Finita la comedy! No matter how much the US dollar resisted, the US inflation data for June dealt a serious blow to it. The consumer price index slowed in June from 3.3% to 3% on an annual basis and from zero to -0.1% on a monthly basis. The growth rate of core inflation inched down from 3.4% to 3.3% y/y and from 0.2% to 0.1% m/m. All indicators came out lower than Bloomberg experts estimated, which led to a fall in Treasury yields and a rise in EUR/USD to 1.09.

Dynamics of US consumer inflation

In his testimony before the US Congress, Jerome Powell noted that the Federal Reserve faces bilateral risks. If he eases monetary policy prematurely, inflation risks soaring. If the rate cuts are delayed, the labor market and the economy could lose momentum. Judging by the fastest disinflationary process since August 2021, the start date of monetary easing has become closer. The derivatives market increased the chances of the first rate cut in September from 73% to 87%, which became a red flag for the EUR/USD bulls.

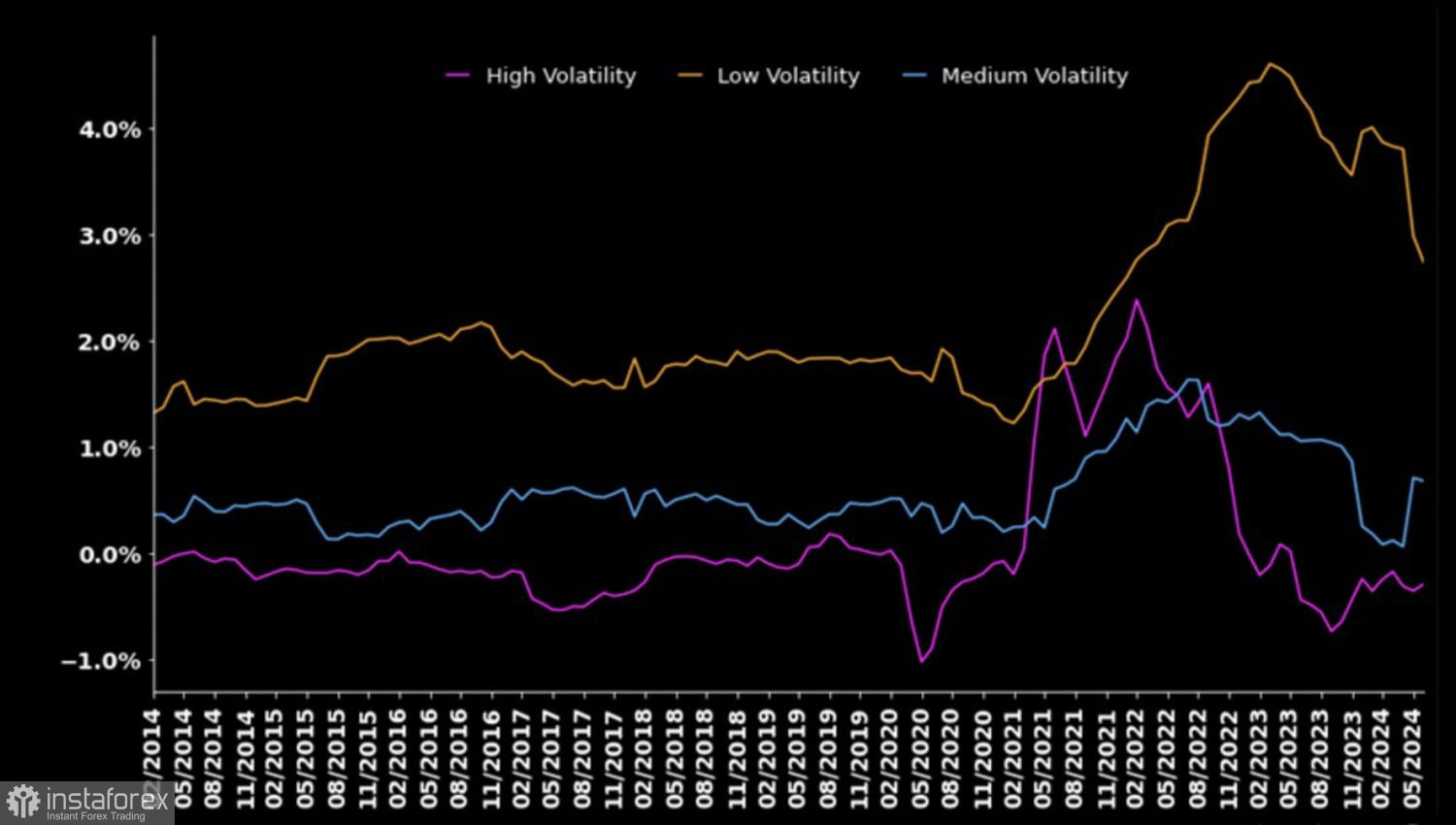

The devil is in the details. Bloomberg noted that the largest drop was observed in the low-volatility components of the consumer price basket, namely, the core CPI which excludes food and energy prices. The fact indicates that inflation is likely to continue its decline. The Federal Reserve is simply obliged to loosen monetary policy, which puts an end to the ambitions of the US dollar.

