As expected, Eurozone inflation slowed to 2.5% in June from 2.6% a month earlier, but this did not affect the market since investors have long been anticipating further interest rate cuts by the European Central Bank. But the fact that the Eurozone unemployment rate remained unchanged, instead of increasing from 6.4% to 6.5%, left an impact on the market. As a result, the euro rose to the upper boundary of the narrow range, although it was quite a modest rise.

The pair wouldn't be able to break out of this range today. Investors are eagerly awaiting the U.S. Department of Labor report, which is set for release on Friday. Until then, no one is willing to take risks. Furthermore, today is a short trading day in the United States due to the Independence Day celebrations tomorrow. Given that the single currency is near the upper boundary of the range, it is more likely for the pair to gradually move towards the lower boundary. However, we don't expect the price to reach this mark. Market activity on Wednesday is expected to be quite low.

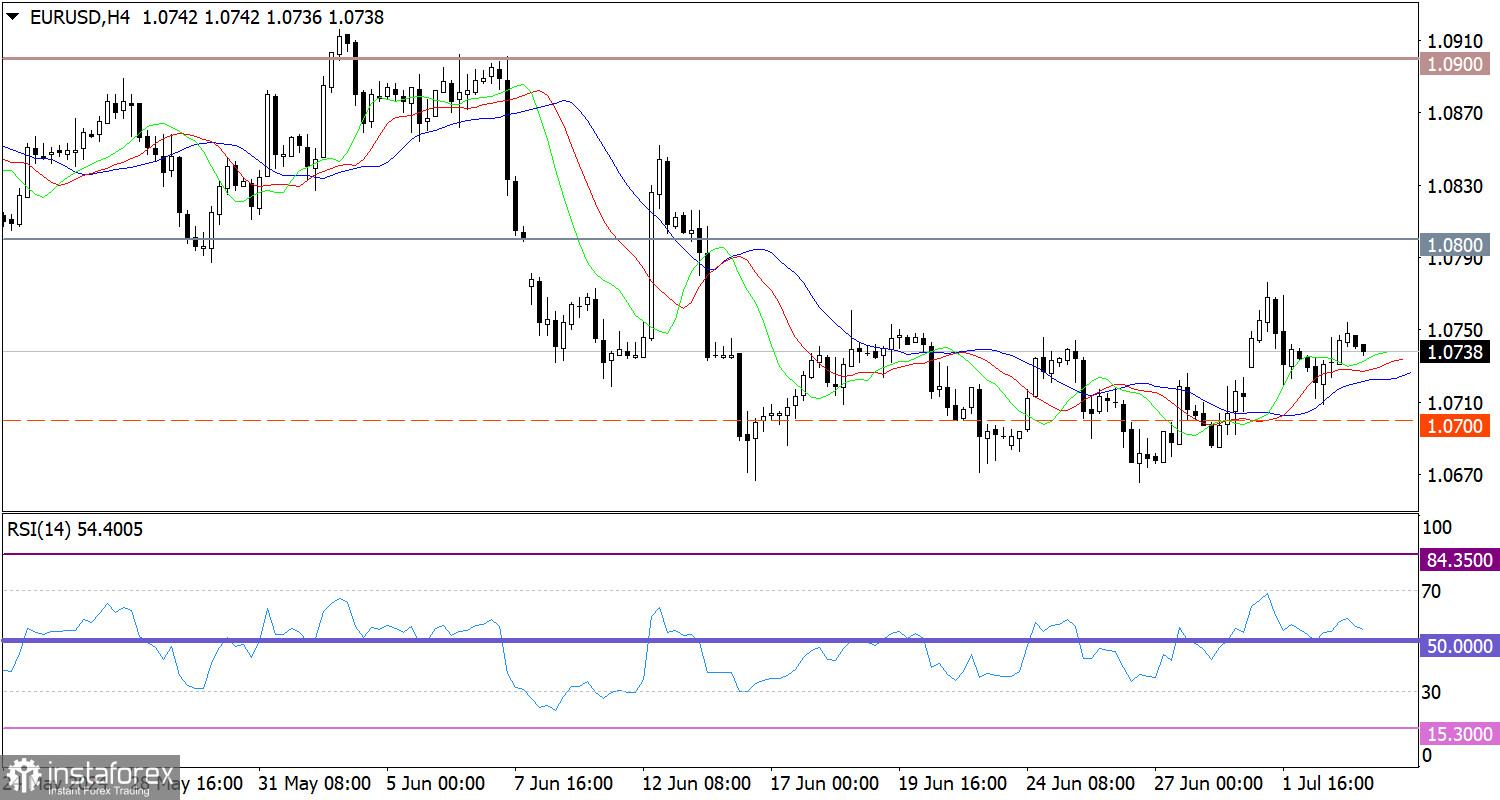

The euro slightly strengthened against the US dollar, but no significant price changes were observed. The pair continues to move within the range of 1.0670/1.0750, with particular focus on the upper boundary.

On the 4-hour chart, the RSI technical indicator is hovering in the upper area of 50/70, which indicates a bullish bias.

Meanwhile, on the same chart, the Alligator's MAs are within the horizontal channel, but are heading upwards.

Outlook

Movement within the horizontal channel is temporary. The main strategy is to strengthen trading positions the moment the flat phase ends. We can confirm that the phase has ended once the price settles beyond either boundary of the range in the intraday period.

In terms of complex indicator analysis, the short term period indicates a bearish bias, while the residual effect of the upward movement remains in the intraday period.