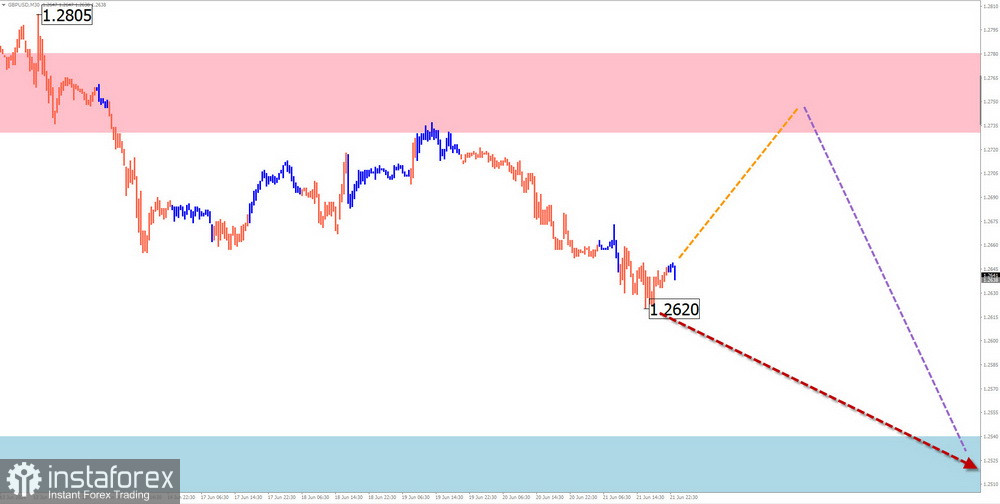

GBP/USD

Analysis:

Since April, the short-term price trend direction of the major British pound pair has been set by an upward trend. As of today, the wave structure still needs to be completed. From a strong potential reversal zone on the weekly scale, the price has been retracing downward since June 12. The potential for decline exceeds the retracement level. Upon confirmation, this movement will mark the beginning of a full correction.

Forecast:

In the coming days, we can expect a pullback in the British pound quotes upwards, up to the calculated resistance zone. After contacting this zone, there is a high probability that the quotes will drift, forming conditions for subsequent downward movement. Further decline within the weekly range is expected to be within the calculated support.

Potential Reversal Zones

Resistance:

- 1.2730/1.2780

Support:

- 1.2540/1.2490

Recommendations:

Purchases: These can be used within individual sessions, with the potential not exceeding the resistance zone.

Sales: Until confirmed reversal signals appear around the resistance zone, there are no conditions for such trades.

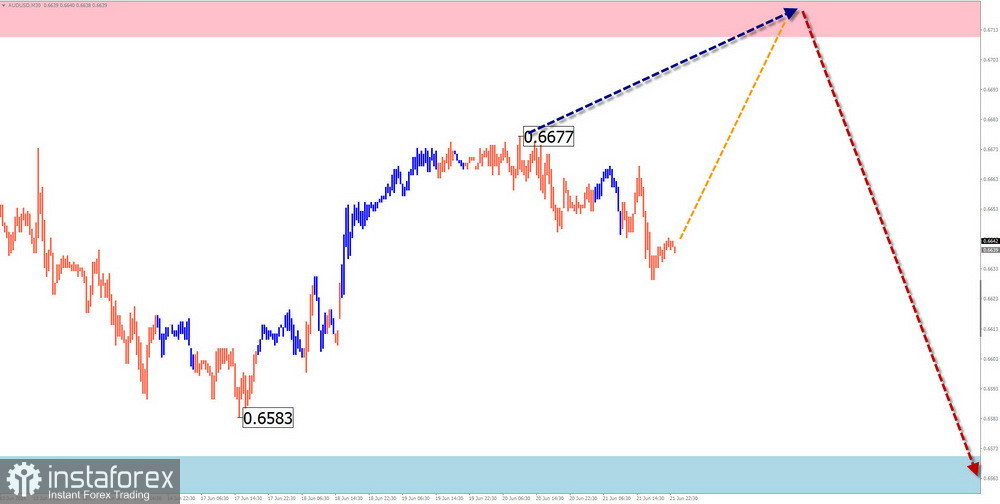

AUD/USD

Analysis:

The price fluctuations of the major Australian dollar pair have been set by a downward wave algorithm over the past year. The analysis of the currently unfinished downward segment from May 31 shows a high likelihood of forming the beginning of a full correction. The price is between the boundaries of a potential reversal zone on the daily timeframe.

Forecast:

The upward movement of the Australian dollar may conclude in the coming days around the calculated resistance. Subsequently, wave logic requires the formation of a counter wave segment. The expected decline is indicated by the calculated support.

Potential Reversal Zones

Resistance:

- 0.6720/0.6770

Support:

- 0.6580/0.6530

Recommendations:

Purchases: Due to limited potential, these can be risky. It is advisable to minimize the volume size.

Sales: These can be considered for trading only after confirmed signals of a change in direction appear.