US CPI Components

But the day started well for the EUR/USD bears. Bloomberg insider indicated that France needs about 15 billion euros of additional budget revenues to meet all EU requirements. It became clear why Finance Minister Bruno Le Maire said that it was essential to achieve a budget deficit of 5.1% of GDP by the end of 2024 and 3% of GDP by the end of 2027. He underscored about 10 billion euros in spending cuts related to restrictions on ministries' budgets, changes in the income tax of energy companies, and cuts at the local government level.

However, neither the right nor the left parties that won the parliamentary elections are going to reduce spending and the budget deficit. On the contrary, the same New Popular Front plans to increase not only the salaries of civil servants but also the use of funds from the country's main financial plan. There is a confrontation with the EU on the horizon, which does not bode well for EUR/USD.

Thus, the US dollar opened today on a positive note but closed in the red. The US inflation report was another nail in its coffin. The approaching start date of the Fed's monetary easing cycle is forcing investors to sell off the USD index.

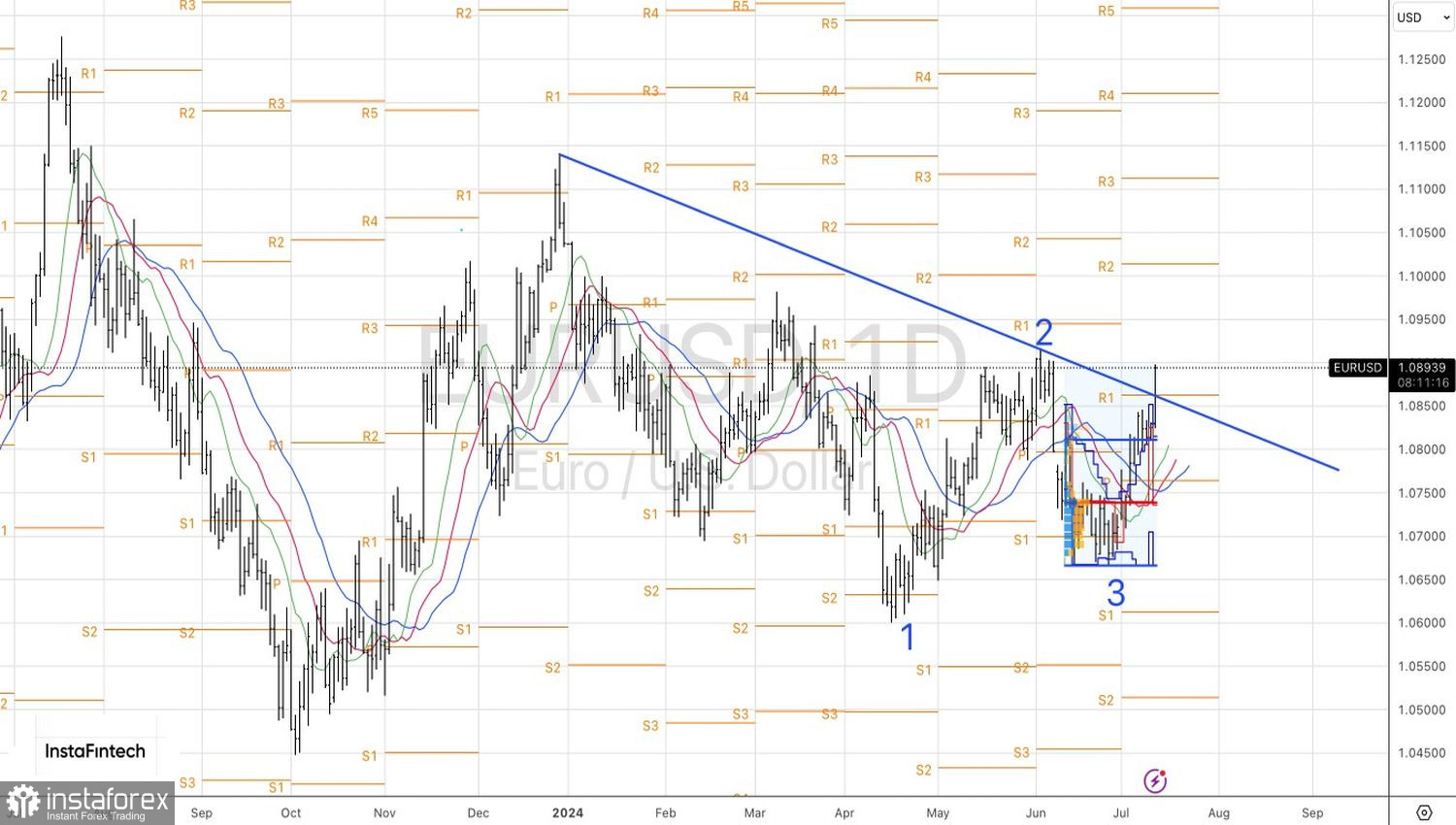

Technically, on the EUR/USD daily chart, a break of the trend line implies a break in the downtrend. It's a good idea to hold long positions formed from 1.0800 and 1.0835 and increase them from time to time, at least as long as the currency pair is quoted above 1.0865. The bullish targets are 1.1020 and 1.1100.