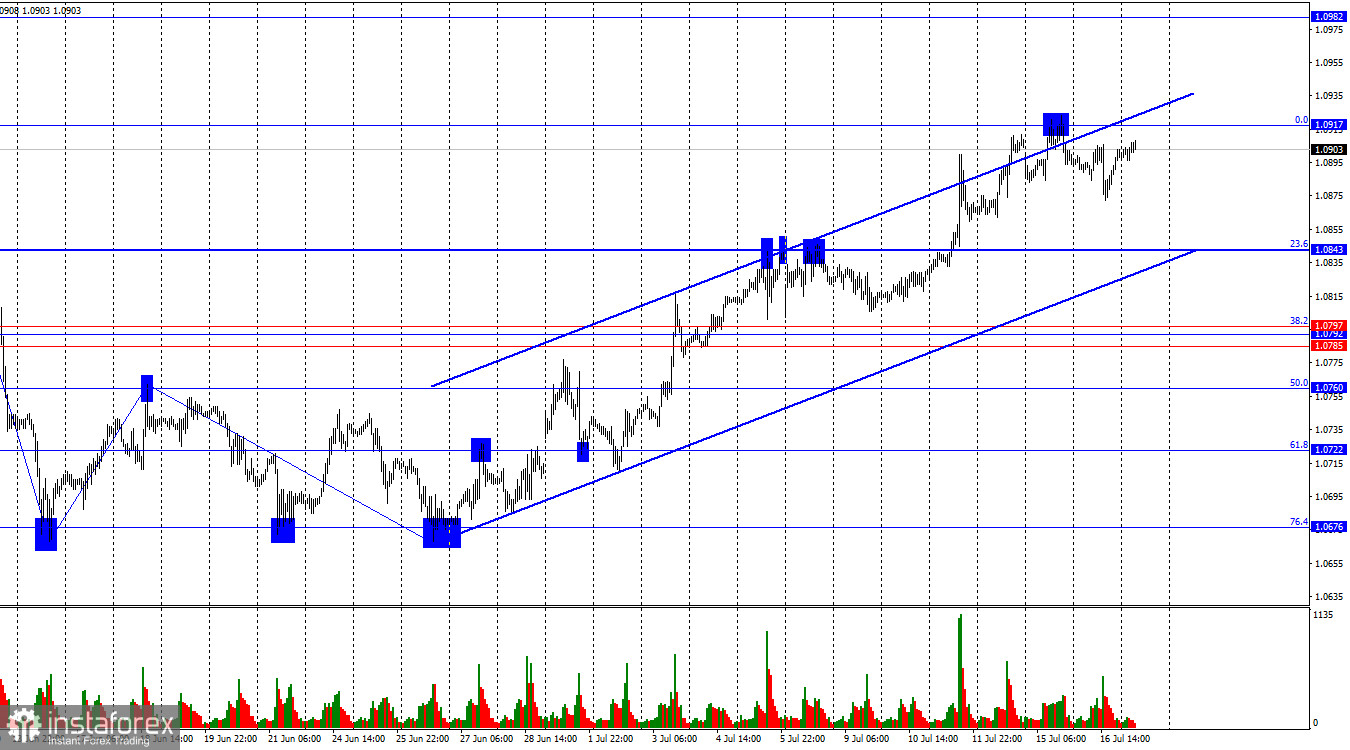

On Tuesday, the EUR/USD pair made a slight decline towards the corrective level of 23.6%-1.0843, but after falling halfway, it reversed in favor of the euro. Thus, the pair may return to the Fibonacci level of 0.0%-1.0917 today. A new rebound from this level will again favor the US dollar and a slight decline towards the 1.0843 level. Consolidation above the 1.0917 level would suggest continued growth towards the next level at 1.0982.

The wave situation has become more complex. The new upward wave broke the peak of the previous wave and continued to form, while the last completed downward wave did not manage to break the low of the previous wave. Therefore, two signs of a trend change from "bearish" to "bullish" were received. The informational background has been supporting only the bulls for more than two weeks. Thus, the bears have not had an opportunity to form even a corrective wave. There are currently no signs of a trend change to "bearish."

The informational background on Tuesday gave the bears a slight chance to "spread their wings." The ZEW economic sentiment index in Germany was only 41.8 points, with expectations of 42.5. The same index in the European Union was 43.7 points, with expectations of 48.1. In both cases, there was a decline in July compared to June. Thus, the bears had a legitimate opportunity to increase positions on Tuesday morning. However, they did not take it. In the afternoon, a retail sales report was released in America, showing no change in June. However, the May figure was revised up from 0.1% to 0.3%, which is good news for the dollar. For a very short period, the dollar rose, but by the end of the day, the bears had once again retreated from the market.

