The euro is confidently moving towards the previously announced target of $1.08, despite the ongoing political uncertainty in France, the slowdown in European consumer prices, and the statement by Governing Council member Gediminas Simkus that the ECB will cut the deposit rate twice more in 2024. Investors are starting to price in the weakening of the US dollar amid ongoing worrying signals from the American economy and the readiness of FOMC officials to adopt a dovish stance.

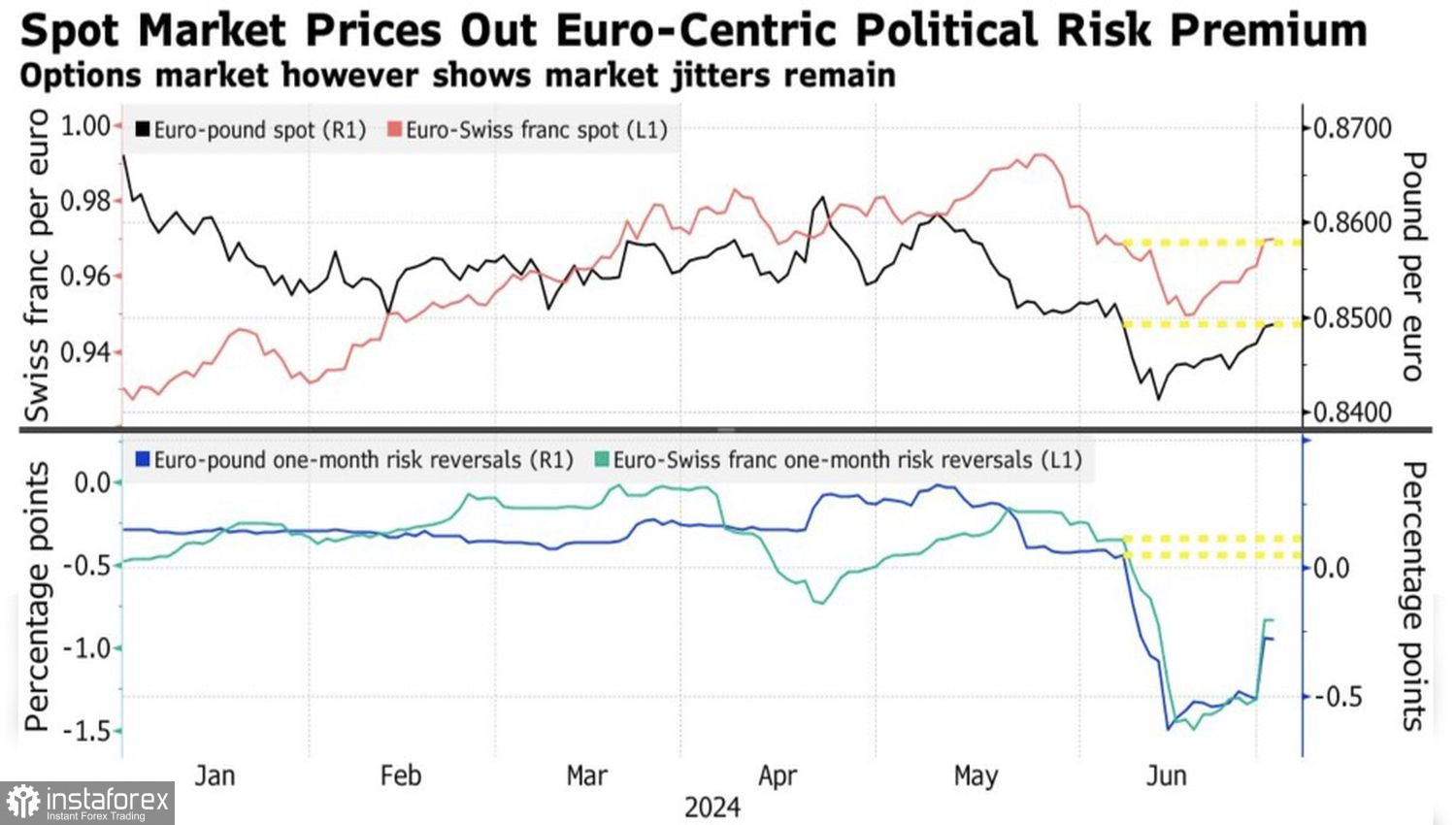

Unlike the currency market, derivatives signal that political unrest in France is not yet over. Risk reversals in EUR/CHF and EUR/GBP pairs have not returned to levels seen in early June. It was then that Emmanuel Macron signed his political death warrant by announcing snap elections to the National Assembly.

Dynamics of EUR/CHF, EUR/GBP, and Risk Reversals

This could have alarmed investors, but they are beginning to understand: regardless of the outcome of the second round of voting, there will be no Frexit. Consequently, there will be no drop in EUR/USD to parity. If this is the case, the French "bearish" driver for the major currency pair can be considered played out. It's time to shift attention to other factors.

