Review of trades and trading advice on the European currency

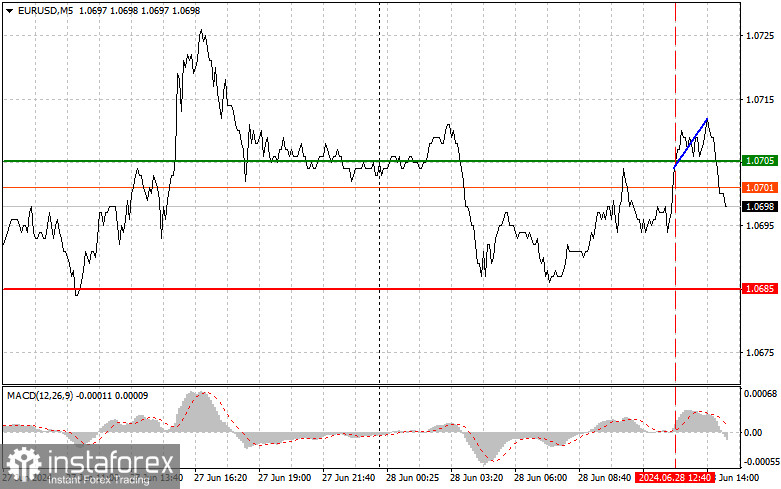

The test of the price at 1.0705 in the first half of the day coincided with when the MACD indicator started to move above the zero mark, confirming a correct entry point for buying the euro. However, as you can see, there was no significant upward movement. For this reason, I decided to exit positions and reconsider the strategy, especially since the second half of the day promises a lot of economic data. It will all begin with the core Personal Consumption Expenditures (PCE) index, changes in personal spending levels, changes in personal income levels, and the University of Michigan Consumer Sentiment Index. The day will conclude with important inflation expectations from the University of Michigan and speeches by FOMC members Thomas Barkin and Michelle Bowman. Strong economic data and a firm stance by policymakers are reasons to sell the euro. As for the intraday strategy, I plan to act based on the implementation of scenarios #1 and #2.

Signal to Buy

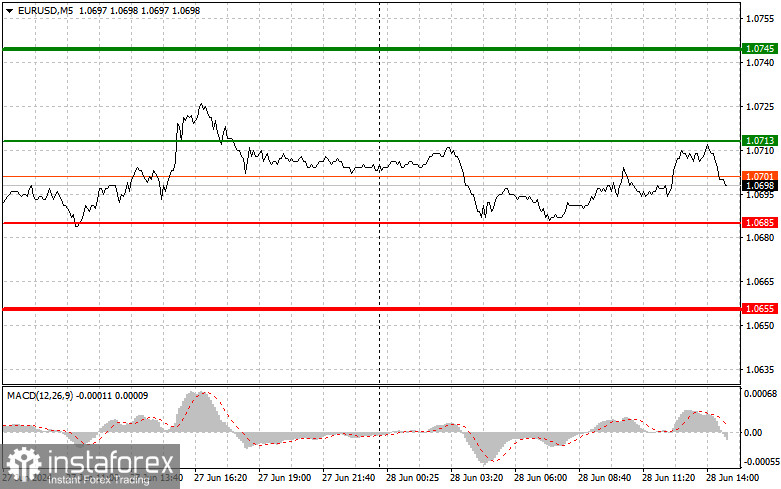

Scenario #1: I plan to buy the euro when the price reaches around 1.0713 (green line on the chart), with a target to rise to 1.0745. At 1.0745, I will exit the market and sell the euro in the opposite direction, targeting a movement of 30-35 points from the entry point. Expecting the euro to move upwards today is contingent upon weak US data. Important! Before buying, ensure that the MACD indicator is above the zero mark and is just beginning its upward movement.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the price at 1.0685, at a moment when the MACD indicator is in the oversold area. This will limit the downward potential of the pair and lead to a reversal upwards in the market. Expect growth towards the opposite levels of 1.0713 and 1.0745.

Signal to Sell

Scenario #1: I will sell the euro after it reaches 1.0685 (red line on the chart). The target will be at 1.0655. I plan to exit the market and immediately buy the euro in the opposite direction (targeting a movement of 20-25 points in the opposite direction from the level). Pressure on the pair will return in case of strong US data. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just starting to decline from it.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the price at 1.0713, at a moment when the MACD indicator is in the overbought area. This will limit the upward potential of the pair and lead to a reversal downwards in the market. Expect a decline towards the opposite levels of 1.0685 and 1.0655.

What's on the chart:

Thin green line - entry price to buy the trading instrument;

Thick green line - potential price to place Take Profit or manually take profit, as further growth above this level is unlikely;

Thin red line - entry price to sell the trading instrument;

Thick red line - potential price to place Take Profit or manually take profit, as further decline below this level is unlikely;

MACD indicator. When entering the market, it is important to consider overbought and oversold zones.

Important. For novice Forex traders, making entry decisions very cautiously is essential. It's best to stay out of the market before major fundamental reports are released to avoid sharp price fluctuations. If you decide to trade during news releases, always use stop orders to minimize losses. You can quickly lose your entire deposit without stop orders, especially if you do not use money management and trade with large volumes.

And remember, successful trading requires a clear trading plan similar to the one presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for intraday traders.