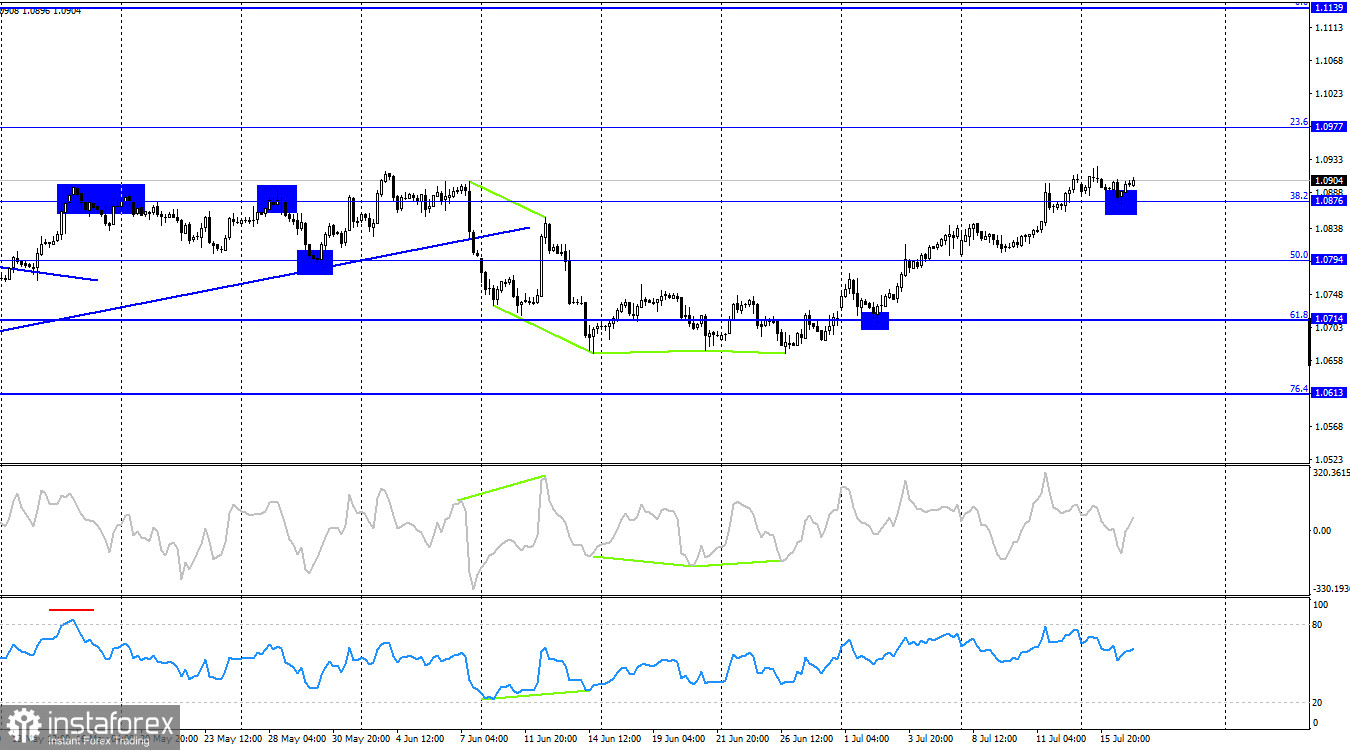

On the 4-hour chart, the pair consolidated above the corrective level of 38.2%–1.0876. Thus, the growth process may continue towards the next Fibonacci level at 23.6%–1.0977. No emerging divergences are observed in any indicator today. There is a need to form a corrective wave on the hourly chart, so closing on the 4-hour chart below the 1.0876 level will favor the dollar and a slight decline towards the corrective level of 50.0%–1.0794.

