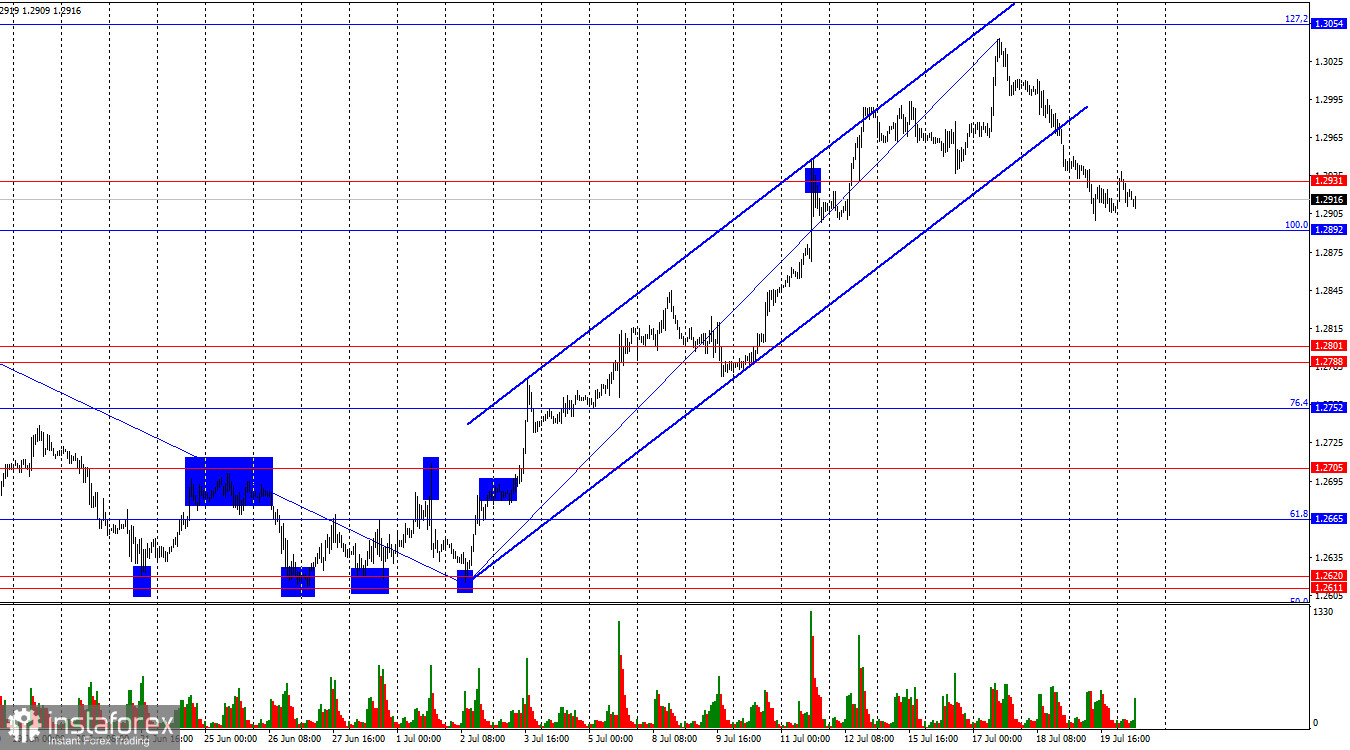

On the hourly chart, the GBP/USD pair entered the support zone of 1.2892–1.2931 on Friday. Securing quotes below this zone will allow the pound to continue declining towards the next support zone of 1.2788–1.2801. Securing quotes above the 1.2892–1.2931 zone will favor the bulls again, and the pound may resume its rise toward the 127.2% corrective level at 1.3054. I do not expect strong movements in the first two days of the week as there will be no significant information background.

