The British pound might plummet this week. I would like to mention this right off the bat. Take note that the pound is still in demand in the currency market and it often ignores the news background. The wave pattern remains intact but it could go through some changes. The past few days have allowed us to breathe a slight sigh of relief, as the GBP/USD quotes have failed to break through the 1.2822 mark. Now, wave 2 or b is considered complete, and we can expect a new downward wave to form.

It is very fortunate that the UK will release its inflation report for May. What sounds even better is that the Consumer Price Index may slow down to 2% or even lower. This suggests that the Bank of England might start easing monetary policy at its next meeting, which the market initially expected in the fall-winter of 2024. In this case, the Federal Reserve would be the only central bank to start lowering rates at an uncertain time. Undoubtedly, this is a great factor for reducing demand for the pound. However, if the British currency refuses to fall, then we might as well close the GBP/USD chart for a long time...

On Thursday, the BoE is set to hold its meeting, and it may surprise the markets. Analysts currently lean toward the expectation that rates will remain at their current level. However, if inflation in the UK drops to 2% or even lower, the central bank may decide to start lowering rates immediately. The BoE will have a day to assess the slowdown in inflation. Take note that practically all of the central bank policymakers have repeatedly said over the past six months that the danger lies not only in lowering rates too early but also in doing so too late. If inflation drops to the target level, why should the central bank continue to hold the rate at its peak value? But the market is already expecting the rate to remain at the same level. If it is lowered, the pound might exhibit the movement it should have shown over the past two months, only covering the downward distance in a week instead of two months.

