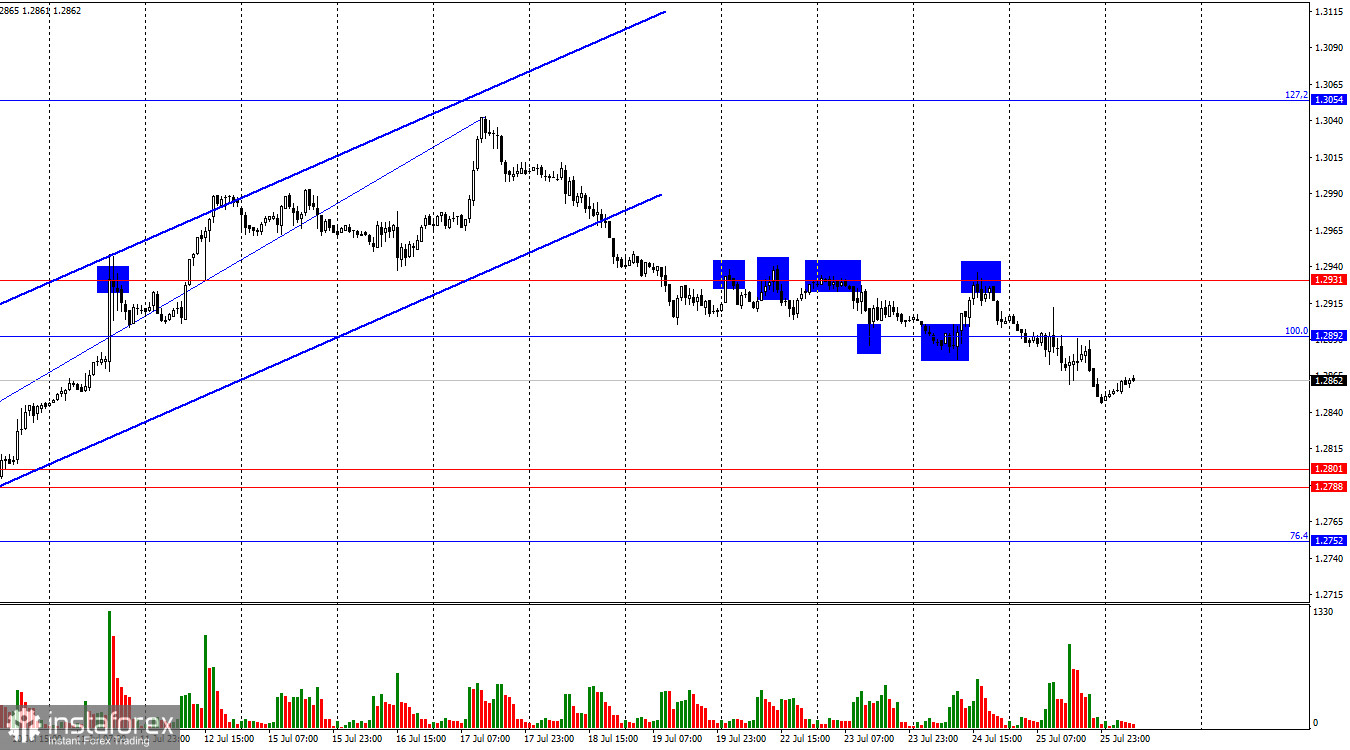

On the hourly chart, the GBP/USD pair consolidated below the zone of 1.2892–1.2931 on Thursday, allowing for further decline towards the next support zone of 1.2788–1.2801. I still do not consider the possibility of the pound rising for now, as the pair recently consolidated below the upward trend channel. A rebound from the zone of 1.2788–1.2801 may signal a minor rise for the pound.

