EUR/USD initially corrected to the Murray level "4/8" - 1.0742, and then to the moving average, rebounding from both. Thus, the pair may resume the downward movement and this may continue in the coming days. The price remains below the moving average line, and we only expect the euro to fall further. Take note that the euro steadily rose for two months. It moved upward even when the news background was against it. We consistently noted how the pair kept showing illogical movements, which resembled market makers working against retail traders. Regardless, the fact that the European Central Bank started a monetary policy easing cycle in June cannot go unnoticed. The fact that the Federal Reserve did not start its rate cut cycle in March or June also speaks volumes. We consider the combination of these two factors enough reason for the euro to fall to price parity. We repeatedly mentioned this.

In the first two trading days of the week, we can highlight two events in the Eurozone. On Monday, ECB President Christine Lagarde delivered another speech, and on Tuesday, a report on the final estimate for inflation in May was published. Let's have a closer look at these events. Lagarde informed the market that the ECB's key rate could be reduced "not according to plan." Incidentally, the market itself drew up the next "plan" for the ECB's rate cuts. Participants expect the ECB to lower the rate once every two meetings, but Lagarde said that everything would depend on macroeconomic indicators, particularly inflation. It is worth noting that the market loves to build various hypotheses about future events, act on them, and then it may turn out that they were incorrect. Such situations only add confusion to the charts.

As expected, annual consumer price inflation in the eurozone accelerated to 2.6% in May. There's absolutely nothing alarming about this, as inflation does not have to decrease every single month. However, this shouldn't boost the euro. Before the ECB meeting, the market might have thought that due to rising inflation, the ECB would delay easing monetary policy to a later date. Now, this is no longer an option, as the central bank has already begun monetary easing. In any case, a single 0.2% annual increase is not a reason to talk about an upward trend.

Therefore, based on the events of Monday and Tuesday, we can conclude that the market situation has remained unchanged. The market is still bearish; the euro has been rising for too long, and the global downtrend remains intact. As a result, we expect EUR/USD to fall to at least 1.0450. Since the Fed is not expected to soften its stance in the near future, we see no reason for the pair to resume the upward movement observed in recent months.

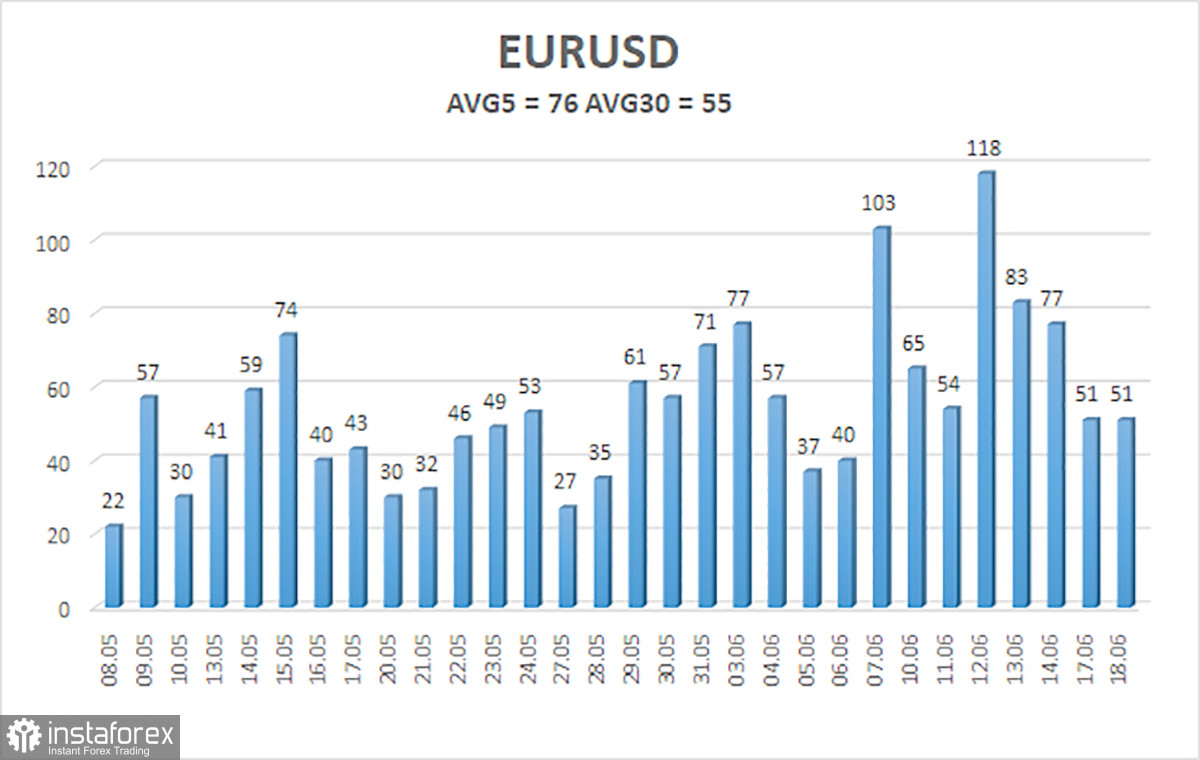

The average volatility of the EUR/USD pair over the last five trading days as of June 19 is 76 pips, which is considered an average value. We expect the pair to move between the levels of 1.0663 and 1.0815 on Wednesday. The higher linear regression channel has turned upwards, but the global downtrend remains intact. The CCI indicator entered the oversold area once again, but at this time we do not expect a strong uptrend.

Nearest support levels:

S1 - 1.0681

S2 - 1.0620

S3 - 1.0559

Nearest resistance levels:

R1 - 1.0742

R2 - 1.0803

R3 - 1.0864

Trading Recommendations:

The EUR/USD pair maintains a global downtrend, and continues to stay below the moving average on the 4-hour timeframe. In previous reviews, we said that we don't consider long positions and that we should wait for a continuation of the downtrend. At this time, short positions are still valid. The targets are 1.0620 and 1.0559. The rebound from 1.0681 triggered a bullish correction, but we expect it to end soon. We don't recommend buying the euro, as we believe that the global downtrend has resumed, and the single currency has no grounds for growth.

Explanation of the chart:

- Linear Regression Channels – Helps determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

- Moving Average Line (settings 20.0, smoothed) – Determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels – Target levels for movements and corrections.

- Volatility Levels (red lines) – The probable price channel in which the pair will spend the next day, based on current volatility indicators.

- CCI Indicator – Its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is imminent.