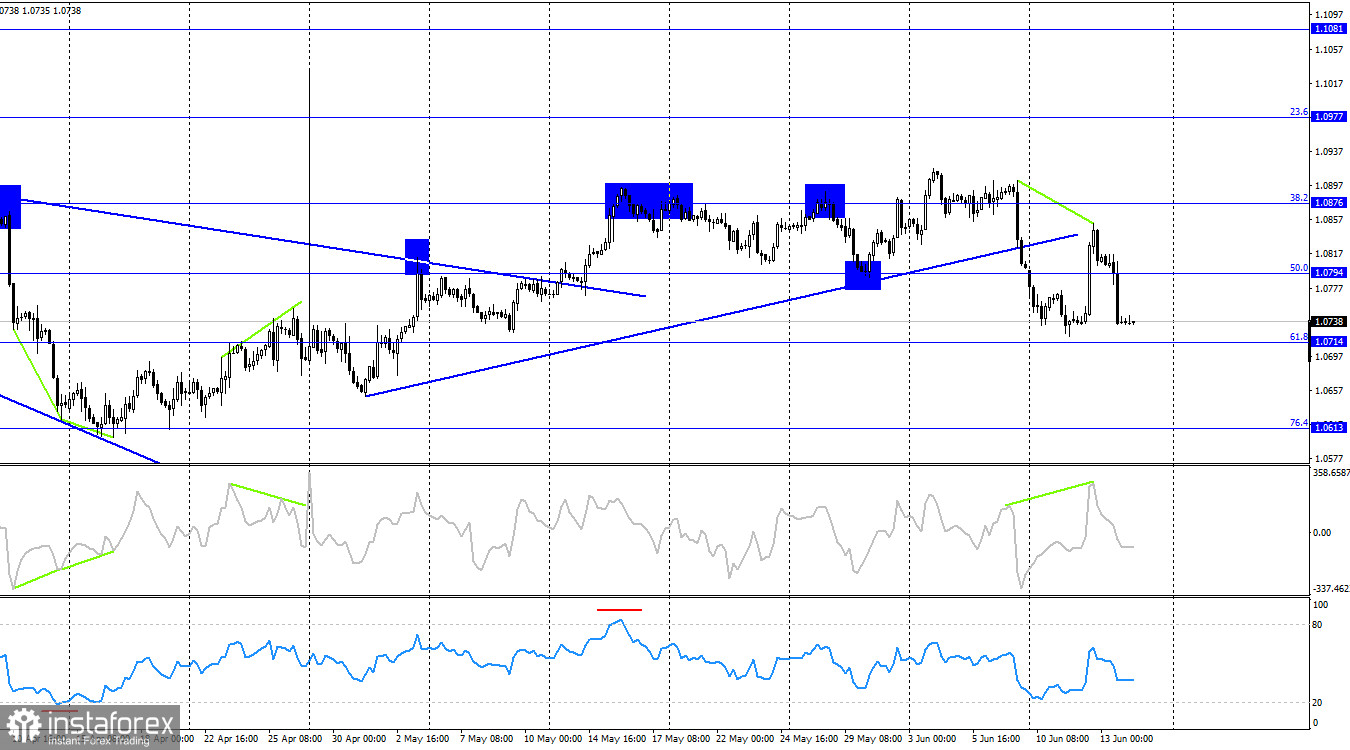

On the 4-hour chart, the pair reversed in favor of the US dollar after forming a bearish divergence with the CCI indicator. However, the divergence did not cause the dollar's growth; instead, the Fed met outcomes and reduced the likelihood of rate cuts in 2024. The decline in quotes may continue towards the 61.8% Fibonacci level at 1.0714. A rebound from this level will favor the euro and a minor rise, but after consolidating below the ascending trendline, I expect a much larger decline.

