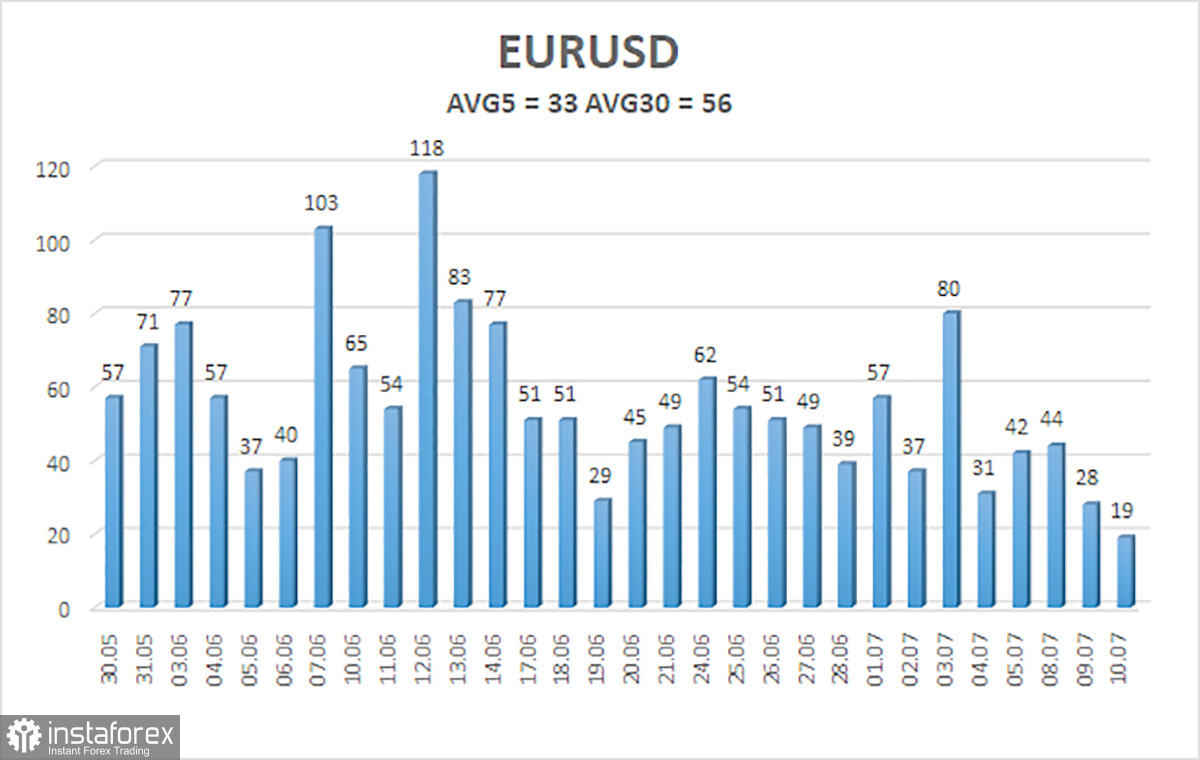

EUR/USD continued to show mind-boggling movements on Wednesday. Volatility has been falling almost every day, prompting the question: how low can it go? As seen in the chart below, even from relatively average levels a few weeks ago, volatility continues to decline. We are now observing movements of just 30-40 pips per day. What will happen in a month? Movements of 20 pips?

We've repeatedly discussed the issue of volatility before, and it doesn't seem to be going away. But along with it, new problems arise. With current movements being extremely-weak, the technical picture is becoming quite unusual. What do we see on the 4-hour timeframe? A not-so-strong decline a few weeks ago, followed by an even weaker bullish correction. The market took five weeks to move a total of 420 pips for these two swings. Since the current movement can be considered a correction, it would be reasonable to expect that the downward movement would resume. On the 24-hour timeframe, the global downtrend also remains intact, as each subsequent high is lower than the previous one. Everything suggests that the euro will decline, but what can be done if the pair moves 30 pips per day and it doesn't even constantly move in the same direction?

The fundamental background remains unchanged over time. A few months ago, the market clearly understood that the European Central Bank would start easing monetary policy faster than the Federal Reserve. We are now in the midst of this process. ECB rates are decreasing and are likely to continue to decrease in 2024, as inflation in the Eurozone continues to confidently head towards the 2% target. In the US, the situation is the opposite, and we have already mentioned that the indicator has not actually decreased since last summer, when it reached 3%. Currently, the Consumer Price Index is 3.3%, and today it may be announced that it slowed to 3.1% in June. If inflation was 3% last summer and 3.1% this summer (tentatively), is the indicator actually slowing down or accelerating?

Thus, we still believe that it is premature to expect the Fed to ease its policy unless inflation drops at least to 2.5%. Recall that the ECB started easing at a level of 2.4%, and the Bank of England, even with consumer price growth rates reduced to 2%, is still contemplating the appropriateness of rate cuts in August. Therefore, even if US inflation drops to 2.5%, this would not guarantee a rate cut at the next meeting. Core inflation remains high at 3.4%, and no one expects it to slow down by the end of June. How can one expect rate cuts in just two months with such data? Hence, we still believe that the euro should resume its downward movement. Of course, the market might resolve this puzzle in its own way, but we are talking about a consistent and logical movement. We can't predict how market makers will behave.

The average volatility of the EUR/USD pair over the last five trading days as of July 11 is 33 pips, which is considered a very low value. We expect the pair to move between 1.0794 and 1.0860 on Thursday. The higher linear regression channel is directed upwards, but the global downward trend remains intact. The CCI indicator entered the oversold area, but it has already been more than compensated by the bullish correction.

Nearest support levels:

S1 - 1.0803

S2 - 1.0742

S3 - 1.0681

Nearest resistance levels:

R1 - 1.0864

R2 - 1.0925

R3 - 1.0986

Trading Recommendations:

EUR/USD maintains a global downtrend, while it continues to rise on the 4-hour timeframe. In previous reviews, we said that we expect a continuation of the global downtrend. However, at this time we can't deny that the euro is rising again due to comprehensible reasons. Unfortunately, both the market and macro data are against the dollar at the moment. We believe that the euro can't start a new global trend right now when the ECB eases its monetary policy, so most likely the pair will continue to fluctuate between the levels of 1.0650 and 1.1000. Traders may opt for short positions in the upper part of this range and after the price consolidates below the moving average. Targets are around the 1.0681 level.

Explanation of the chart:

- Linear Regression Channels – Helps determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

- Moving Average Line (settings 20.0, smoothed) – Determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels – Target levels for movements and corrections.

- Volatility Levels (red lines) – The probable price channel in which the pair will spend the next day, based on current volatility indicators.

- CCI Indicator – Its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is imminent.