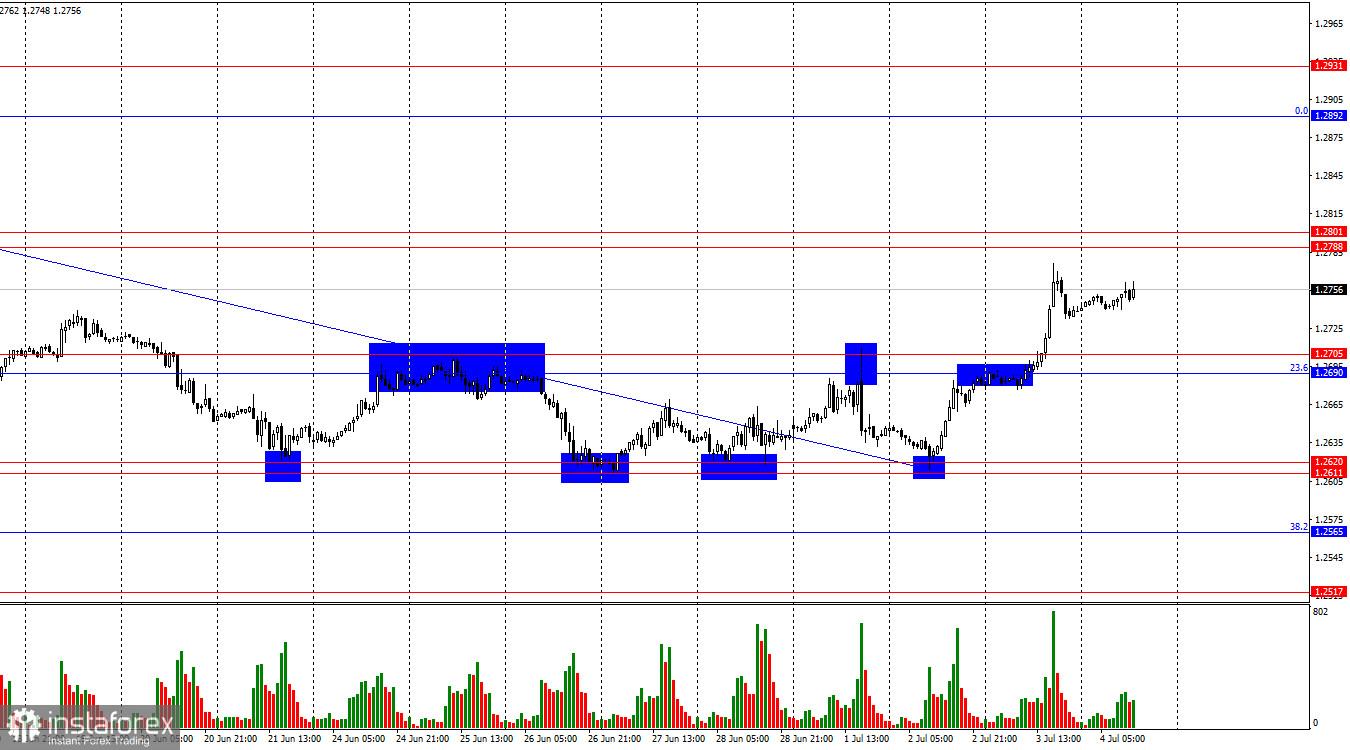

On the hourly chart, the GBP/USD pair consolidated above the resistance zone of 1.2690–1.2705 on Wednesday, marking the end of another sideways trend. Now, the pair's growth may continue towards the next resistance zone of 1.2788–1.2801. A rebound from this zone will favor the US dollar and a slight decline towards the zone of 1.2690–1.2705. Consolidation above 1.2788–1.2801 will increase the likelihood of further growth towards the next corrective level of 0.0%–1.2892.

