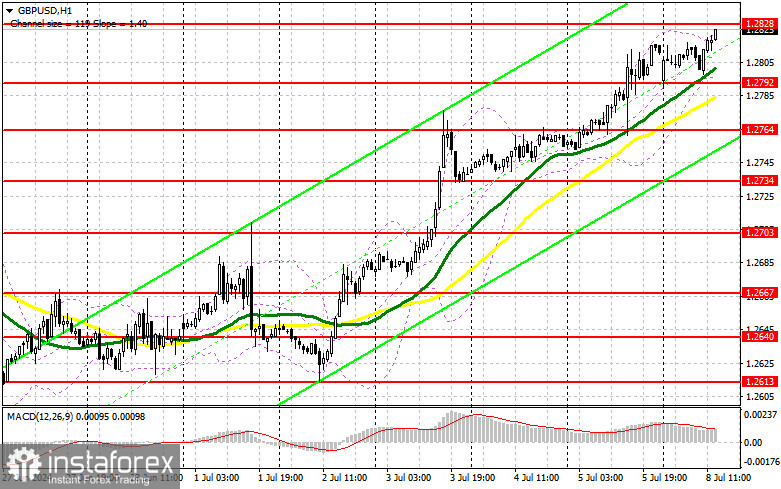

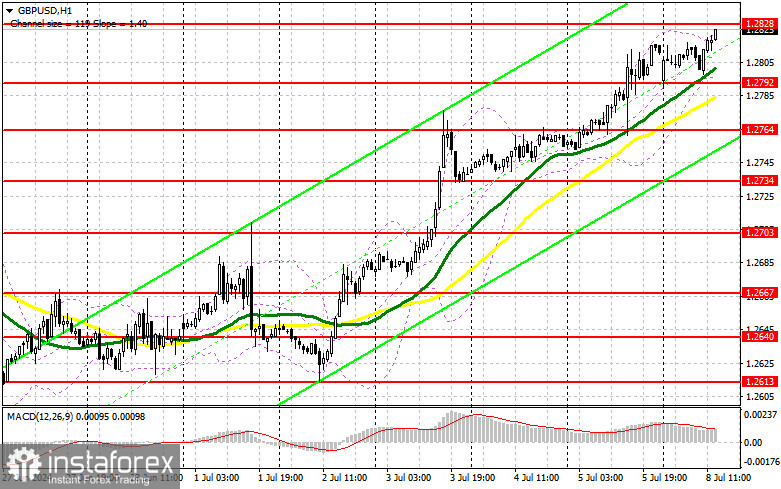

In my morning forecast, I focused on the level of 1.2828 and planned to make market entry decisions from there. Let's look at the 5-minute chart and analyze what happened. The rise occurred, but the formation of a false breakout at 1.2828 did not happen, which did not allow entering the market with short positions. Similarly, we did not see a test of 1.2792, so no purchases were made. The technical picture for the second half of the day remains unchanged.

To open long positions on GBP/USD, you need:Given the lack of statistics from the UK and the sustained demand for the British pound, which has already updated the weekly high, it is better to trade in continuation of the bullish trend. In the second half of the day, apart from the US consumer credit report, there is nothing else, so buyers will have every chance to test 1.2828. Of course, in a bullish market, a more optimal strategy would be to buy on corrections, and after forming a false breakout around the support of 1.2792, it was formed at the end of last week. This will give a good entry point into long positions with the prospect of updating a new weekly high of 1.2828. A breakout and a reverse top-down test of this range will strengthen the upward potential of the pound, which will lead to an entry point into long positions with the possibility of a test of 1.2858. The ultimate target will be the area of 1.2890, where I will take profits. In the scenario of a decline in GBP/USD and a lack of activity from the bulls at 1.2792 in the second half of the day, pressure on the pair will increase at the beginning of the week, although this is unlikely. This will also lead to a decline and an update of the next support at 1.2764, increasing the chances of developing a bearish correction. Therefore, only the formation of a false breakout will be a suitable condition for opening long positions. I plan to buy GBP/USD immediately on a rebound from the minimum of 1.2734, with the target of an intraday correction of 30-35 points.To open short positions on GBP/USD, you need:Sellers have not been able to manifest themselves in the first half of the day, and now the focus shifts to defending the new resistance at 1.2828. Testing this level is likely in the case of very weak lending data from the US, and only forming a false breakout there will provide a suitable option for opening short positions to reduce to the support at 1.2792, where the moving averages favor the bulls. A breakout and bottom-up retest of this range will hit buyers' positions, triggering stop-loss orders and opening the way to 1.2764. The ultimate target will be the area of 1.2734, where I will take profits. Testing this level will severely harm the pound's upward potential. In the scenario of GBP/USD rising and a lack of activity at 1.2828 in the second half of the day, buyers will likely have a chance to continue the rise at the beginning of the week. In that case, I will postpone sales until a false breakout at 1.2858. Without downward movement, I will sell GBP/USD immediately on a rebound from 1.2890, expecting an intraday correction of 30-35 points.