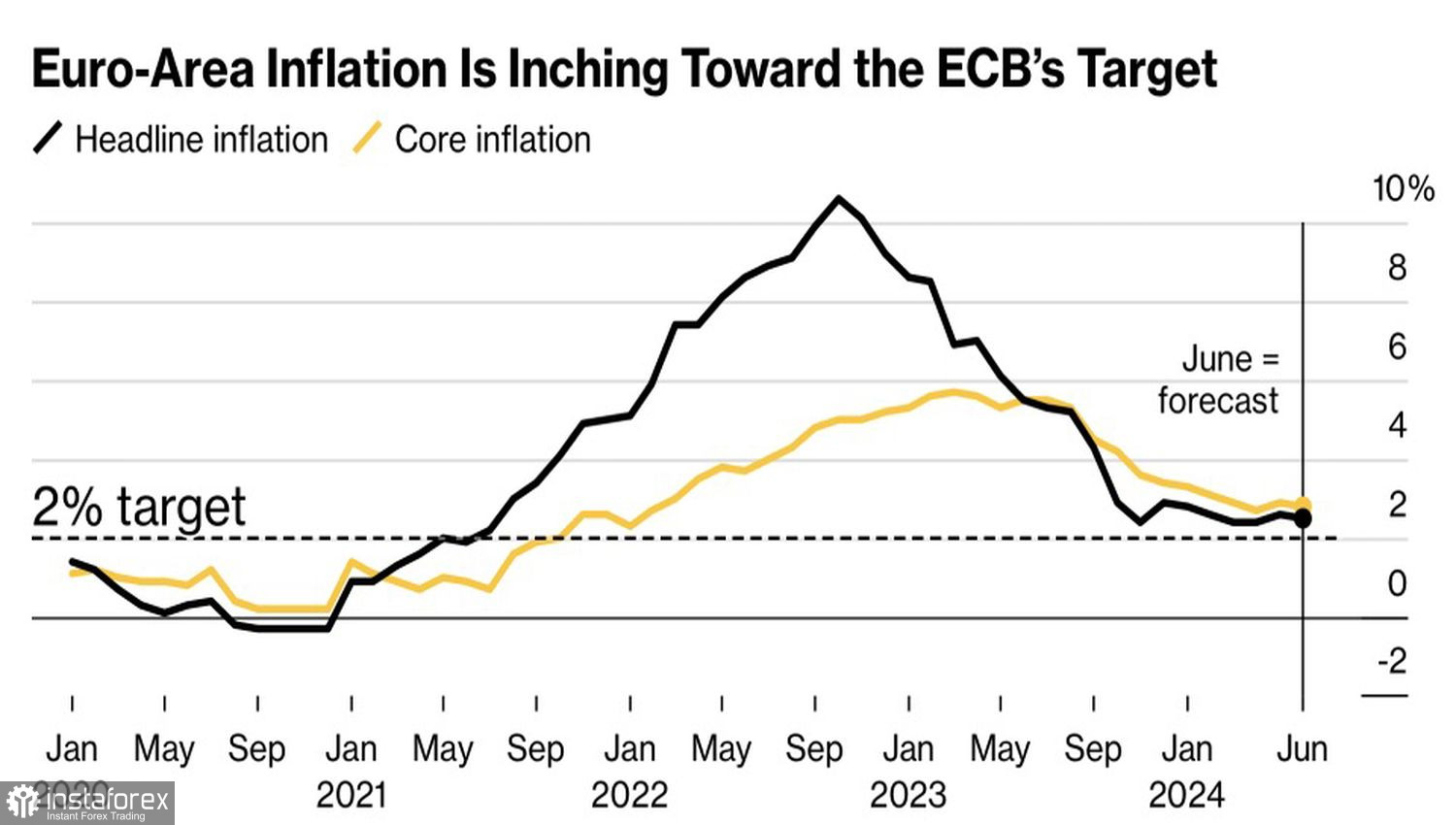

Neither the ECB nor the Fed is in a hurry to cut rates, which does not give an advantage to either EUR/USD buyers or sellers. Christine Lagarde claims that the fight against inflation is still ongoing. Philip Lane believes that the Governing Council will have the necessary data after the July meeting and notes that the European Central Bank needs time. Pierre Wunsch is only ready to support more than two acts of monetary expansion in 2024 if there is convincing evidence that inflation will return to the 2% target. The first, I remind you, took place in June. Gabriel Makhlouf believes that it is sufficient.

Dynamics of European inflation

Thus, the number of centrists on the Governing Council exceeds the number of "doves," which can be considered a "bullish" driver for EUR/USD.

