Overview of trading and tips on EUR/USD

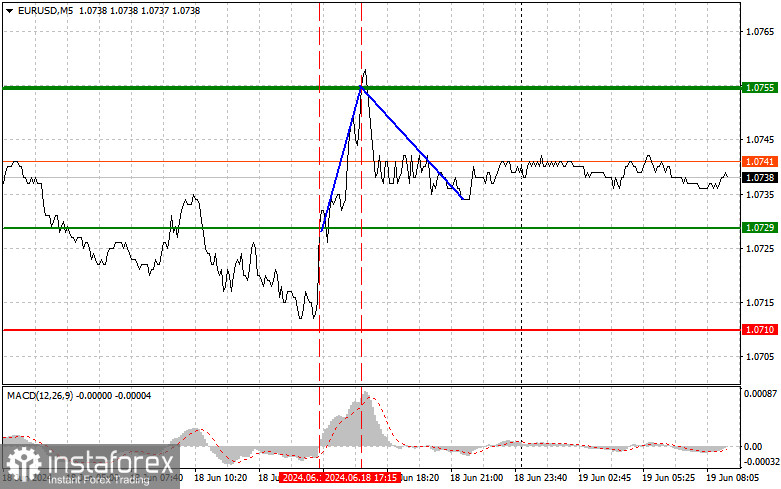

The price test of 1.0729 occurred at a time when the MACD indicator was just starting to rise from the zero mark, which confirmed the correct entry point to buy the euro. As a result, EUR/USD rose by more than 25 pips. Selling on the rebound at 1.0755, according to scenario No. 2, also yielded about 15 pips of profit. Yesterday, reports on the Eurozone Consumer Price Index, especially core prices, and ZEW economic sentiment indexes for Germany and the Eurozone limited the pair's upward potential, while weak U.S. retail sales pushed the euro to actively rise in the second half of the day.

Today, euro buyers may face challenges in the first half of the day since there is no significant data other than the European Central Bank's current account balance. This will also affect market volatility, so I don't expect much from the first half of the day. As for the intraday strategy, I will rely more on the implementation of scenarios No. 1 and 2.

Buy signals

Scenario No 1. Today, you can buy the euro when the price reaches 1.0747 plotted by the green line on the chart, aiming for growth to the level of 1.0780. At the level of 1.0780, I plan to exit the market and also sell the euro in the opposite direction, counting on a movement of 30-35 pips from the entry point. You can count on the euro to rise today, but only within the framework of the bullish correction and with the expectation of testing yesterday's high. Before buying, make sure that the MACD indicator is above the zero mark and is just starting to rise from it.

Scenario No 2. I am also going to buy the euro today in case of two consecutive tests of the price of 1.0727 at the time when the MACD indicator is in the oversold area. This will limit the downward potential of the instrument and lead to an upward reversal of the market. We can expect growth to the opposite levels of 1.0747 and 1.0780.

Sell signals

Scenario No 1. I plan to sell the euro after EUR/USD reaches the level of 1.0727 plotted by the red line on the chart. The target will be the level of 1.0687, where I am going to exit the market and buy immediately in the opposite direction (expecting a movement of 20-25 pips in the upward direction from the level). Pressure on EUR/USD will increase in case the price fails to consolidate near the intraday high and weak Eurozone data. Before selling, make sure that the MACD indicator is below the zero mark and is just starting to decline from it.

Scenario No 2. I am also going to sell the euro today in case of two consecutive price tests of 1.0747 at the time when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward reversal of the market. We can expect a decline to the opposite level of 1.0727 and 1.0687.

What's on the chart:

The thin green line is the entry price at which you can buy the trading instrument.

The thick green line is the price where you can set Take-Profit (TP) or manually fix profits, as further growth above this level is unlikely.

The thin red line is the entry price at which you can sell the trading instrument.

The thick red line is the price where you can set Take-Profit (TP) or manually fix profits, as further decline below this level is unlikely.

MACD line: it is important to be guided by overbought and oversold areas when entering the market

Important: Novice traders in the cryptocurrency market need to be very cautious when making decisions to enter the market. It is best to stay out of the market before important fundamental reports are released to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

Remember, for successful trading, it is necessary to have a clear trading plan, similar to the one I presented above. Spontaneously making trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.