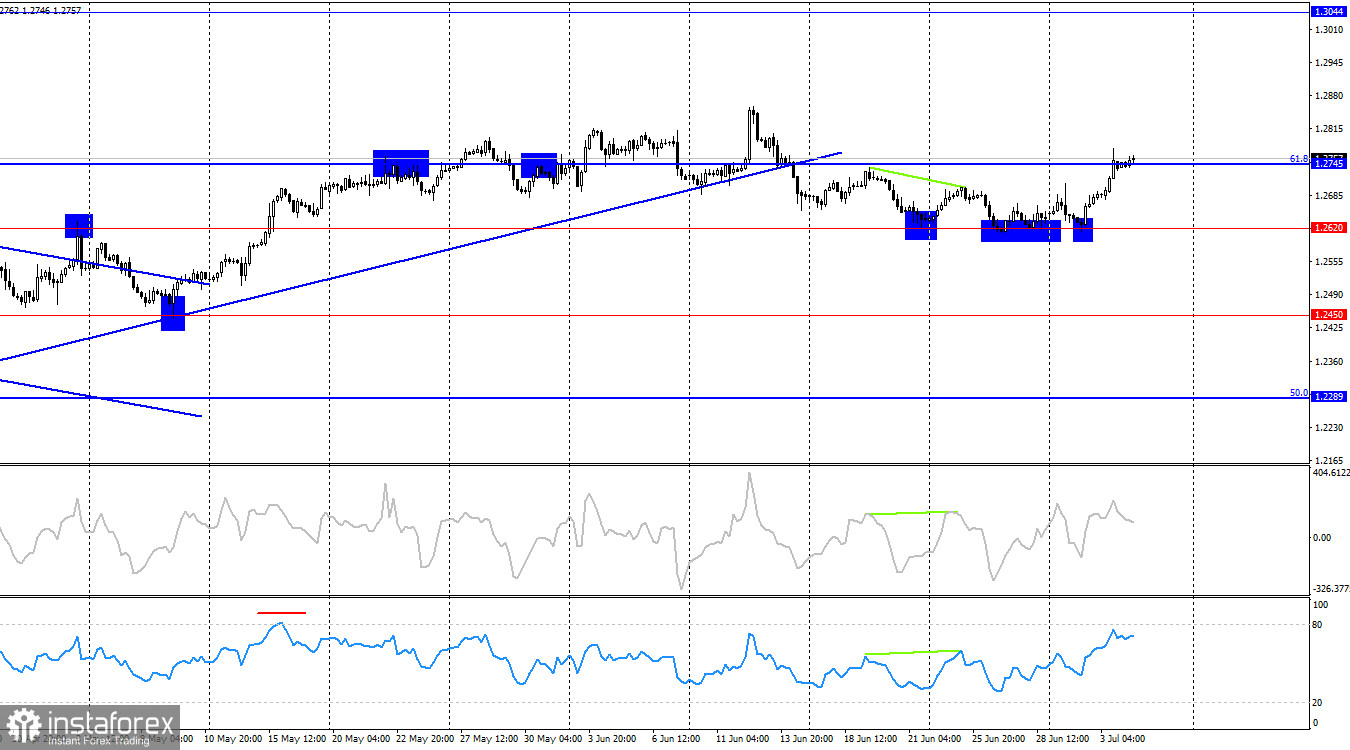

The wave situation remains unchanged. The last upward wave broke the peak from June 4, while the most recent downward wave (formed on June 12) managed to break the low of the previous wave. Thus, the trend for the GBP/USD pair remains bearish. I am cautious about conclusions regarding the beginning of a bearish trend, as bears still show weakness regularly, and the news background often makes their further attacks impossible. This week, they had to retreat due to news from the USA. The bearish trend will officially be broken after the peak of the last upward wave from June 12 – 1.2858 is breached. The pound needs to rise by another 100 points to reach this level.

The news background for the pound was the same as for the euro, as all the major news came from the USA. The same ADP and ISM reports were the main reasons for the bears' retreat. However, it should be noted that the bears had enough time to break through the support zone of 1.2611–1.2620 on their own without relying solely on the news background. They failed to do so, and the bulls couldn't stay out of the market forever. This week, most of the reports from the USA were weaker than traders' expectations, but there is still Friday left. The Nonfarm Payrolls and unemployment reports could yield unexpectedly positive figures, strengthening the US dollar at the end of the week.

On the 4-hour chart, the pair turned in favor of the British currency after four rebounds from the level of 1.2620 and then rose to the corrective level of 61.8%–1.2745. This level is not a strong barrier for the bulls, but a rebound from it might lead to a slight decline. If you look closely at the 4-hour chart, there are no obstacles to the further growth of the pound. The bears couldn't even break the easiest level.