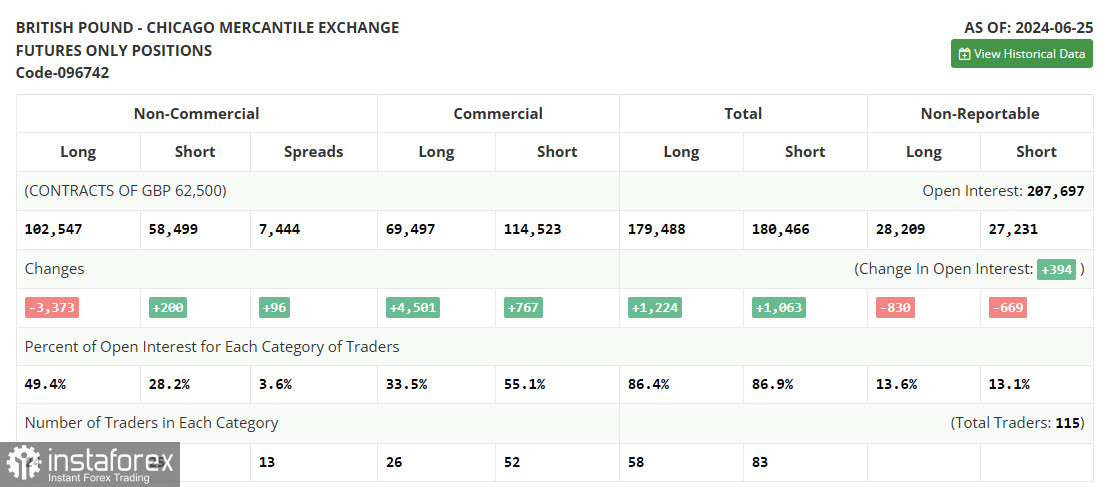

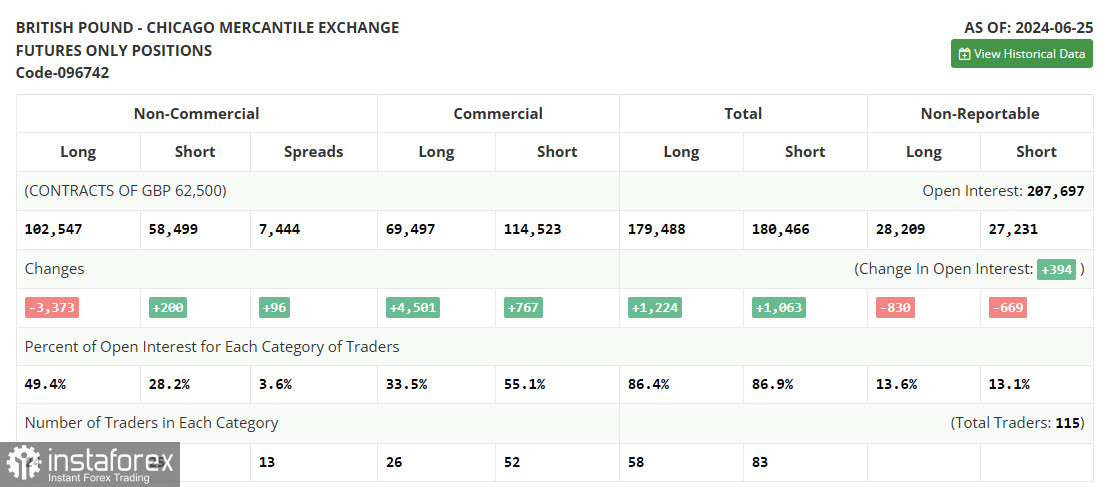

The COT report (Commitment of Traders) for June 25 showed an increase in short positions and a decrease in long ones. Recent comments from Bank of England representatives regarding future policy and the potential rate cuts in August this year continued to pressure the pound. The incoming economic statistics also leave much to be desired, and the pound reacts negatively each time. Apparently, in the realities of the Federal Reserve's firm stance, demand for the dollar will likely remain, and the pound will continue to fall. The latest COT report indicates that long non-commercial positions fell by 3,373 to 102,547, while short non-commercial positions increased by 200 to 58,499. As a result, the spread between long and short positions increased by 96.

Indicator Signals:Moving Averages:Trading is conducted above the 30 and 50-day moving averages, indicating a further rise in the pair.Note: The author considers the period and prices of moving averages on the H1 hourly chart, which differs from the general definition of classical daily moving averages on the D1 daily chart.Bollinger Bands:In case of a decline, the indicator's lower boundary, around 1.2792, will act as support.Indicator Descriptions:

- Moving average: Determines the current trend by smoothing out volatility and noise. Period – 50. Marked in yellow on the chart.

- Moving average: Determines the current trend by smoothing out volatility and noise. Period – 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA – period 12. Slow EMA – period 26. SMA – period 9.

- Bollinger Bands: Period – 20.

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.