Throughout Friday, the currency market essentially stood still. This is not surprising, given the complete absence of macroeconomic data from the Eurozone or the United States. We may see the same scenario today due to the empty economic calendar. However, political factors are coming to the forefront once again. Yesterday, Joe Biden officially announced his withdrawal from the upcoming presidential election. The Democratic Party needs to select a new candidate as soon as possible, which naturally introduces uncertainty and will likely exert pressure on the dollar. However, another likely scenario is for the greenback to rise due to the withdrawal of a candidate whose health has been the subject of much discussion in recent weeks. In theory, these two scenarios balance each other out. But the dollar cannot be stagnant. Everything will now depend on the Democratic Party and how quickly it can decide on a new candidate for the president of the United States.

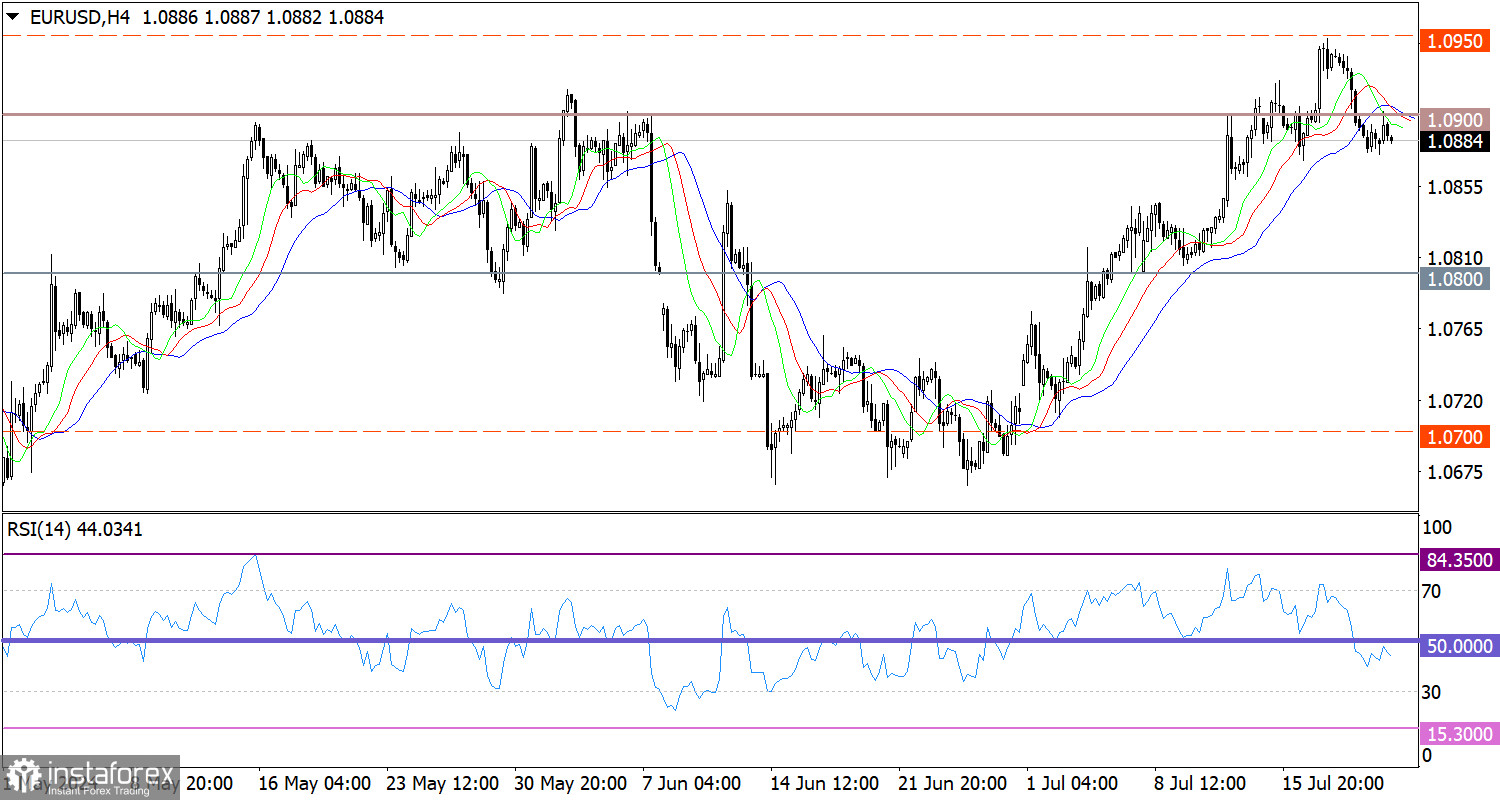

The EUR/USD pair is going through a correction from the lower area of the psychological level of 1.0950/1.1000. As a result, the euro has fallen below the 1.0900 mark.

During the correction, the RSI dropped below the neutral level of 50 in the 4-hour time frame, indicating an increase in the volume of short positions on the euro.

As for the Alligator indicator in the same time frame, the lines are intertwined, meaning that the upward cycle is slowing down.

Outlook

The euro must settle below the 1.0850 level to support the corrective cycle. Under this scenario, the price could move towards the 1.0800 level. The bullish scenario will come into play if the price returns above the 1.0900 level.

Complex indicator analysis suggests a correction in the short-term and intraday time frames.