GBP/USD continued to show bullish bias on Friday, and it has even strengthened over the last two days. While there were reasons to buy the U.S. dollar on Thursday, there were none on Friday. Yes, the consumer sentiment index from the University of Michigan again came out weaker than expected, but at the same time, the Producer Price Index rose by 0.2% in June compared to the previous month. This means that U.S. inflation could accelerate again. However, the market chose to ignore the second report, as it indicated the need to buy the dollar.

The British currency continues to rise almost every day, whether there are grounds for it or not. For about nine months now, we've repeatedly stated that the British pound is trading illogically and remains too expensive. This is an obvious fact to us. However, it is noteworthy that the market and its major players are not obliged to follow fundamentals and macroeconomics. When they don't, such hard-to-explain movements occur. Trading purely on technicals is not the best approach right now. On the 24-hour timeframe, it is clear that the price just broke all the highs of the last six months. It often happens that after this, the market starts actively building long positions, thinking that a new trend has begun. In reality, major players immediately start selling and moving the pair in the opposite direction. Therefore, we cannot recommend long positions. Also, it is important to note that the Bank of England is one step away from lowering its rate, unlike the Federal Reserve.

The third consecutive week will begin with a "political Monday." In the last week and the week before that, the market was influenced by the results of the elections in France. Although these have a rather distant relation to the British pound, the market deemed this factor useful for long positions. So why not take advantage of it? Today, the day might start with new rallies and gaps. On Saturday, there was an attempt on the life of former US President Donald Trump, and such an event is unlikely to go unnoticed by the currency market. So, right at the beginning of the week, the price could fluctuate significantly.

Among the macroeconomic events, we can highlight the UK inflation data. This time, the indicator is not expected to change, but there's always a chance that the actual value could turn out to be different from the forecast. If inflation in the UK continues to decrease while the pound continues to rise, this will serve as another confirmation that the current upward trend is completely illogical. But if inflation accelerates, this will give the market a reason to buy the pound sterling. On Monday, Fed Chair Jerome Powell will speak, where, as seen last week, the market may latch onto any dovish hint while ignoring all hawkish statements.

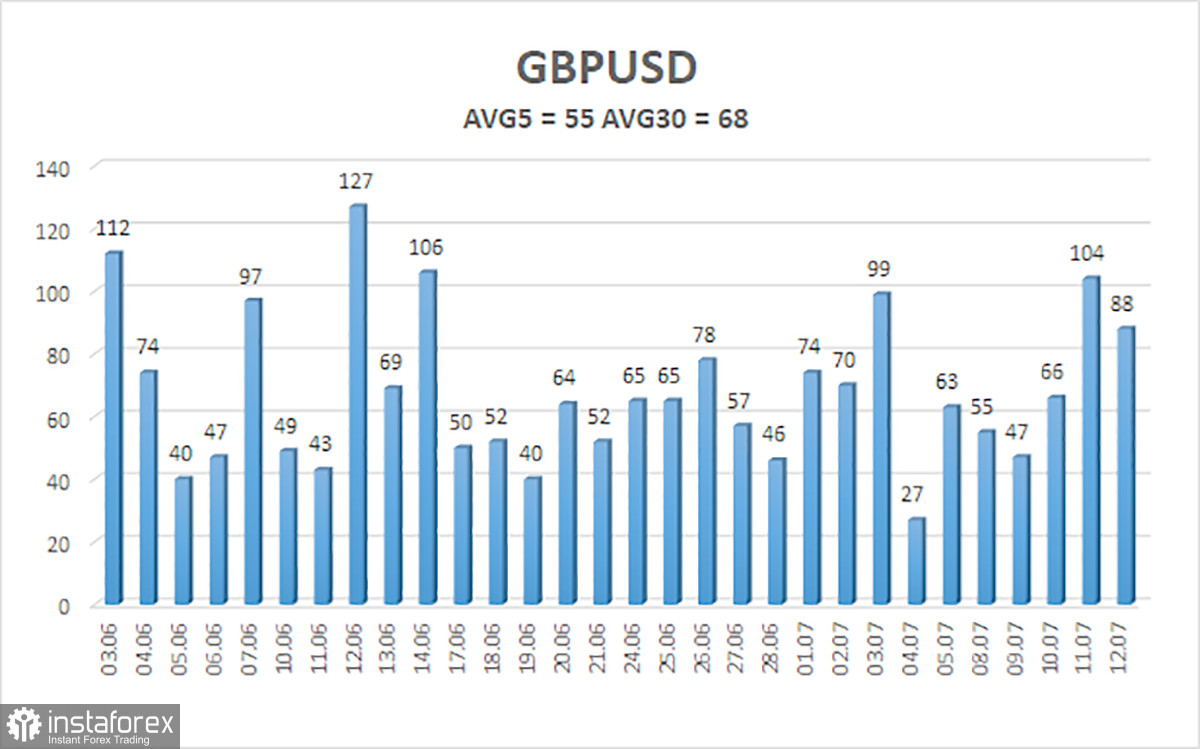

The average volatility of GBP/USD over the last five trading days is 55 pips. This is considered a low value for the pair. Today, we expect GBP/USD to move within a range bounded by the levels of 1.2929 and 1.3039. The higher linear regression channel is pointing upwards, which suggests that the upward trend will continue. The CCI indicator entered the overbought area for the second time, implying an impending decline.

Nearest support levels:

S1 - 1.2939

S2 - 1.2878

S3 - 1.2817

Nearest resistance levels:

R1 - 1.3000

R2 - 1.3062

R3 - 1.3123

Trading Recommendations:

The GBP/USD pair continues to rise rapidly, ignoring all factors in favor of the dollar. Although the U.S. released quite a number of disappointing data, we believe that this isn't enough for the pound to sustain its growth. We don't see how the pound would be able to rise above the level of 1.2817. Another batch of weak U.S. data has put pressure on the dollar once again, and in addition to that the fundamental background, the policy of the Fed and the BoE no longer carries significant weight for the market. Therefore, we cannot say that long positions are the obvious choice at this time. However, from a technical standpoint, long positions remain valid, and the pound is appreciating almost every day.

Explanation of Illustrations:

- Linear Regression Channels – Helps determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

- Moving Average Line (settings 20.0, smoothed) – Determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels – Target levels for movements and corrections.

- Volatility Levels (red lines) – The probable price channel in which the pair will spend the next day, based on current volatility indicators.

- CCI Indicator – Its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is imminent.