EUR/USD showed mixed movements throughout Monday. The euro's rise in the night and the morning raised the most questions. Yes, there are quite a few important events in the EU and the US that will undoubtedly affect the pair's movements. However, there were no significant announcements overnight or on Monday morning. Nonetheless, the euro opened Monday with a bullish gap and continued to rise even before the scheduled reports were published.

It is worth noting that last week, the price failed to consolidate below the Murray level "-1/8" at 1.0681. Thus, the pair's upward retracement seemed logical and expected. However, the downtrend remains on both the 4-hour and 24-hour timeframes, giving the impression that the market is simply gaining momentum before starting a new decline. Let us remind you that we don't expect anything from the euro except a decline in the coming weeks and months. Of course, it is unlikely to be rapid and continuous, but the euro should only move downward.

This week, as already mentioned, the macroeconomic and fundamental background will be very strong. On Monday, the business activity indices in the manufacturing sectors of the EU and the US, including the ISM index, were published. In addition, European Central Bank President Christine Lagarde delivered a speech on Monday. But that's not all. Today, the inflation report for the European Union will be released, and inflation is currently one of the most important reports. According to forecasts, the Consumer Price Index will slow down to 2.5%, which is not particularly significant for the euro. The ECB has begun easing monetary policy, and a 0.1% change in the indicator is unlikely to increase or decrease the likelihood of a second rate cut in September. It is clear that the faster inflation falls, the quicker and more frequently the ECB will lower the rate. The euro may fall further since it simply has no other options while the Federal Reserve keeps its rate unchanged. Therefore, the question is about the pace at which the euro will fall.

In addition, Lagarde will deliver her second speech of the week. We do not expect any bold statements from her, but she might comment on the inflation report and hint at whether the central bank will be ready to lower the rate in September. It's important to mention that some ECB officials believe that the rate should not be lowered so quickly (every second meeting).

By the end of the week, the EU will also release the final estimate of the business activity index in the services sector for June and a retail sales report. These are not crucial reports and will undoubtedly be overshadowed by the US economic reports. Remember, it is the beginning of the month, which means the labor market and unemployment data are being released. Therefore, the market will mainly be focused on the US macro data.

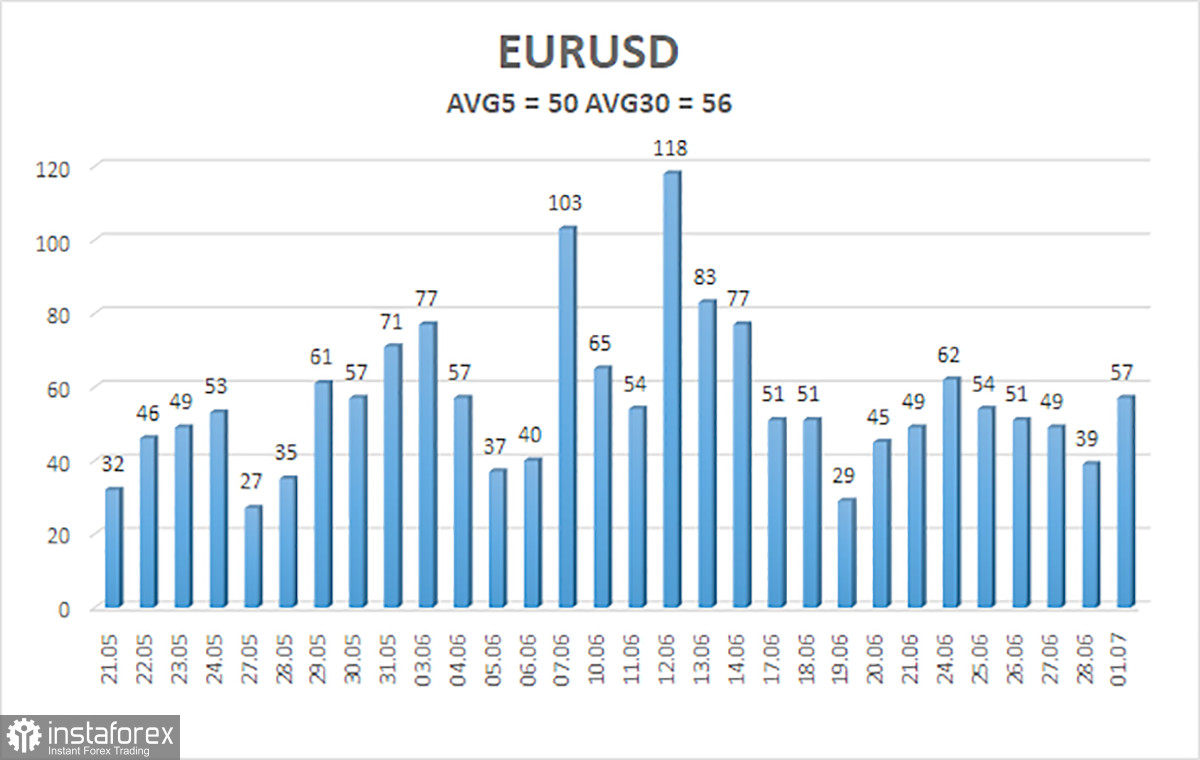

The average volatility of the EUR/USD pair over the last five trading days as of July 2 is 50 pips, which is considered a low value. We expect the pair to move between 1.0684 and 1.0784 on Tuesday. The higher linear regression channel has turned upwards, but the global downtrend remains intact. The CCI indicator entered the oversold area, but it has already been worked out by an upward pullback.

Nearest support levels:

S1 - 1.0681

S2 - 1.0620

S3 - 1.0559

Nearest resistance levels:

R1 - 1.0742

R2 - 1.0803

R3 - 1.0864

Trading Recommendations:

The EUR/USD pair maintains a global downtrend, and the price is located above the moving average on the 4-hour timeframe. In previous reviews, we said that we are waiting for the continuation of the downward trend. At this time, short positions remain relevant, but the corrective move may continue. The third consecutive rebound from 1.0681 provoked another round of the bullish correction. We don't recommend buying the euro, as we believe that the global downtrend has resumed, and the single currency has no grounds for growth. But the price may rise for some time as part of the correction. Especially this week, when no one knows what the data from the EU and US will turn out to be.

Explanation of the chart:

- Linear Regression Channels – Helps determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

- Moving Average Line (settings 20.0, smoothed) – Determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels – Target levels for movements and corrections.

- Volatility Levels (red lines) – The probable price channel in which the pair will spend the next day, based on current volatility indicators.

- CCI Indicator – Its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is imminent.