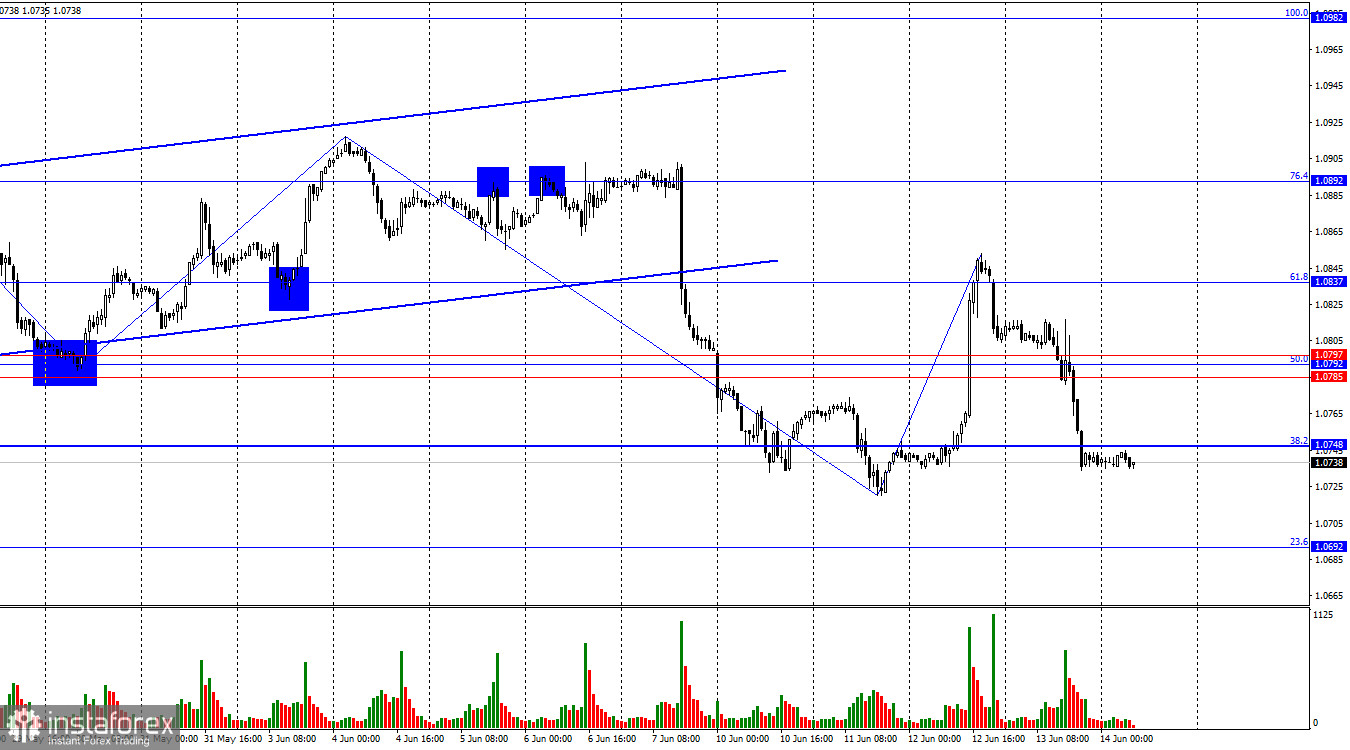

The EUR/USD pair continues to fall for the second day in a row. Before this fall, a downward wave was formed, which broke the bullish trend. A fairly strong upward wave followed this, and now the "bearish" trend has resumed. I say "strong" about the corrective wave because when it was formed, the information background supported bears much more strongly than bulls. However, after the trend had finally been lost, the bulls decided to raise the euro currency as much as possible. Let me remind you that on Wednesday, when the upward wave was fully formed, the US inflation report fell by 0.1%. Core inflation slowed by 0.2%. This is not such a big slowdown that the US currency has fallen by 100 points or more for the second month in a row.

The second point is the results of the Fed meeting. By all accounts, it was a "hawkish" meeting. All that was needed was for Jerome Powell to allow a new tightening of the PEPP if the situation required it. However, even without this, there were enough "hawkish" factors. The interest rate remained at the same peak level, and the chart of forecasts for the FOMC "dot-plot" rate showed a decrease in possible easing by half in 2024. And Jerome Powell said that the slowdown in inflation in the last two months is too small for the regulator to start considering the possibility of easing the PEPP. Nevertheless, the US currency rose very slightly on Wednesday evening, which again raised some questions.

However, Thursday came, and the US dollar, without any support from the information background, showed an increase of 70 points. Friday came, and the dollar rose by another 30 points in just four morning hours. Thus, the market reaction to the Fed meeting was postponed 10-12 hours ahead. In general, we saw the growth of the US currency as it should have been.

Now, I think that the "bearish" trend will develop. It should take place as standard: the main wave, then the corrective one. Today and next week, the fall of the EUR/USD pair may continue, as the low of the previous downward wave was broken only a couple of hours ago.

Traders can use the information background to play against the US currency for corrections and upward pullbacks. Next week, we will see the euro at the level of 1.0602.

Conclusion:

The trend for the EUR/USD pair has changed to "bearish." Over the past two months, we have repeatedly observed situations where economic statistics are not so bad for the US currency, but it is still falling. Now, the situation has changed to the opposite. Yesterday, two American reports turned out to be worse than traders' expectations, but the dollar continued to grow. Dollar buyers have become more active and can now use most of the information to their advantage.

Thus, I expect the pair to fall further by at least another 100 pips. After working out the corrective level of 100.0%–1.0602, it will still be possible to count on the fall of the European currency, as the information background facilitates this. Let me remind you that the main factor now is the beginning of the ECB's easing of the PEPP and the absence of a similar step by the Fed. After working off 1.0602, it will be possible to trade more from the levels, looking for sell signals.