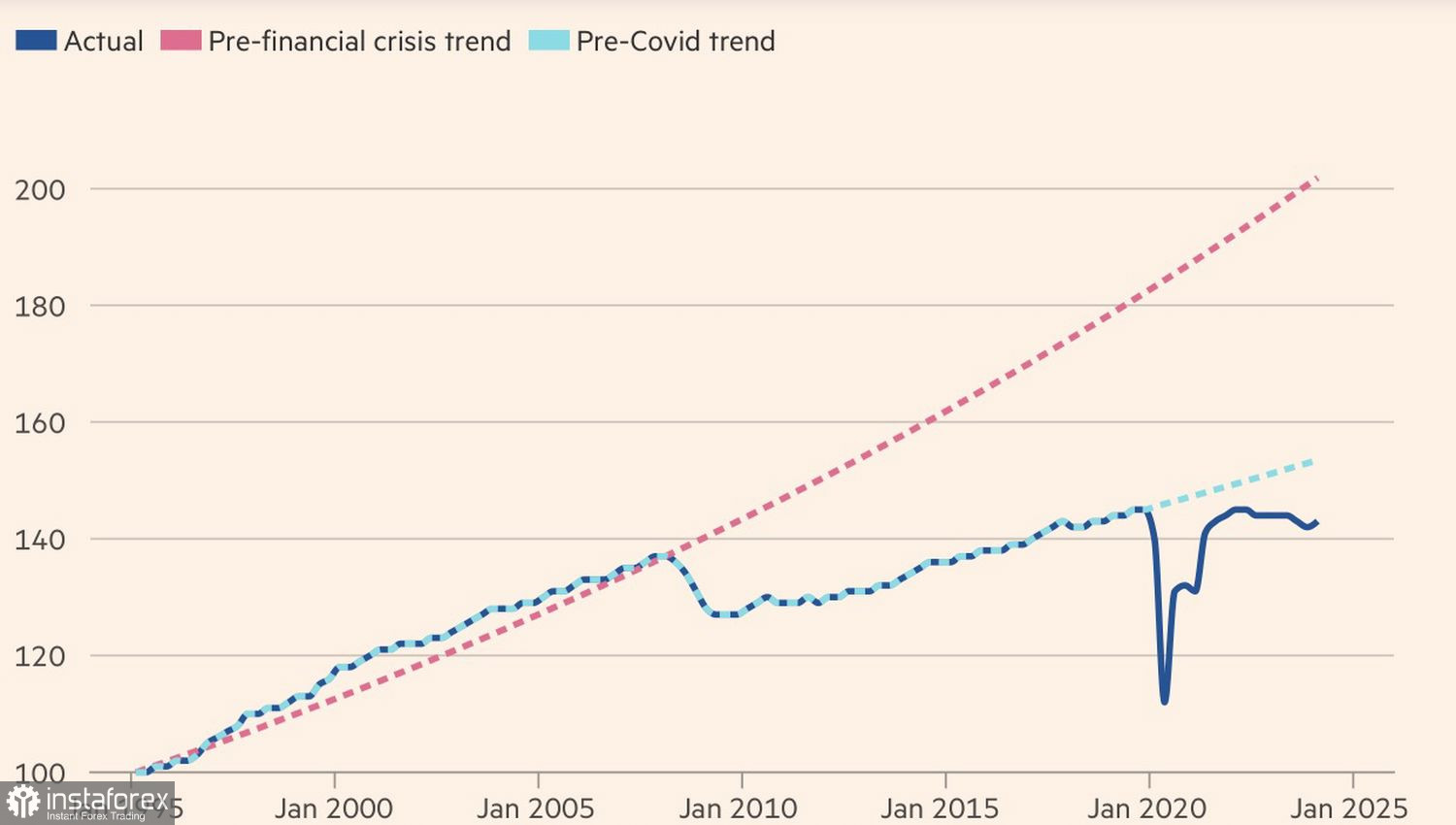

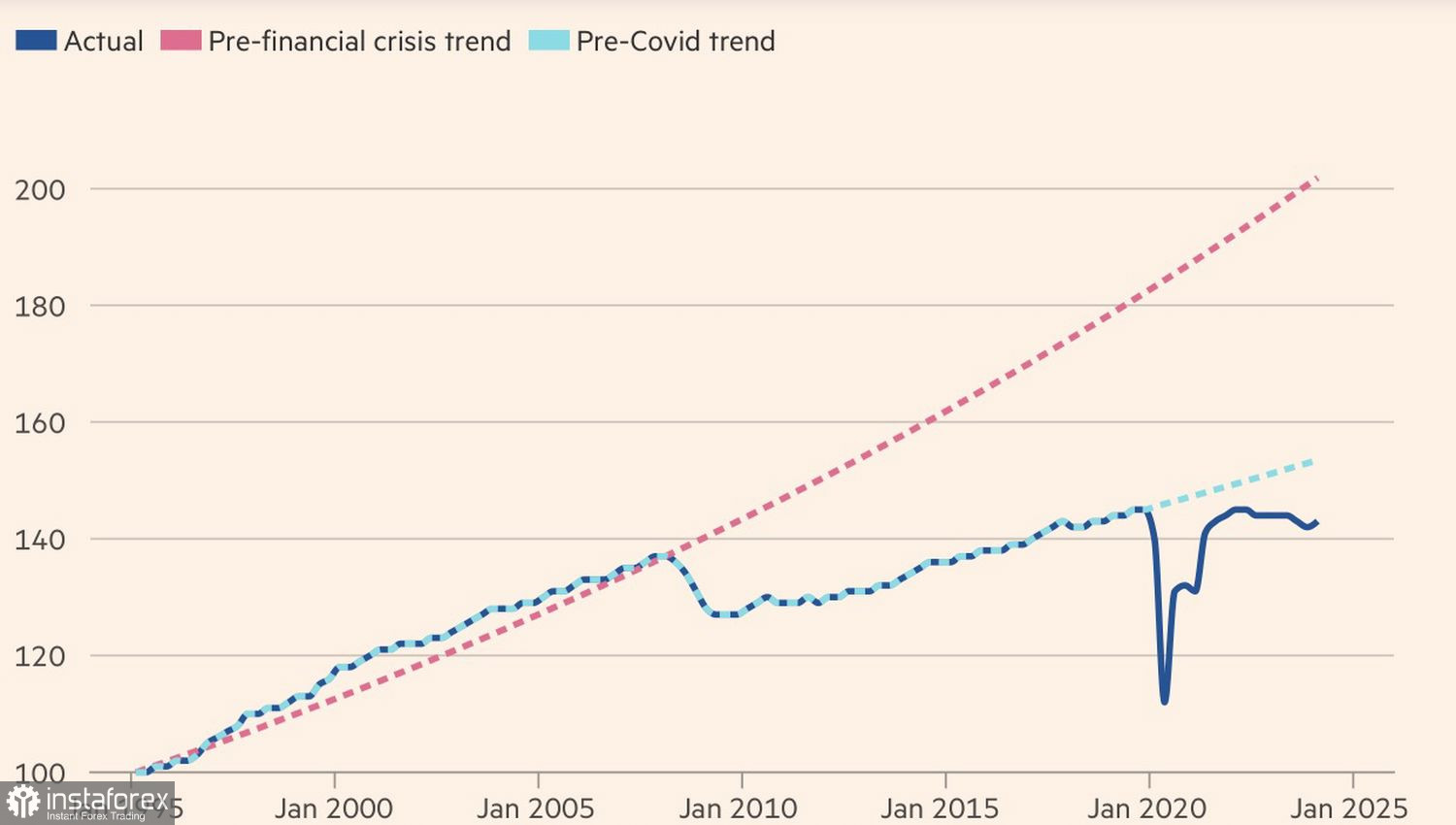

Scandals and upheavals might be entertaining, but investors value stability. The Conservatives have been in power for the past 14 years and have failed to provide it. Brexit, the Scottish independence referendum, government member scandals, and the British debt market's turmoil under Liz Truss's leadership have exhausted voters so much that they handed over a massive 412 seats in the new parliament to the Labour Party. The victory of the Labor Party was also a victory for GBP/USD.Despite the fact that