The upward momentum in the EUR/USD pair, which we observed at the beginning of the week, has completely faded. Yesterday, EUR/USD buyers approached the resistance level of 1.0960 (the upper line of the Bollinger Bands indicator on the D1 timeframe) but halted at 1.0940. Subsequently, sellers took the initiative, pulling the price back into the 1.08 area.

The 1.09 price level is fatal for the bulls of the pair. Since mid-spring (April), they have been trying to consolidate above the 1.0900 target, but each time, they pulled back. The monthly chart shows that the pair remains within a broad price range of 1.0650–1.0900. It has been trading within this range for the fourth consecutive month. Sellers impulsively went lower (year low – 1.0602), buyers – higher, but these were short-term price surges. Each time, the pair has returned. And now EUR/USD buyers failed to consolidate within the 1.09 area.

The current fundamental factors favor further price growth – at least to the boundaries of the 1.10 price level. The American CPI has declined for the second consecutive month (both overall and core), reflecting a slowdown in inflation, and the Federal Reserve has softened its stance. Amid discussions of a possible cut this year – likely at the December meeting – the likelihood of a rate cut at the September meeting has increased to almost 100%. Meanwhile, the European Central Bank is still hesitating about a rate cut in September, judging by the results of the July meeting. Christine Lagarde did not say "yes" or "no" yesterday, tying the final rate decision to the dynamics of inflation indicators. The ECB members' doubts are understandable, as the Eurozone consumer price index shows resilience, unlike the American CPI.

In other words, all the conditions for the growth of the EUR/USD pair are in place. But contrary to expectations, the pair is going down.

And yet, there is logic in all of this. In my opinion, the dollar is growing (and the pair is declining solely due to the strengthening of the US dollar) against the backdrop of recent political events in the US, which have increased Donald Trump's chances of returning to the White House.

It should be noted that the dollar reacted positively to the results of the debates between Trump and Biden, which were disastrous for the incumbent president Biden. The Republican's ratings began to climb, and the Democratic Party started persuading its leader to withdraw from the election race. Today, the New York Times reported that Biden is leaning towards such a decision. According to insiders, he will soon approve Vice President Kamala Harris as his replacement. Axios even specifies the date of such a decision: according to their information, the head of the White House will withdraw from the election this weekend.

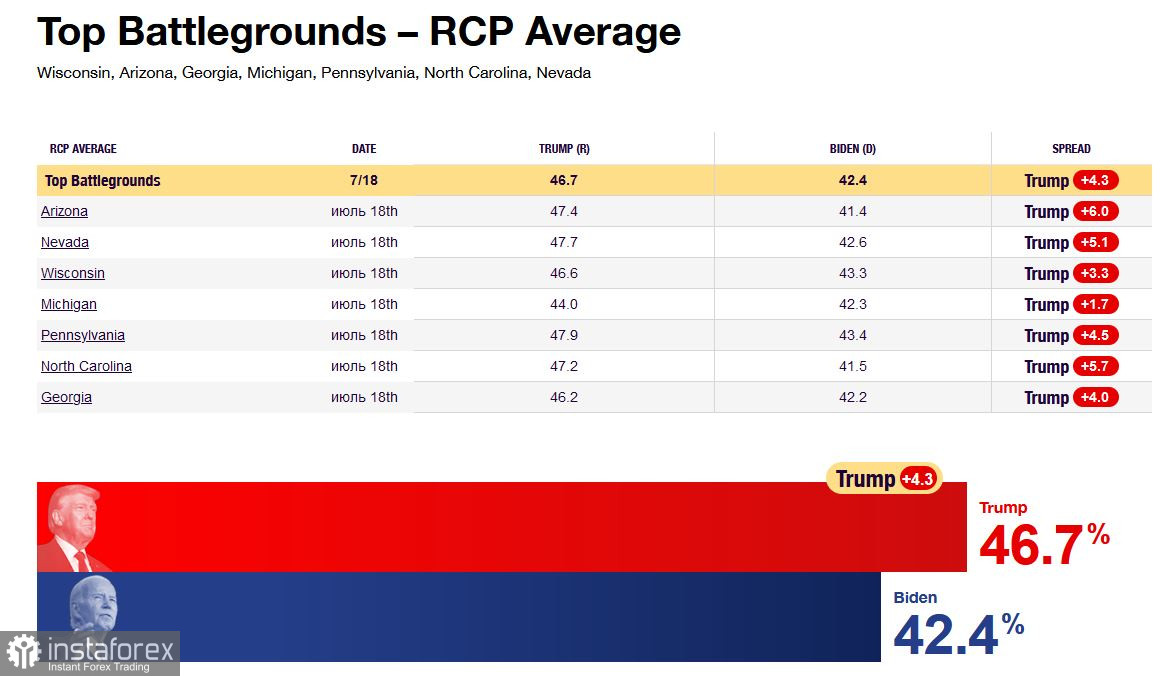

It is worth noting that the US electoral system is quite specific – the elections are indirect. For example, in 2016, Hillary Clinton received almost 3 million more votes from voters than Trump. But she lost by 227 to 304 in the electoral vote. The leader of the Republican Party became president. The outcome of the elections is decided in swing states, where the support for Republicans and Democrats is usually roughly equal. But now, Donald Trump is leading in the swing states of the US, having strengthened his position after surviving an assassination attempt.

American bookmakers currently assess the chances of victory as follows: Trump – 63%, Harris – 22%, Biden – 4%. This does not require further comment.

The currency market ignored the US election race when the candidates' chances were roughly equal. But after Trump, the Republican candidate, pulled ahead, the situation changed. People started recalling Trump's first term and paying more attention to his words. For example, in an interview with Bloomberg TV, he recently stated that he "does not recommend the Federal Reserve to lower the interest rate in September."

Overall, Trump heightened uncertainty well before the elections. The intensification of inflationary protectionist measures and increased geopolitical risks, along with the prospect of a new trade war with China, heightened risk-off sentiment in the markets. This allowed the dollar to regain some lost positions. This happened despite Trump stating in an interview that the strengthening dollar negatively affects the competitiveness of American exports. In this context, he added that if he wins the election, he may move to weaken the greenback (though he did not specify how). As we can see, the dollar is reacting to his possible election in the opposite way.

Further exacerbating risk-off sentiment today was a global failure in the Windows operating system. Microsoft shares lost almost 3%: in the first minutes of pre-market trading on NASDAQ, the shares fell to a low of $427.35. The IT failure affected systems worldwide: it impacted aviation, banks, postal services, and even the London Stock Exchange. According to preliminary data, it was not a cyberattack. Apparently, CrowdStrike released a faulty update to the cybersecurity program integrated into Microsoft's operating system. The scale of the failure alarmed investors (the problem affected the US, many EU countries, Turkey, Australia, India, and Japan), increasing risk-off sentiment in the markets.

From a technical perspective, the EUR/USD pair is testing the intermediate support level of 1.0870 (Tenkan-sen line on the daily chart). If traders overcome this price barrier, the next target for the southern movement will be 1.0820, which corresponds to the upper boundary of the Kumo cloud on the daily chart (and simultaneously the lower boundary of the cloud on the four-hour chart).