Support for buyers came from Jerome Powell's speech in Sintra, Portugal, where he acknowledged progress in the fight against inflation in the US, as well as from yet another round of disappointing reports on the American labor market. The number of unemployment benefit claims rose more than expected, and private-sector employment from ADP was lower than Bloomberg experts predicted. This leads to a decrease in Treasury yields and the USD index.

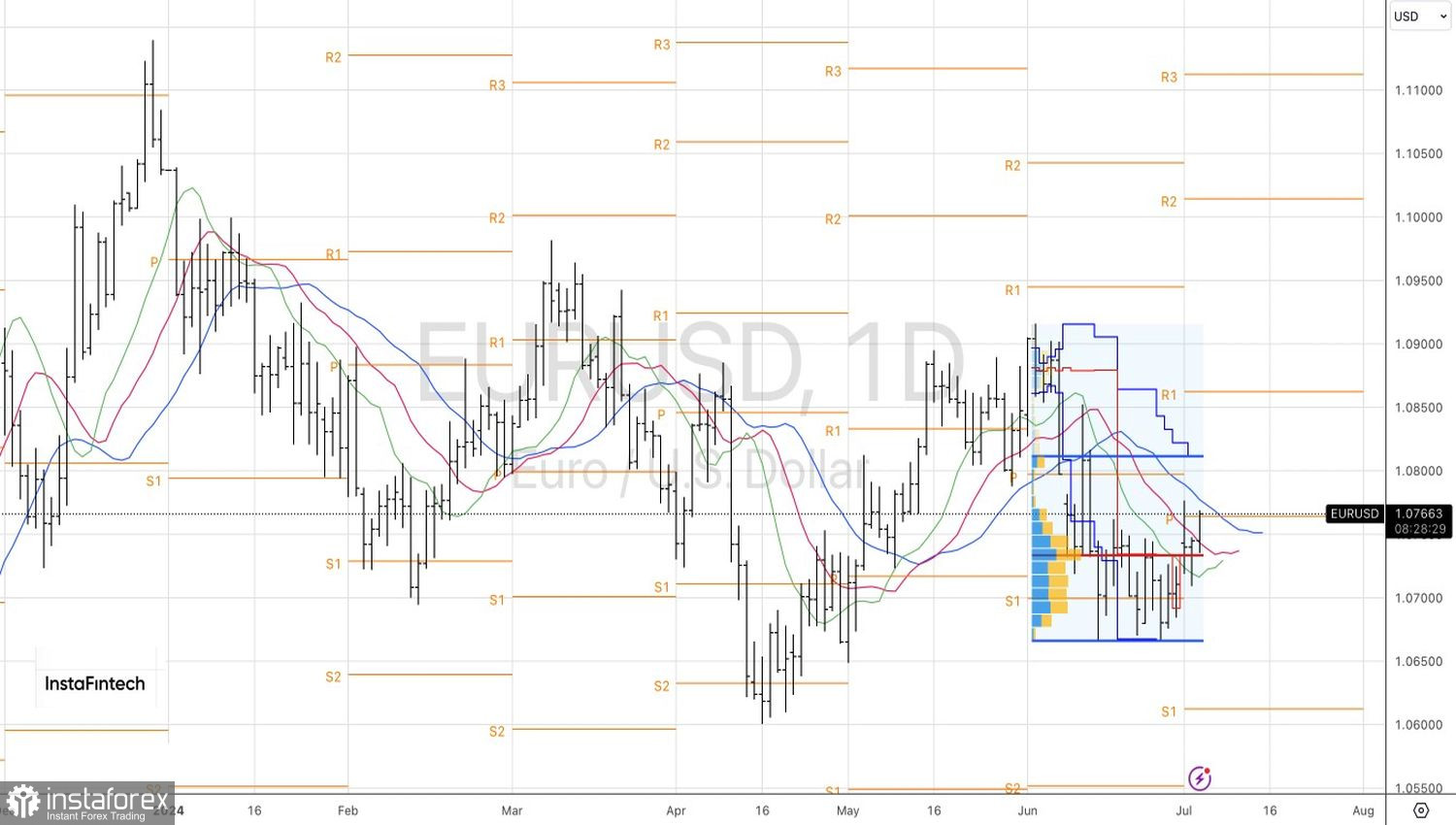

Despite EUR/USD buyers' successes, there is still time to say that everything is in their favor. The decisive factors will be the non-farm payrolls and other labor market indicators, which will be released at the end of the week by July 5th.

Technically, on the daily chart, the EUR/USD bulls managed to push the quotes of the major currency pair beyond the upper boundary of the consolidation range of 1.067-1.072. Consolidation above the pivot level of 1.0765 brings the euro closer to the previously indicated targets of $1.08 and $1.0835. It is advisable to maintain long positions.