Keir Starmer has vowed to make Britain's economic growth the fastest among the G7 countries by stimulating new investment and creating a business-friendly environment, the Labour Party is unlikely to take drastic measures. They plan to act slowly, not raise taxes, and postpone additional fiscal stimulus until the budget improves. Labour aims to bring stability to the UK markets, attracting investors like bees to honey.Dynamics of the British Economy

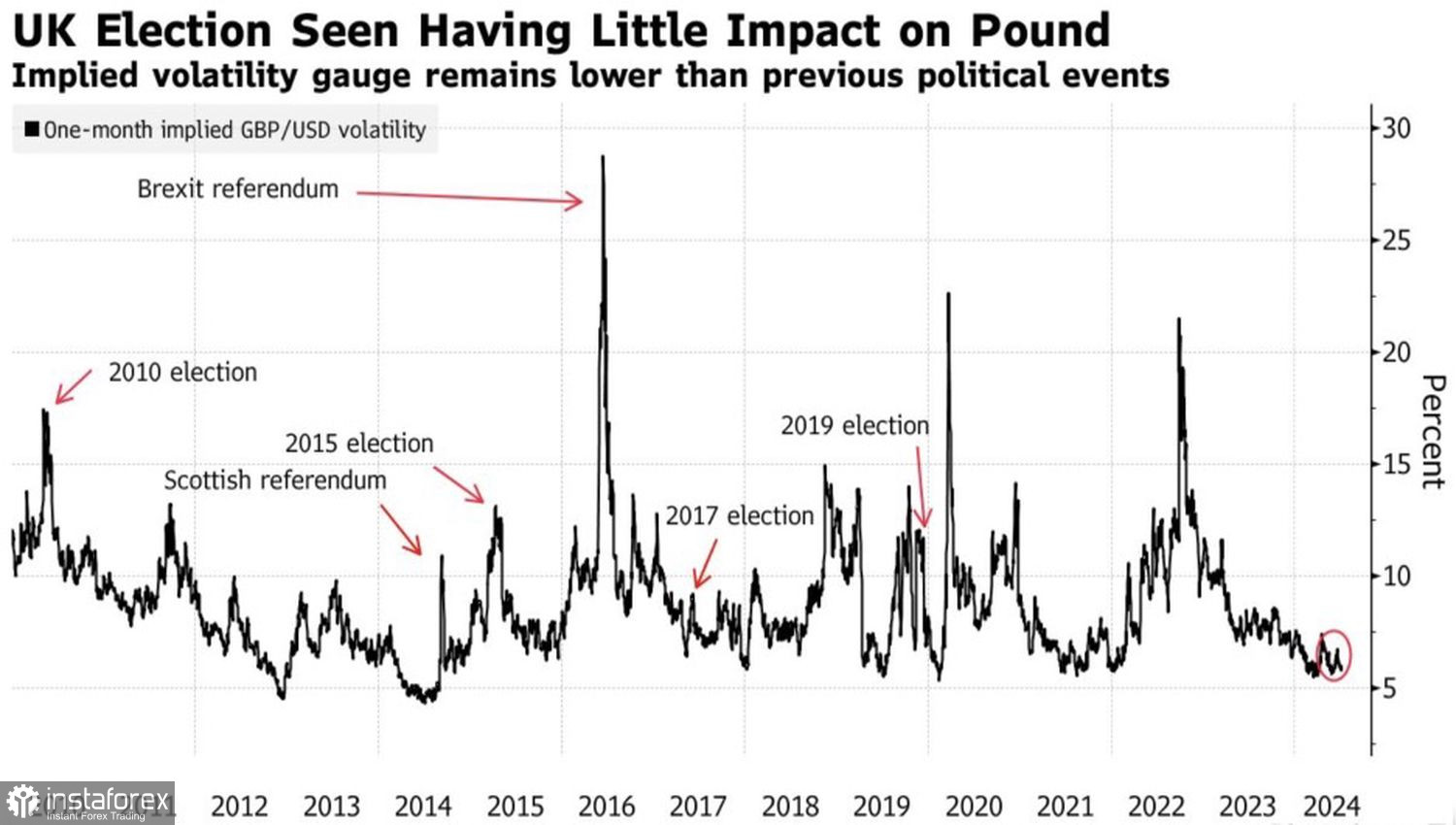

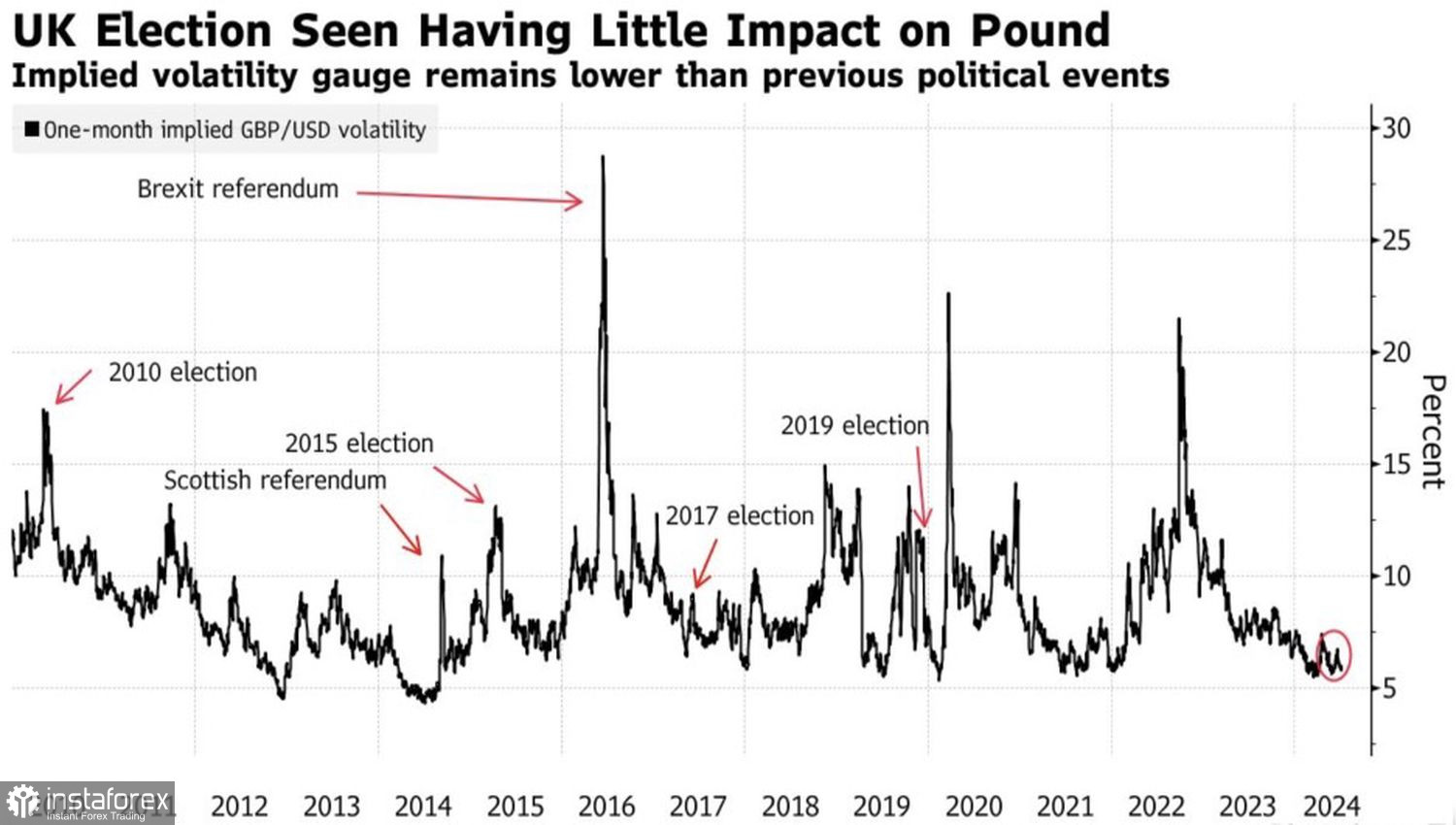

The Labour Party's resounding victory allows Britain to be seen as a bastion of calm, especially in contrast to France's hung parliament and the prospect of Donald Trump returning to the White House with his protectionist policies and eccentricity. Unsurprisingly, the pound's volatility is at a low level, particularly compared to other significant events for the UK economy.This creates ideal conditions for the pound. The 14-year period of Conservative rule allowed investors to humorously refer to it as the "Great British Peso" – GBP – due to its heightened sensitivity to internal and external shocks. Sterling behaved like the currency of a developing country. Those days are over, giving GBP/USD a confident outlook for the future.Dynamics of the Pound's Volatility

It's amazing how, amid political instability, the pound competed with the US dollar for leadership in the race of the G10 currencies. The main drivers of its rally were the accelerated GDP growth in the first quarter and the Bank of England's cautious approach. If the new government refrains from excessive fiscal stimulus and stabilizes finances, Andrew Bailey and his colleagues will have an excellent opportunity to continue their measured approach.

