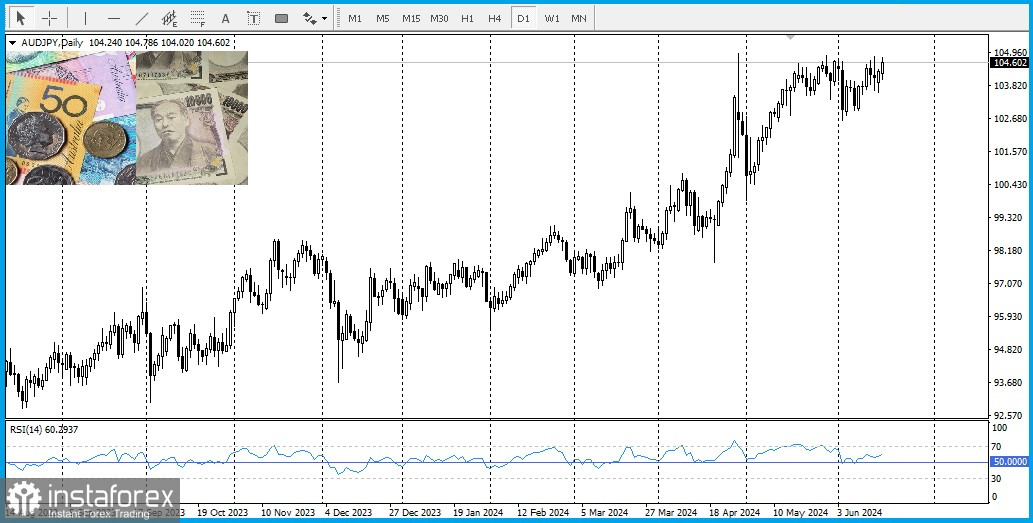

For two days in a row, the AUD/JPY pair has been trying to attract both sellers and buyers. After the Reserve Bank of Australia announced its policy decision, spot prices continued to take a defensive position, trading above the round level of 104.00.

As expected, the RBA decided to keep the official OCR cash rate unchanged at 4.35% for the fifth meeting in a row. In addition, it is assumed that the RBA may raise the interest rate this year due to high inflation. Therefore, such an action will serve as a wayward for the Australian dollar and will support the pair.

Nevertheless, data on China released on Monday highlighted the rise of the world's second-largest economy. Accordingly, this overshadowed the RBA's statements about higher interest rates, thereby undermining the position of antipodean currencies, including the Australian dollar. Meanwhile, the Japanese yen is receiving support from statements by the chairman of the Bank of Japan, Kazuo Ueda, that, of course, depending on economic data, the central bank is ready to raise rates in July.

In addition, speculation that the Japanese authorities may intervene to support the national currency further contributes to the fall of the AUD/JPY pair.

Nevertheless, the positive risk tone in the markets as a whole, which tends to reduce demand for a safe yen, ahead of the press conference of RBA Governor Michele Bullock, supports the risk-sensitive Australian dollar and thereby should help limit any significant drop in the pair.