USD/CHF

Analysis:

The unfinished wave of the Swiss franc chart since December last year has been moving upward. Within this framework, a counter-correction has been forming over the past two months. At the time of analysis, the pair's rate is approaching the upper boundary of the potential reversal zone on the weekly timeframe. The correction structure is nearing completion.

Forecast:

At the beginning of the week, a price decline and an attempt to pressure the support zone can be expected. A brief breach of its lower boundary is possible. In the latter half of the week, the likelihood of a course reversal and a resumption of price increases rises. The calculated resistance indicates the upper boundary of the expected weekly movement.

Potential Reversal Zones

Resistance:

- 0.9020/0.9070

Support:

- 0.8790/0.8740

Recommendations:

Sales: Have limited potential. It is safer to reduce the trading volume.

Purchases: These can be used in trading after a confirmed reversal within the calculated support.

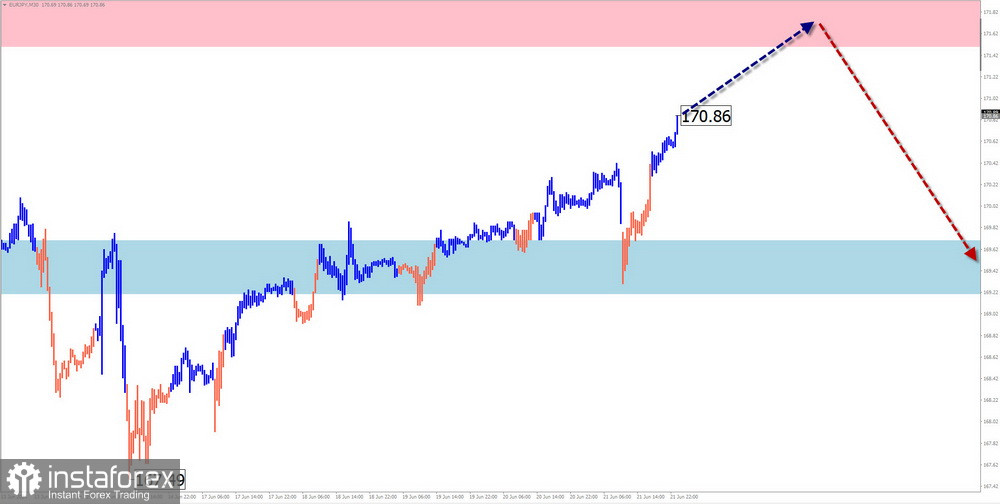

EUR/JPY

Analysis:

The EUR/JPY cross quotes continue their upward movement on the price chart. Last week, the price entered the boundaries of a strong potential reversal zone on the weekly timeframe, approaching its upper boundary. No signals of an imminent direction change are observed on the pair's chart.

Forecast:

At the beginning of the upcoming week, the cross is expected to move predominantly sideways. Near the calculated support zone, conditions for a reversal and a transition to a growth phase in price fluctuations can be expected. The calculated resistance indicates the upper boundary of the pair's likely weekly range.

Potential Reversal Zones

Resistance:

- 171.50/172.00

Support:

- 169.70/169.20

Recommendations:

Sales: Have limited potential. Reducing the trading volume will reduce risk.

Purchases: Transactions are premature until confirmed reversal signals appear around the support area on your trading systems.

EUR/GBP

Analysis:

The EUR/GBP cross quotes continue their movement on the chart according to the downward wave algorithm. Analysis of the wave structure shows the formation of the final part (C). Within this framework, a counter-retracement has been developing in recent days, which needed to be completed at the time of analysis.

Forecast:

During the upcoming weekly period, the overall bearish vector of the cross's price movement is expected to continue down to the calculated support boundaries. In the next couple of days, a brief rebound to the calculated resistance area is not ruled out.

Potential Reversal Zones

Resistance: 0.8500/0.8550

Support: 0.8300/0.8250

Recommendations:

Purchases: There are no conditions for such transactions in the market for this pair.

Sales: These can become the primary direction for trading upon the appearance of signals around the calculated resistance.

US Dollar Index

Analysis:

The fluctuations of the North American dollar index fit into the algorithm of an upward wave that started in December last year. The correction phase ended on June 12. The subsequent upward segment possesses the necessary wave level to continue the rise. Within its structure, a corrective pullback has become necessary.

Forecast:

In the coming week, the overall bearish vector of the index movement will continue. In the first days, a brief upward pullback, not exceeding the resistance boundaries, cannot be ruled out. The highest volatility is likely in the latter half of the week. The calculated support runs along the upper level of the strong potential reversal zone.

Potential Reversal Zones

Resistance: 105.50/105.65

Support: 104.650/104.50

Recommendations:

In the upcoming week, trading transactions aimed at strengthening national currencies in major pairs may be profitable. Upon the appearance of reversal signals around the support area, such transactions should be concluded.

Explanations: In simplified wave analysis (SWA), all waves consist of 3 parts (A-B-C). The latest unfinished wave is analyzed on each timeframe (TF). Dotted lines indicate expected movements.

Attention: The wave algorithm does not take into account the duration of instrument movements over time!