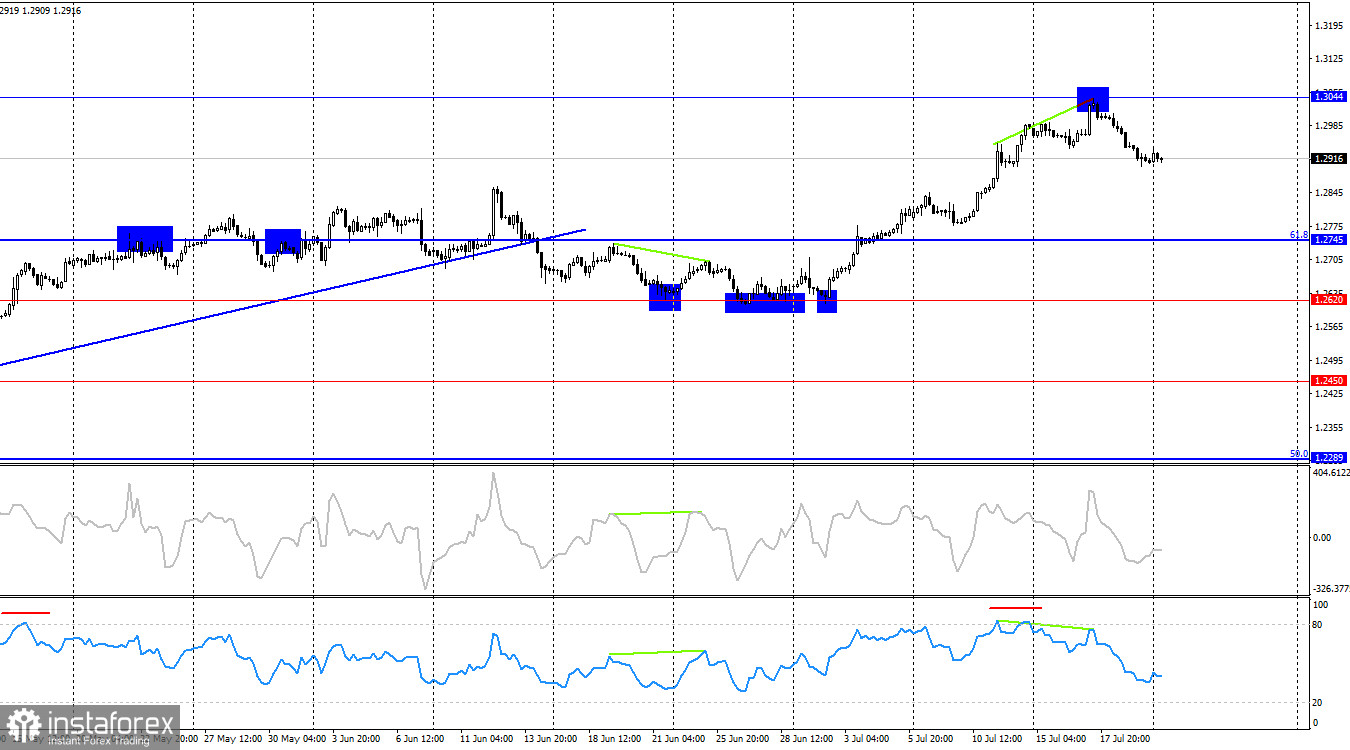

The situation with the waves changed last week. The latest downward wave (which started forming on June 12th) managed to break the low of the previous downward wave, and the latest upward wave managed to break the peak of the last upward wave. Thus, we saw a trend reversal to "bullish" after the "bearish" trend that did not materialize. The pound's growth may continue, but now traders must form at least a corrective downward wave. A change to a "bearish" trend is not yet on the agenda from a wave point of view. For this to happen, the pair must break the last low from July 2nd. Whether the bears have enough strength for this is a big question.

The information provided on Friday supported the bears. Retail volumes decreased by 1.2% in June, including fuel sales, and by 1.5% excluding fuel. Traders expected a much smaller reduction. Thus, the pound's decline was justified. In my opinion, further decline of the pound seems inevitable, but there are few graphic signals for selling and trend reversal to "bearish" right now. A "bearish" trend can be expected after a confident close below the 1.2892 level. Early this week, the pair may swing from side to side, forming false signals in the 1.2892–1.2931 zone.

