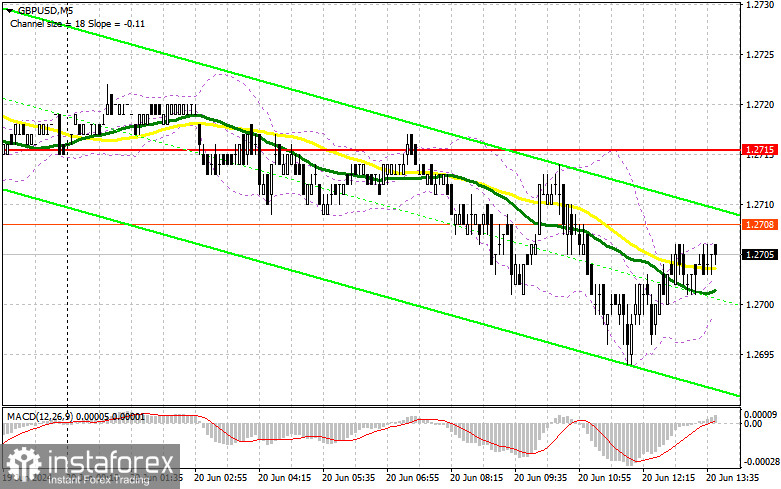

In my morning forecast, I paid attention to the 1.2715 level and planned to make decisions on entering the market from it. Let's look at the 5-minute chart and figure out what happened there. The pound rose, but a couple of points were missing before the test and the false breakout, so I couldn't enter short positions from there. In the afternoon, the technical picture still needed to be revised.

To open long positions on GBP/USD, you need:

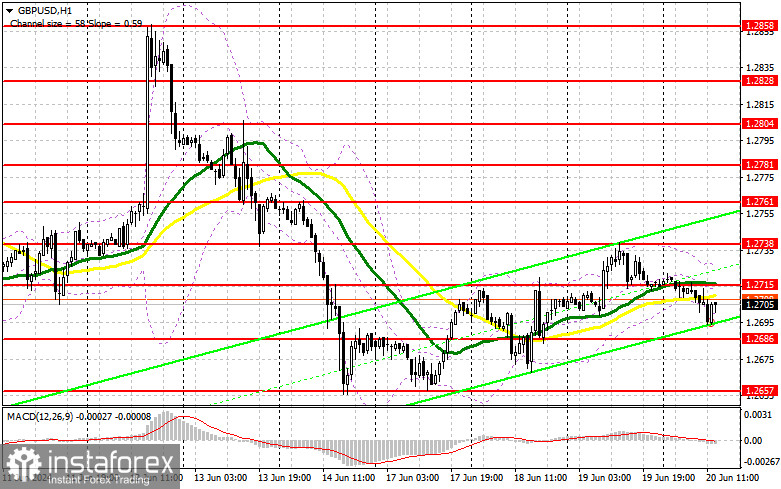

We discussed the Bank of England's decision on interest rates in detail in the morning forecast, so I see it continuing. In addition to the regulator's forecasts, statistics on the United States will also be published. In the case of the former position of the Bank of England, it is also worth paying attention to. Data on the Fed-Philadelphia manufacturing index, the number of new foundations laid, the volume of construction permits issued, and the number of initial applications for unemployment benefits are expected. Strong statistics will be a reason to sell the pound and buy the American dollar. Given that the technical picture has yet to be revised, the primary task of buyers will be to protect the nearest support of 1.2686, on which all the emphasis is placed. Only the formation of a false breakdown there after the decision of the Bank of England will give an entry point into long positions with the aim of a new wave of growth to the level of 1.2715 – resistance, where the moving averages are located. A breakout and a reverse top-down test of this range will be a suitable condition for buying, already counting on the 1.2738 update. The farthest target will be the 1.2761 area, where I'm going to take profits. In the scenario of a decline in GBP/USD and a lack of activity on the part of the bulls at 1.2686 in the afternoon, buyers of the pound will lose all initiative, which will only increase pressure on the pair. This will also lead to a decrease and update of the next support of 1.2657. Only the formation of a false breakout will be a suitable condition for opening long positions. I plan to buy GBP/USD immediately on a rebound from the 1.2631 minimum, aiming for a 30-35 point intraday correction.

For Opening Short Positions in GBP/USD:

Sellers can take control of the market at any moment, and a dovish stance by the Bank of England on future interest rate policy will be enough for this. In the case of a bullish reaction to the decision, only a false breakout formation at the 1.2715 resistance, where the moving averages are located, will be a suitable option for opening short positions, aiming for a decline towards the 1.2686 support, which was not reached in the morning. A return below this level, along with a breakout and reverse bottom-up test, will be a major blow to buyers, leading to stop orders being triggered and opening the way to 1.2657. The furthest target will be the 1.2631 area, where I plan to take profits. Testing this level will also indicate a return of market control to the sellers. In the scenario of GBP/USD rising and no bearish activity at 1.2715 in the second half of the day, buyers will strengthen their advantage. In this case, I will postpone sales until a false breakout at 1.2738. If there is no downward movement there, I will sell GBP/USD immediately on a rebound from 1.2761, but expecting a 30-35 point downward correction within the day.

Indicator Signals:

Moving Averages

Trading is conducted below the 30 and 50-day moving averages, indicating a possible decline in the pair.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands

In case of a decline, the lower boundary of the indicator, around 1.2685, will act as support.

Description of Indicators

- Moving Average: Determines the current trend by smoothing volatility and noise. Period 50, marked in yellow on the chart.

- Moving Average: Determines the current trend by smoothing volatility and noise. Period 30, marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period 12, Slow EMA period 26, SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial Traders: Speculators such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and meet specific requirements.

- Long Non-commercial Positions: Represent the total long open position of non-commercial traders.

- Short Non-commercial Positions: Represent the total short open position of non-commercial traders.

- Total Non-commercial Net Position: The difference between short and long positions of non-commercial traders.