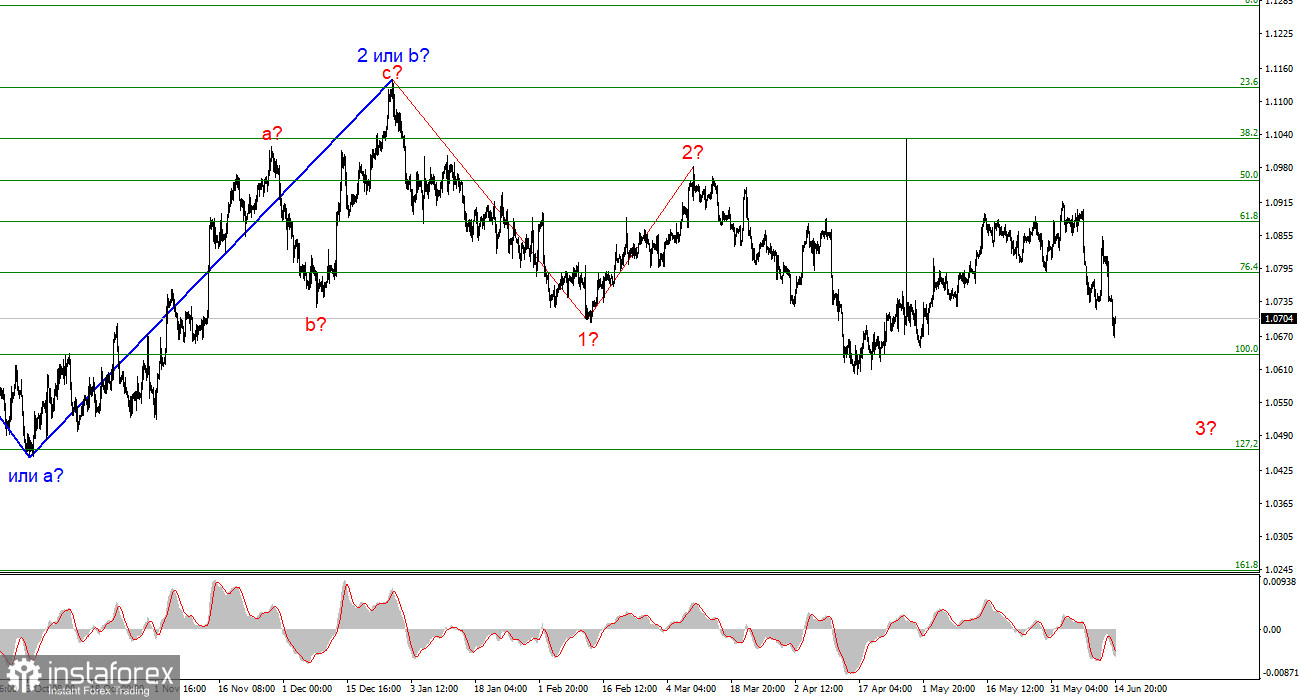

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. In the near future, I expect a downward wave 3 or c to form with a significant decline in the instrument. I am considering short positions with targets near the 1.0462 mark. The internal wave structure of wave 3 or c may take on a corrective five-wave form, but in this case, quotes should drop to the 1.04 area.

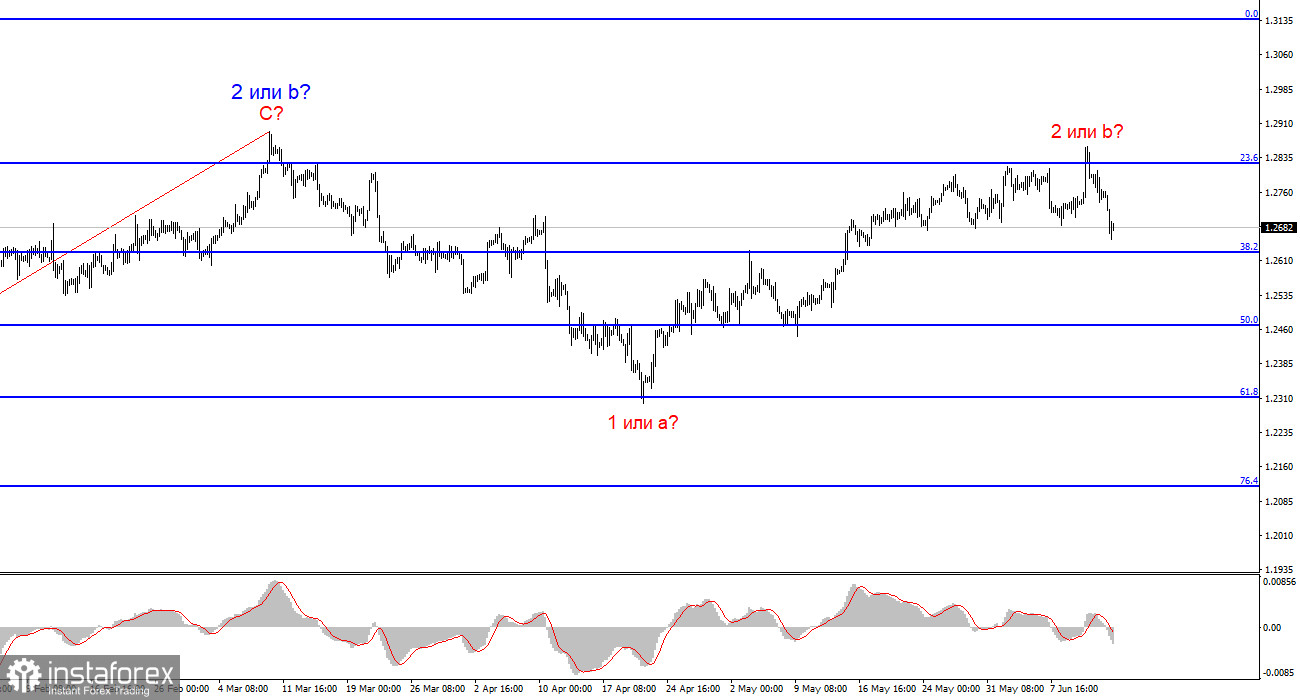

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c has not yet been canceled. Since the instrument bounced around the 1.2822 mark, as well as near the peak of the supposed wave 2 or b, you may consider short positions with initial targets around the 1.2315 mark. However, proceed with caution, as it is still difficult to guarantee that the market has definitely turned bearish.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.