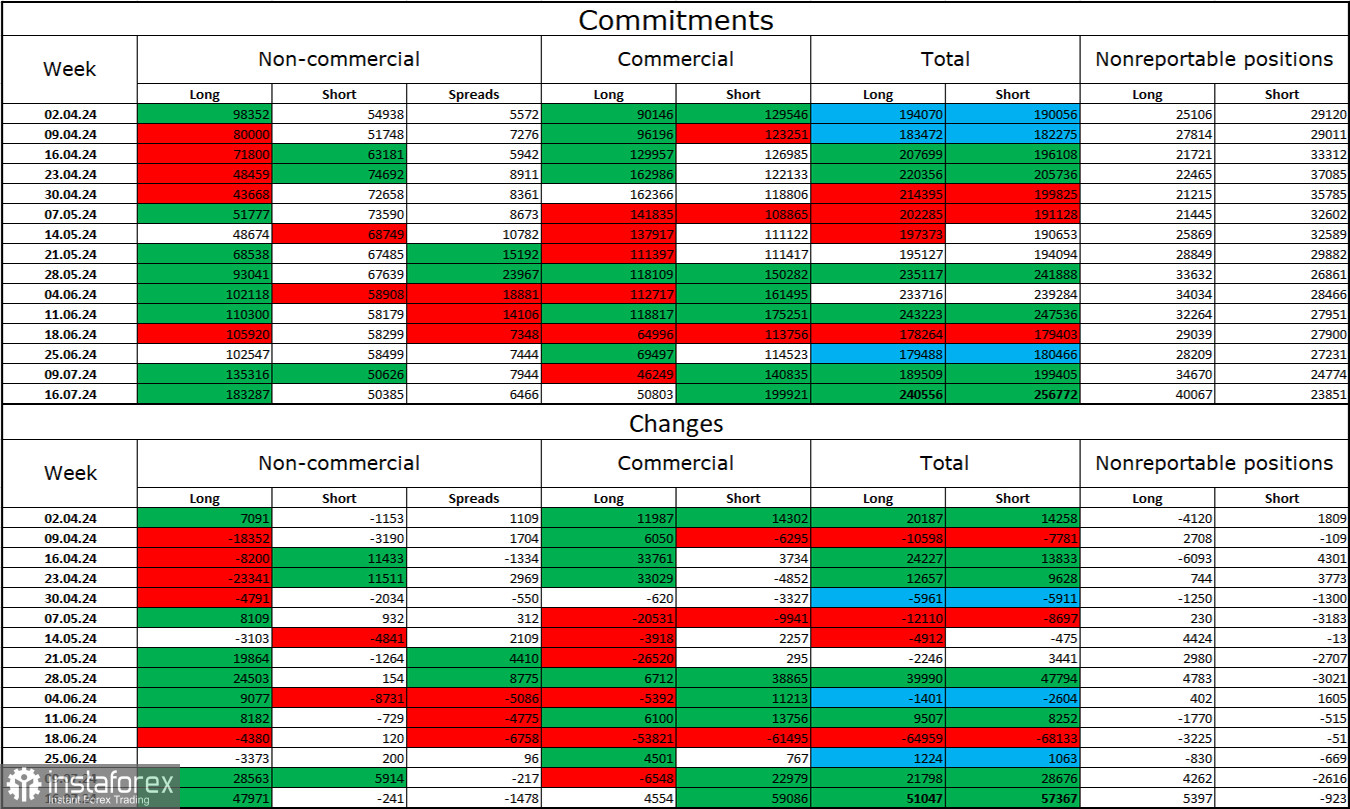

The sentiment of the "Non-commercial" trader category became even more "bullish" last week. The number of long positions held by speculators increased by 47,971 units, while the number of short positions decreased by 241. Bulls still hold a solid advantage. The gap between long and short positions is already 133,000: 183,000 versus 50,000.

The pound still has prospects for falling, but the COT reports currently suggest otherwise. Over the past three months, the number of long positions has increased from 98,000 to 183,000, while the number of short positions has decreased from 54,000 to 50,000. Over time, professional players will again start getting rid of long positions or increasing short positions, as all possible factors for buying the British pound have already been worked out. However, it should not be forgotten that this is just an assumption. Graphical analysis indicates a likely decline, but this does not negate the weakness of the bears, who could not even "take" the 1.2620 level.

News Calendar for the US and the UK:

On Monday, the economic events calendar does not contain any entries. The influence of the information background on market sentiment today will be absent.

GBP/USD Forecast and Trading Tips:

On the 4-hour chart, sales of the pound were possible upon the rebound from the 1.3044 level, targeting the lower boundary of the upward channel. On the hourly chart, these sales can now be closed or held in anticipation of a close below the 1.2892–1.2931 zone. I consider purchases unadvisable for the next couple of days.

Fibonacci levels are constructed from 1.2892 to 1.2298 on the hourly chart and from 1.4248 to 1.0404 on the 4-hour chart.