To open long positions on GBP/USD, the following is required:

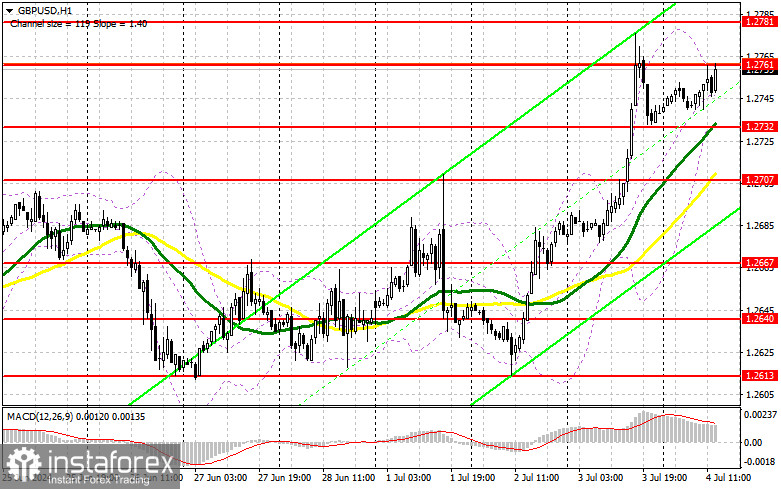

The absence of UK statistics and holidays in the US will undoubtedly affect the further upward potential of the pound, so be very cautious when buying today. Low trading volume and low market volatility can hinder the pair's directional movement. In case of a decline in GBP/USD, active defense of the support at 1.2732 with a false breakout will provide a good entry point for long positions with the prospect of a rebound and retest of the resistance at 1.2761, which has not yet been breached. A breakout and retest of this range from top to bottom will restore the pound's upward potential, leading to an entry point for long positions with the possibility of updating to 1.2781 – a new weekly high. The furthest target will be the area of 1.2804, where I plan to take profits. If GBP/USD declines and there is no bullish activity around 1.2732 in the second half of the day, pressure on the pair will return. This will also lead to a decline and retest of the next support at 1.2707, increasing the chances of a bearish correction after yesterday's growth. Therefore, only a false breakout at this level will be a suitable condition for opening long positions. I plan to buy GBP/USD on a rebound from the 1.2667 minimum with a target correction of 30-35 points intraday.

To open short positions on GBP/USD, the following is required:

Sellers managed to show themselves around 1.2761, but that's it for now. Clearly, the main task for the second half of the day remains the defense of the same level, 1.2761. Only a false breakout there, similar to the one described above, will provide a suitable option for opening short positions targeting a decline and a test of the support at 1.2732, where the moving averages supporting the bulls are located. A breakout and retest of this range from bottom to top, amid the absence of US statistics and the closure of many markets, will hit the buyers' positions, leading to stop-loss triggers and opening the way to 1.2707. The furthest target will be the area of 1.2667, where I will take profits. Testing this level will severely harm the pound's upward potential. If GBP/USD rises and there is no activity at 1.2761 in the second half of the day, it is more likely that buyers will try to continue the growth. In that case, I will postpone sales until a false breakout at 1.2781. If there is no downward movement there either, I will sell GBP/USD on a rebound from 1.2804, but only expecting an intraday correction of 30-35 points.

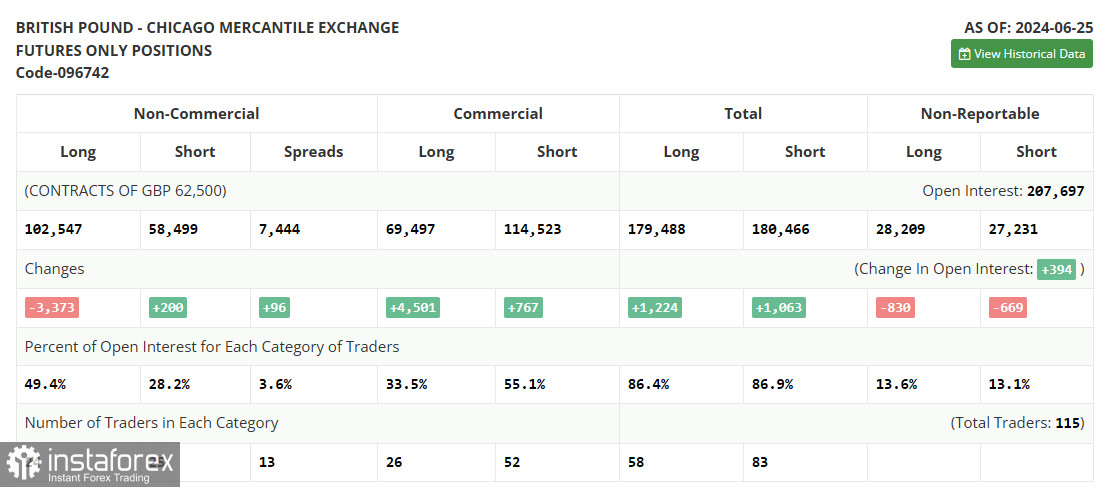

In the COT report (Commitment of Traders) for June 25, there was an increase in short positions and a decrease in long positions. Recent comments from Bank of England representatives about future policy and the likely rate cuts in August this year have continued to pressure the pound. Incoming economic data also leaves much to be desired, which the pound negatively reacts to each time. Given the Federal Reserve's firm stance, demand for the dollar is likely to remain, and the pound is expected to continue falling. The latest COT report indicates that long non-commercial positions decreased by 3,373 to 102,547, while short non-commercial positions increased by 200 to 58,499. As a result, the spread between long and short positions increased by 96.

Indicator Signals:

Moving Averages

Trading is taking place above the 30 and 50-day moving averages, indicating the potential for further growth in the pair.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands

In case of a decline, the indicator's lower boundary, around 1.2732, will act as support.

Indicator Descriptions:

- Moving average: Determines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average: Determines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

- MACD (Moving Average Convergence/Divergence): Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions, who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- Total non-commercial net position: The difference between the short and long positions of non-commercial traders.