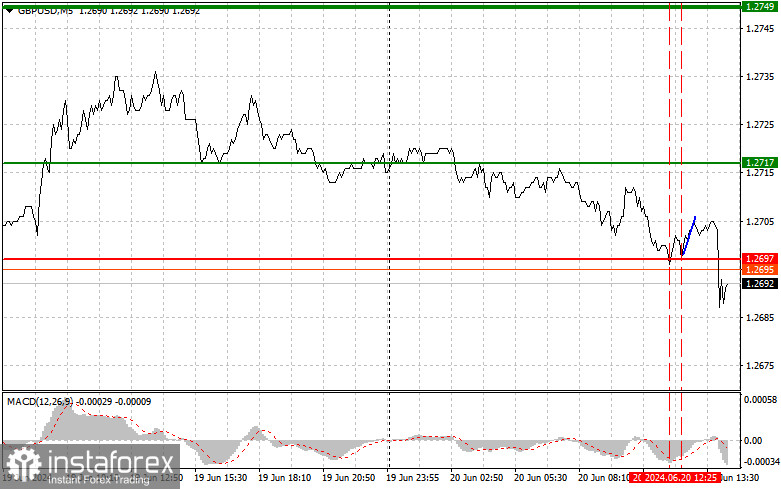

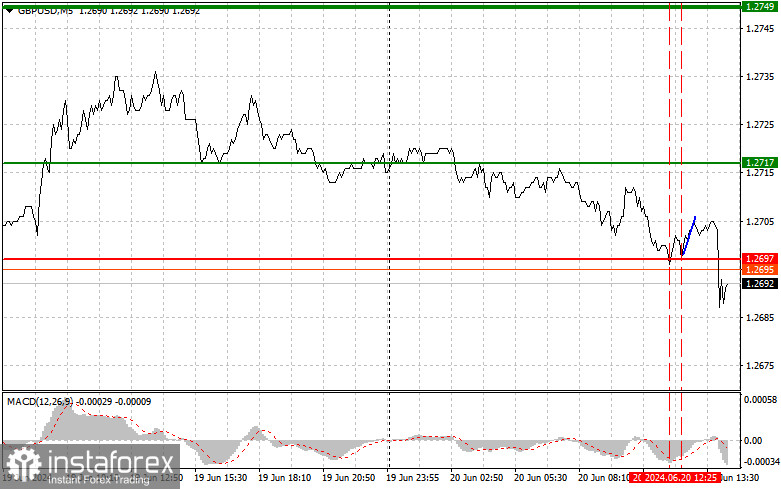

Analysis of transactions and tips on trading the British poundThe price test of 1.2697 came at a time when the MACD indicator went down a lot from zero, which limited the further downward potential of the pair. The second test of this level occurred at the time when the MACD was in the oversold area, which led to the implementation of the buy scenario No. 2. However, a significant rise in the pound did not occur. After the Bank of England's interest rate decision was announced, there was another test of 1.2697 when the MACD started moving down from the zero mark, giving a selling entry point that remains valid at the time of writing. In addition to the Bank of England's decision, today will also see the release of the Philadelphia Fed Manufacturing Index, new housing starts, and building permit data in the US. Initial jobless claims figures are unlikely to have a major market impact. As for the intraday strategy, I plan to act based on the implementation of scenarios No. 1 and No. 2.

Buy signalScenario No. 1: I plan to buy the pound today when I reach the entry point in the area of 1.2714 (green line on the chart) in order to grow to the level of 1.2765 (thicker green line on the chart). Around 1.2765, I will exit the buy trades and open sell trades in the opposite direction (aiming for a 30-35 point move back from the level). A rise in the price of a pound today can only be expected after weak US data. Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise from it.Scenario #2: I also plan to buy the pound today in case of two consecutive tests of the 1.2697 price when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to an upward market reversal. Expect growth towards the opposite levels of 1.2714 and 1.2765.Sell SignalScenario #1: Today, I plan to sell the pound after the 1.2697 level (red line on the chart) is broken, leading to a quick drop in the pair. The key target for sellers will be 1.2656, where I will exit the sell trades and open buy trades in the opposite direction (aiming for a 20-25 point move back from the level). Sellers will emerge after Bailey's speech, but only if the Bank of England Governor takes a dovish stance. Important! Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline from it.Scenario #2: I also plan to sell the pound today in case of two consecutive tests of the 1.2714 price when the MACD indicator is in the overbought area. This will limit the upward potential of the pair and lead to a reverse downward reversal of the market. We can expect a decline to the opposite level of 1.2697 and 1.2656.

What's on the chart:

- Thin green line is the entry price at which you can buy a trading instrument.The thick green line is the estimated price where you can place Take profit or fix profits yourself, since further growth is unlikely above this level.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Expected price for setting Take Profit or independently fixing profits, as further decline below this level is unlikely.

- MACD Indicator: When entering the market, it is important to consider overbought and oversold areas.

- Important Note:

Beginner traders in the Forex market should make market entry decisions very cautiously. It is best to stay out of the market before important fundamental reports are released to avoid sharp exchange rate fluctuations. If you decide to trade during the news release, always place stop orders to minimize losses. Without placing stop orders, you can lose your entire deposit very quickly, especially if you do not use money management, but trade in large volumes.And remember that for successful trading it is necessary to have a clear trading plan, following the example of the one I presented above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.