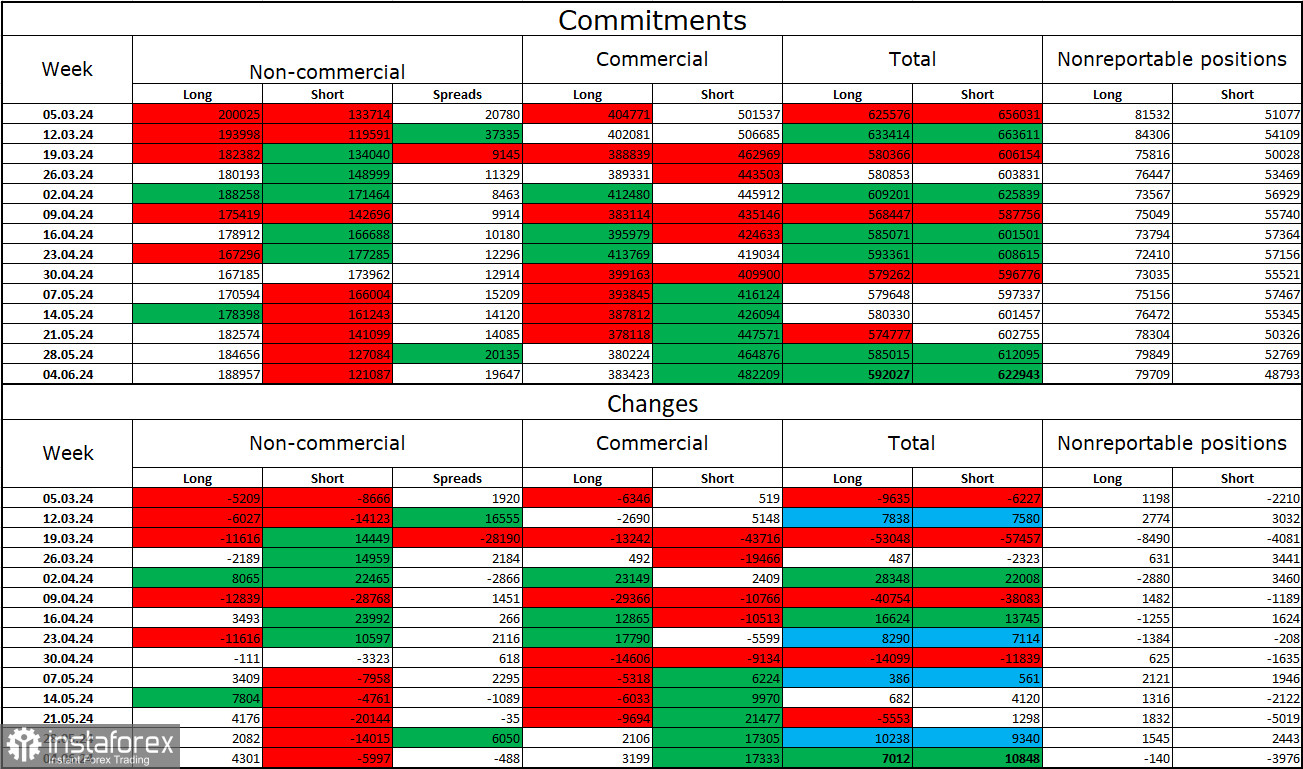

Commitments of Traders (COT) Report:

During the last reporting week, speculators opened 4,301 long contracts and closed 5,997 short contracts. The sentiment of the "Non-commercial" group turned bearish a few weeks ago, but now the bulls have the advantage again and are increasing it. The total number of long contracts speculators hold is now 189,000, while short contracts total 121,000. The gap is again widening in favor of the bulls.

However, the situation will continue to change in favor of the bears. I do not see long-term reasons to buy the euro, as the ECB has begun easing monetary policy, which will reduce the yields of bank deposits and government bonds. In the US, they will remain high for at least several months, at least making the dollar more attractive to investors.

News Calendar for the US and Eurozone:

- US: University of Michigan Consumer Sentiment Index (14:00 UTC).

- Eurozone: ECB President Christine Lagarde's speech (17:30 UTC).

The economic events calendar for June 14 contains two entries, with Christine Lagarde's speech standing out. The impact of the information backdrop on trader sentiment today could be moderate.

Forecast for EUR/USD and Trading Tips:

Sales of the pair were possible yesterday upon closing below the support zone of 1.0785–1.0797, with targets at 1.0748 and 1.0692. The first target has been achieved, and trades can be kept open for the second target. Euro purchases are possible upon a rebound from 1.0722 (the last price low) on the hourly chart, targeting 1.0785.