EUR/USD

Yesterday was a calm day on the forex market, with the euro slightly decreasing after bouncing off the daily balance indicator line (red moving average). It seems that the markets are waiting for the U.S. inflation data to be released on Thursday. The forecast suggests that the core CPI will remain at 3.4% y/y and the overall CPI will decrease from 3.3% y/y to 3.1% y/y. However, we have already heard warnings from FOMC members that inflation is persistent, so the data might turn out slightly worse than expected. And as a result, the dollar could put pressure on counter-dollar currencies.

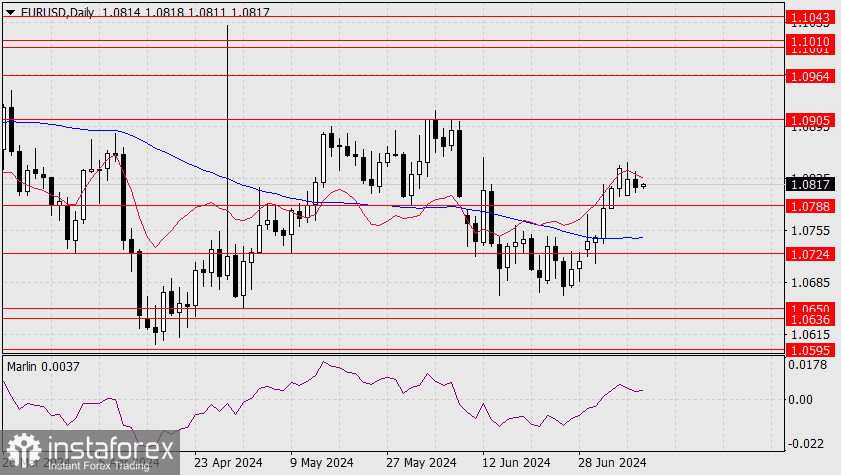

The euro is currently consolidating above the support level of 1.0788. A break below this level opens the target at 1.0724. The MACD line is gradually approaching this level, and the price might pierce it to test the horizontal support. The Marlin oscillator is in the positive territory, waiting for a reason to strengthen the movement, just like the price.

On the 4-hour chart, the price is approaching the balance and MACD indicator lines. This indicates that the price is in preparation to simultaneously break through three lines: the price level, the balance line, and the MACD line. The release of the U.S. CPI data coincides with this moment in time. This is our main scenario. An alternative scenario will unfold if the price rises above the July 8th high of 1.0846 – opening the target at 1.0905.