USD/JPY

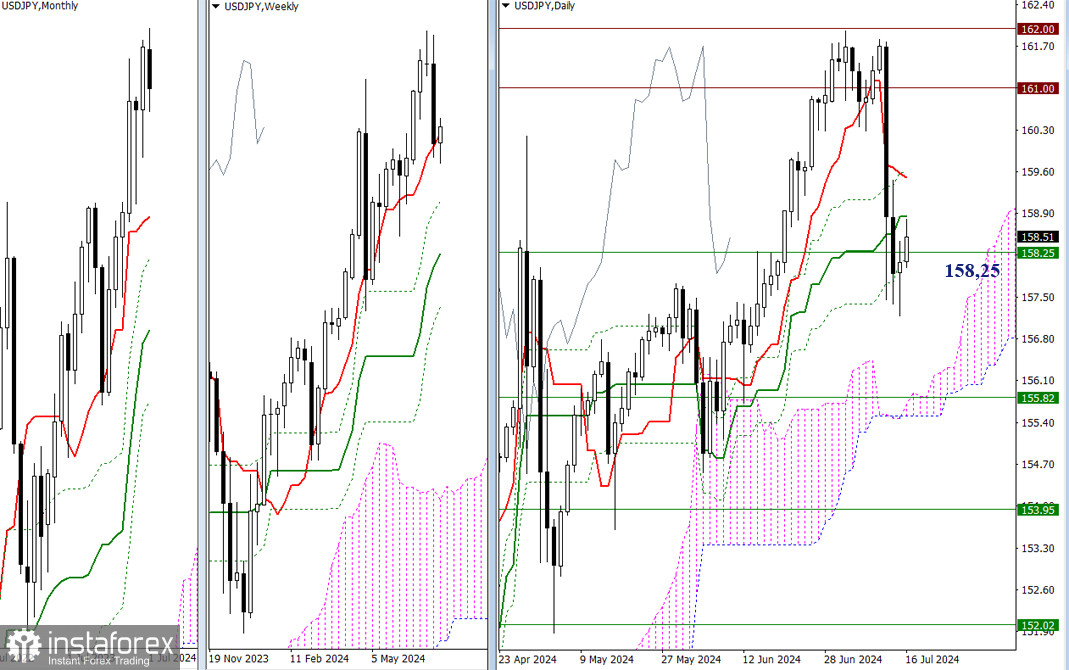

Higher timeframes

The bulls are currently trying to stay in the zone of influence of the weekly short-term trend (158.25). But in order to secure a good position in the current situation, first of all, they need to regain the levels of the daily Ichimoku cross (158.84 - 159.50) by consolidating above them. In case the bears are active in the market and USD/JPY continues to decline, the nearest important bearish reference point is still the area of the daily cloud (155.89 - 155.51), reinforced by the weekly support (155.82).

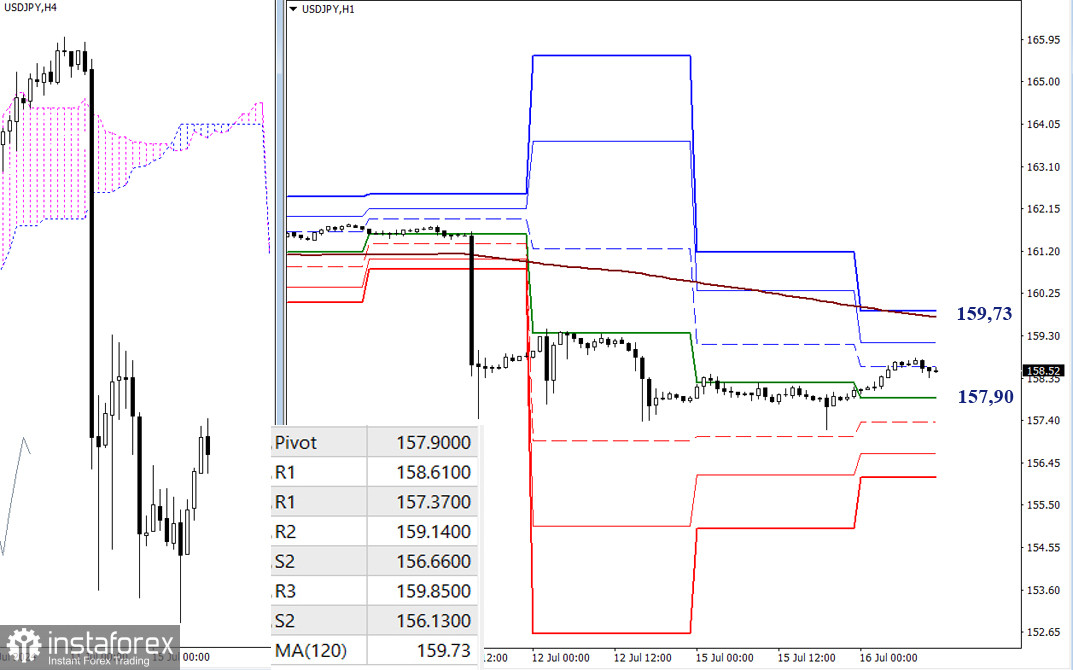

H4 – H1

The bears currently have the main advantage on the lower timeframes. The pair is trading below the weekly long-term trend (159.73). A consolidation above the trend, as well as its reversal, may be the basis to change the current balance of power and new prospects may emerge for the bulls. If the correction ends and the bears manage to test the low again, in continuation of the decline, then the support of the classic Pivot levels (157.90 - 157.37 - 156.66 - 156.13) will serve as a guide on this path.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)