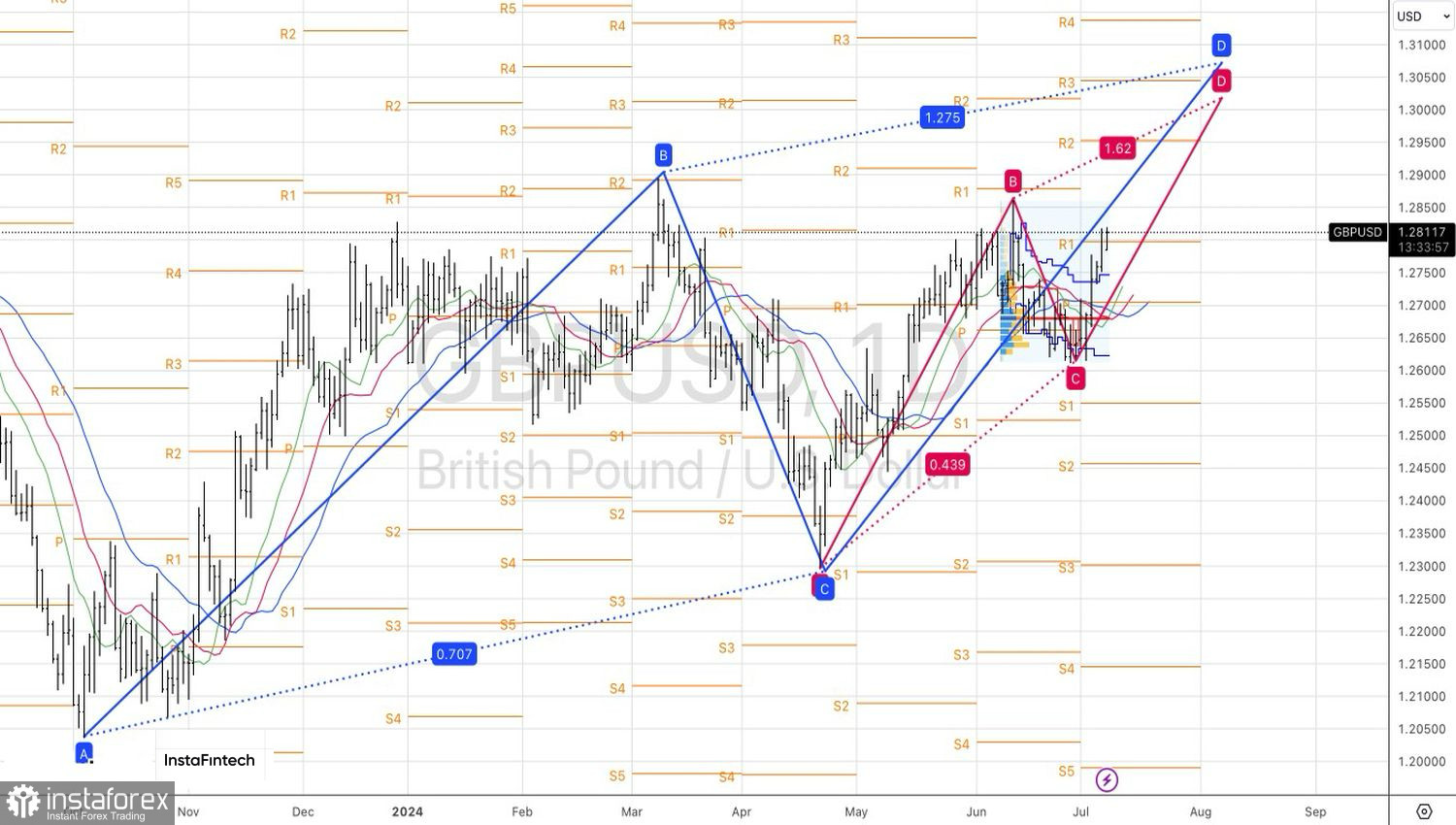

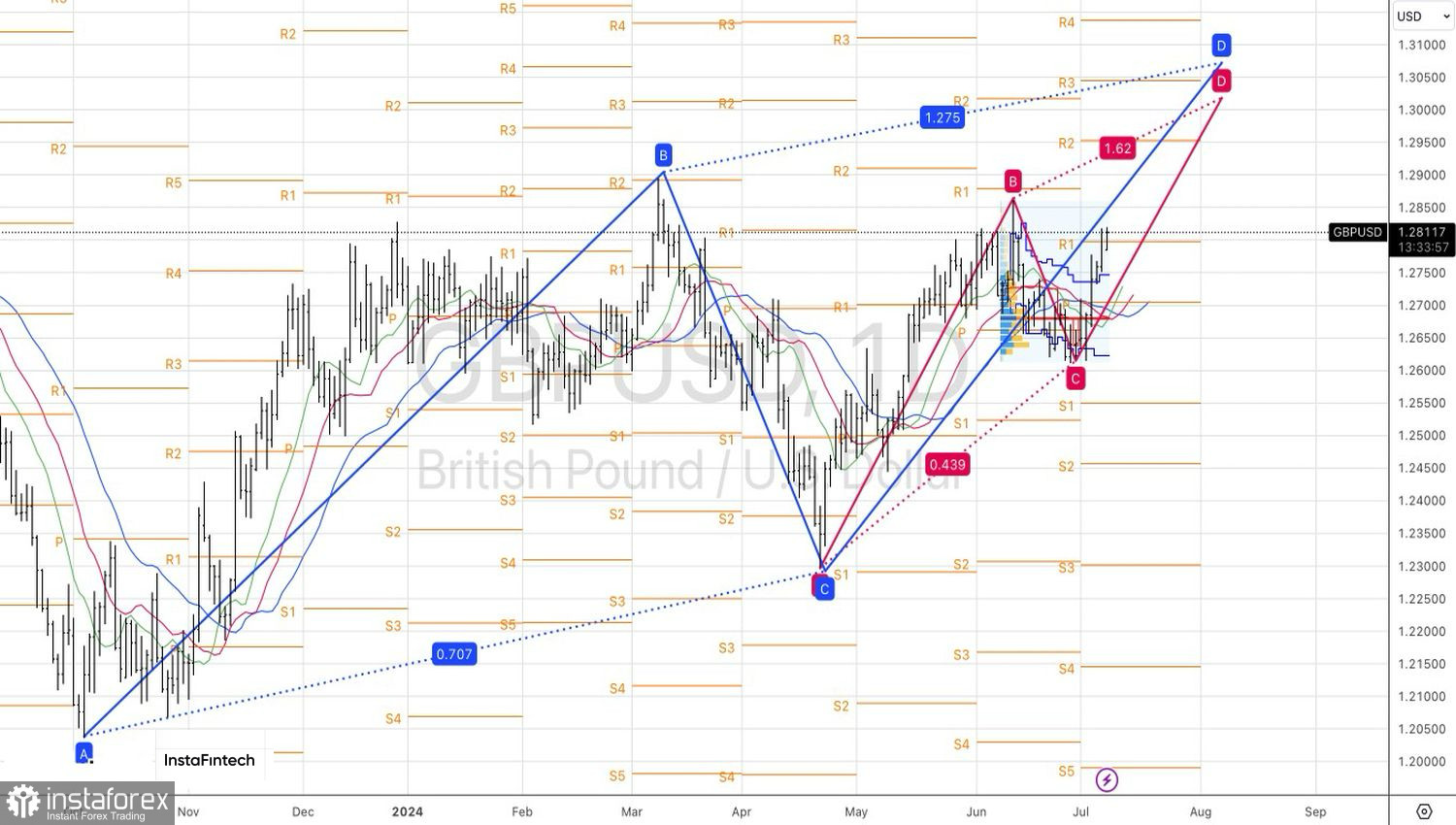

If the BoE maintains the repo rate at 5.25% in August, the bulls on GBP/USD will have a new reason to attack. Especially since the pound's opponent is weaker than before. The US economy is slowing down, and the Fed is on the brink of discussing monetary policy easing.Technically, on the daily GBP/USD chart, the bulls are ready to restore the upward trend. If they manage to update the June high, the subsidiary pattern AB=CD will be activated. In such conditions, buying the pair towards 1.3010 and 1.3075 makes sense.