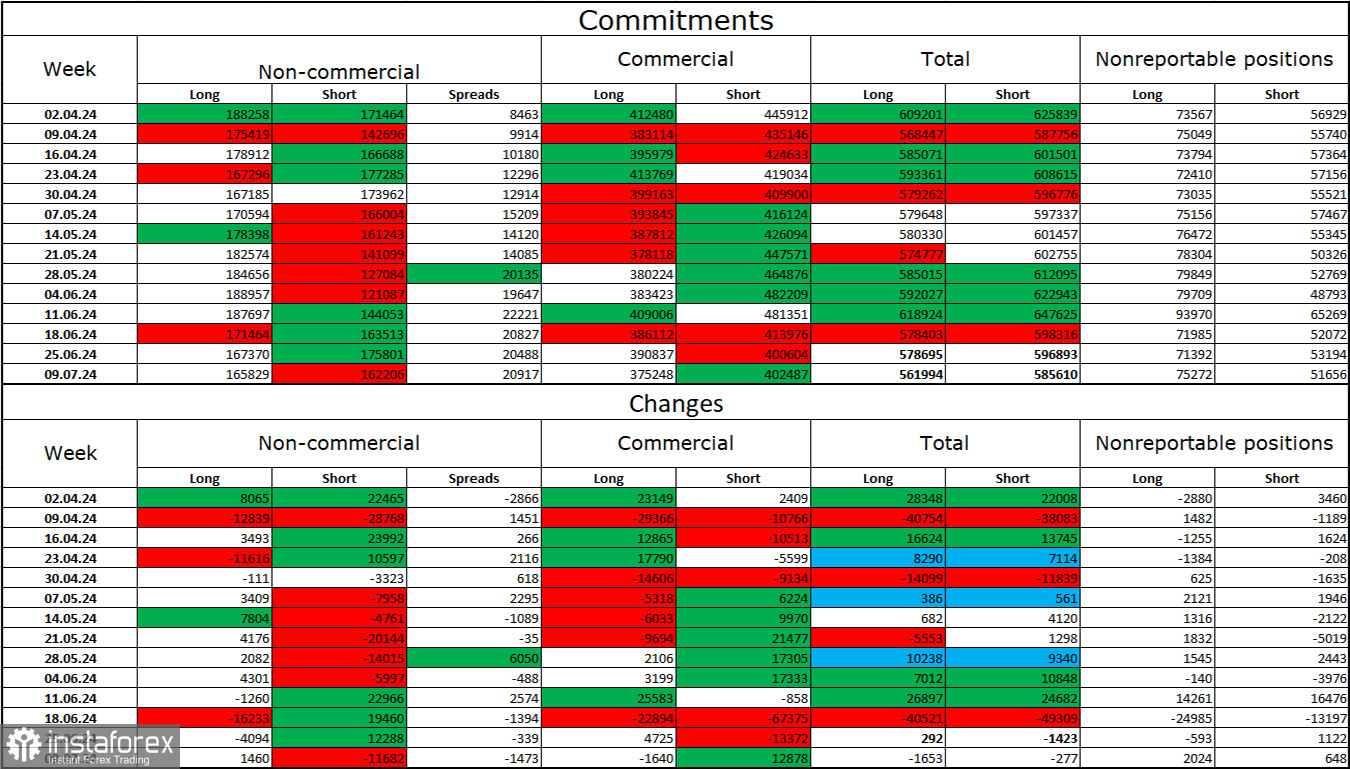

Commitments of Traders (COT) Report:

During the last reporting week, speculators opened 1,460 long positions and closed 11,682 short positions. The sentiment of the "Non-commercial" group turned "bearish" several weeks ago, but there is currently an equilibrium between bulls and bears. The total number of long positions held by speculators is now 165,000, and short positions – 162,000. I still believe that the situation will continue to change in favor of the bears. I do not see long-term reasons to buy the euro, as the ECB has started easing monetary policy, which will lower the yields on bank deposits and government bonds. In America, they will remain high for several more months, making the dollar more attractive to investors. The potential for the euro to decline looks substantial even according to the COT reports. Currently, the number of short positions among professional players is growing. However, we should not forget about graphical analysis, which currently allows for opposite conclusions.

News Calendar for the US and Eurozone:

- Eurozone – Consumer Price Index (09-00 UTC).

- US – Number of Building Permits Issued (12-30 UTC).

- US – Number of Housing Starts (12-30 UTC).

- US – Industrial Production Change (12-30 UTC).

On July 17, the economic events calendar contains four entries, none of which are particularly noteworthy. The impact of the informational background on traders' sentiment today may be weak.

Forecast for EUR/USD and Trading Recommendations:

Selling the pair was possible with a rebound on the hourly chart from the 1.0917 level with a target of 1.0843. These trades can now be kept open. Buying was possible upon closing above 1.0843 with a target of 1.0917. This level has been reached. New purchases – upon closing above the 1.0917 level with a target of 1.0977.

Fibonacci level grids are built from 1.0602 to 1.0917 on the hourly chart and from 1.0450 to 1.1139 on the 4-hour chart.