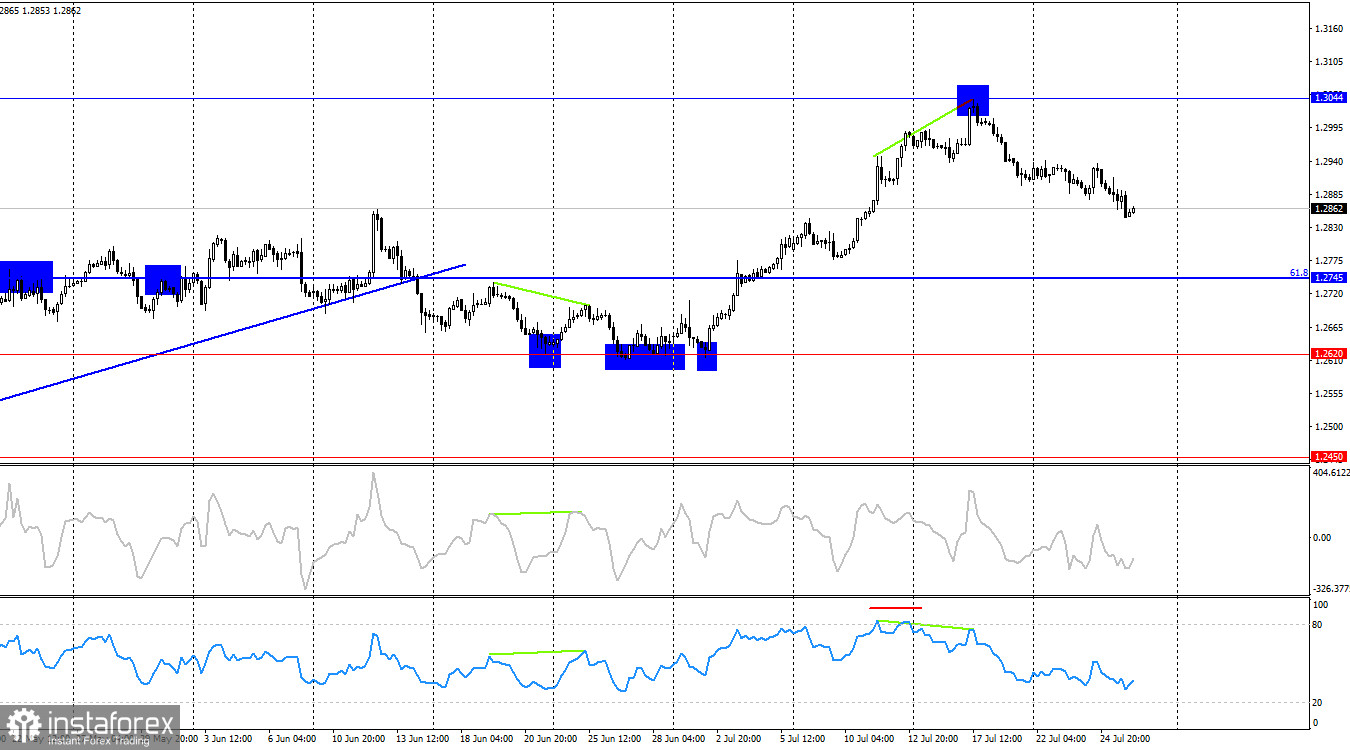

The wave situation changed last week. The last completed downward wave (which started forming on June 12) managed to break the low of the previous downward wave, and the last upward wave managed to break the peak of the previous upward wave. Thus, we are currently dealing with a "bullish" trend. The pound's rise may continue, but traders now need to form a corrective downward wave. There is no talk of a trend change to "bearish" from a wave perspective yet. For this to happen, the pair needs to break the last low from July 2. Whether the bears have enough strength to reach this level remains uncertain.

Thursday's information background allowed the dollar to continue its rise and for the bears to launch attacks. The American economy grew stronger in the second quarter than expected, and traders paid less attention to the report on durable goods orders for the pound than for the euro. This could be because the pound has shown much stronger growth in recent months compared to the euro. Consequently, it should also show a stronger decline. Additionally, it's worth noting that the ECB has begun easing monetary policy, unlike the Fed and the Bank of England. Thus, the European currency has more reasons for decline than the British pound. The Bank of England is in a position where rate cuts could begin at any meeting. However, the longer the British regulator waits, the stronger the positions of the British currency and bulls.

On the 4-hour chart, the pair rebounded from 1.3044 level with the formation of a "bearish" divergence on the RSI indicator. Earlier, this same indicator entered the overbought zone. Thus, several sell signals were generated on the higher timeframe. The decline may now continue towards the 61.8% retracement level at 1.2745. On the hourly chart, the bears closed below the trend channel, which also allows for continued pair decline.