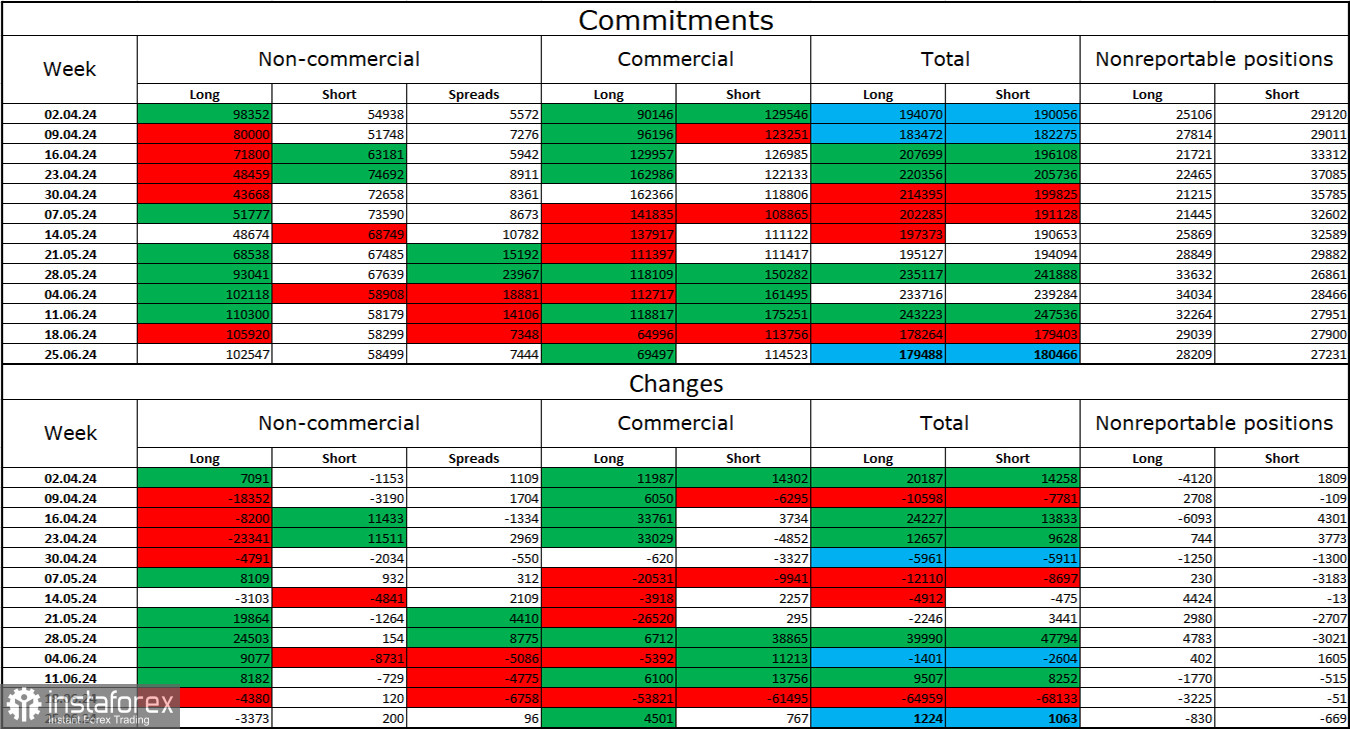

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" category of traders became slightly less bullish over the last reporting week. The number of long positions held by speculators decreased by 3,373, while the number of short positions increased by 200. Bulls still have a solid advantage. The gap between the number of long and short positions is 44 thousand: 102 thousand against 58 thousand.

The pound still has prospects for a decline. Graphical analysis has provided several signals of a broken bullish trend, and bulls can't keep attacking forever. Over the past three months, the number of long positions has grown from 98 thousand to 102 thousand, while the number of short positions has increased from 54 thousand to 58 thousand. Over time, major players will continue to shed long positions or increase short positions, as all potential buying factors for the pound have already been exhausted. However, it is important to remember that this is just an assumption. Graphical analysis still shows the weakness of the bears, who can't even break the 1.2620 level.

Economic Calendar for the USA and UK:

The economic events calendar does not contain any important entries on Thursday. Therefore, the impact of the news background on market sentiment will be absent today.

Forecast for GBP/USD and Trading Tips:

Sales of the pound are possible on a rebound from the zone of 1.2788–1.2801 with a target of 1.2690–1.2705. Purchases could have been considered on a rebound from the zone of 1.2611–1.2620 on the hourly chart with a target of 1.2690–1.2705. Then, on a close above the zone of 1.2690–1.2705 with a target of 1.2788–1.2801. The first target has been reached, and the second is almost there.

The Fibonacci level grids are built at 1.2036–1.2892 on the hourly chart and at 1.4248–1.0404 on the 4-hour chart.