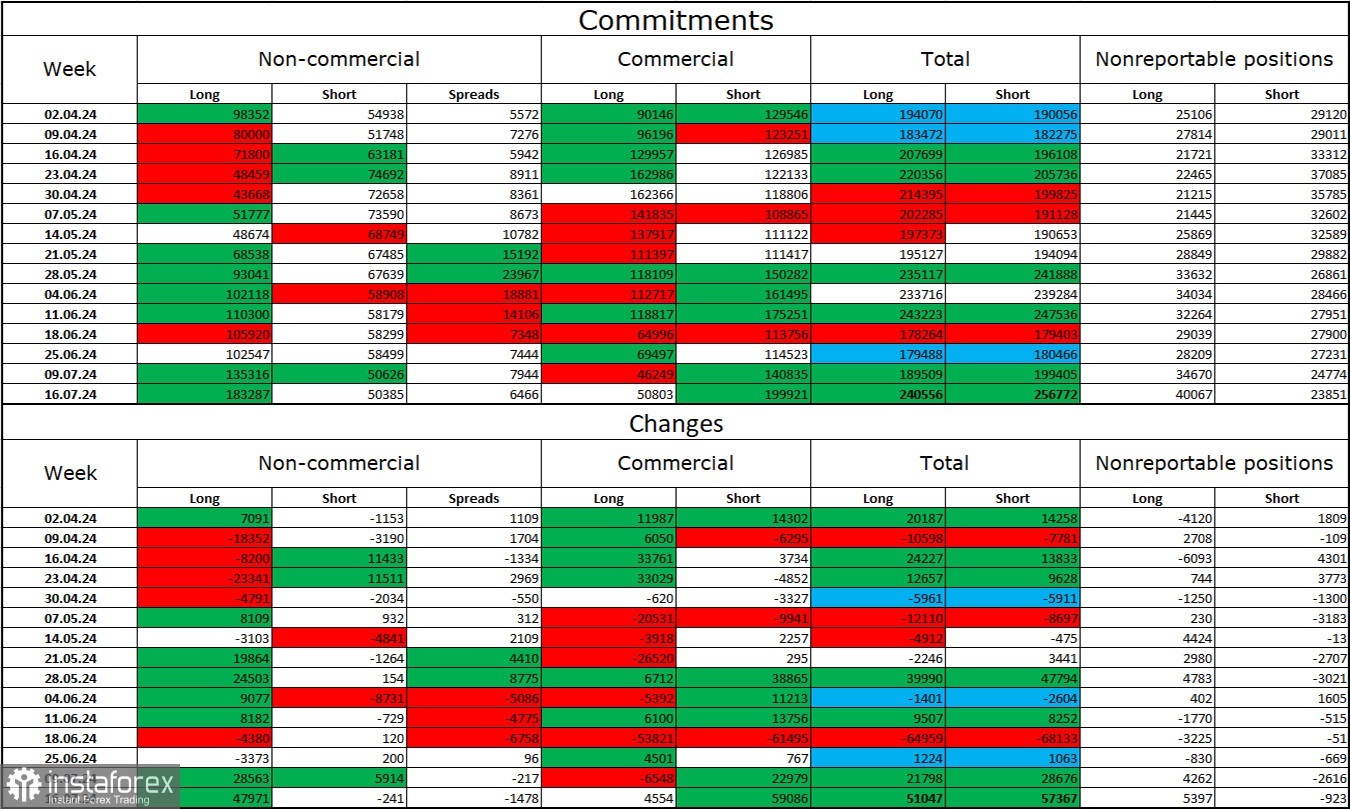

Commitments of Traders (COT) Report

The sentiment of the "Non-commercial" trader category became even more "bullish" over the last reporting week. The number of long positions held by speculators increased by 47,971, while the number of short positions decreased by 241 units. The bulls still have a solid advantage. The gap between the number of long and short positions is now 133,000: 183,000 vs. 50,000.

In my opinion, the prospects for the pound's decline remain, but the COT reports currently suggest otherwise. Over the last 3 months, the number of long positions has grown from 98,000 to 183,000, while the number of short positions has decreased from 54,000 to 50,000. I believe that over time, professional traders will start shedding long positions or increasing short positions again, as all possible factors for buying the British pound have already been exhausted. However, it should not be forgotten that this is merely a hypothesis. Graphic analysis suggests a likely decline, but it does not negate the weakness of the bears, who couldn't even take the 1.2620 level.

News Calendar for the US and the UK:

US:

- Personal Consumption Expenditures (PCE) Price Index (12:30 UTC)

- Personal Income and Spending (12:30 UTC)

- University of Michigan Consumer Sentiment Index (14:00 UTC)

Friday's economic events calendar includes several entries. The influence of the information background on market sentiment today may be moderate in strength and predominantly in the second half of the day.

Forecast for GBP/USD and Trading Advice:

Sales of the pound were possible upon a rebound from the level of 1.3044 on the 4-hour chart with the target of the lower boundary of the upward trend channel. These sales can now be kept open with the target zone of 1.2788–1.2801. I consider buying the pound in the next couple of days to be impractical.

Fibonacci grids are built at 1.2892–1.2298 on the hourly chart and at 1.4248–1.0404 on the 4-hour chart.