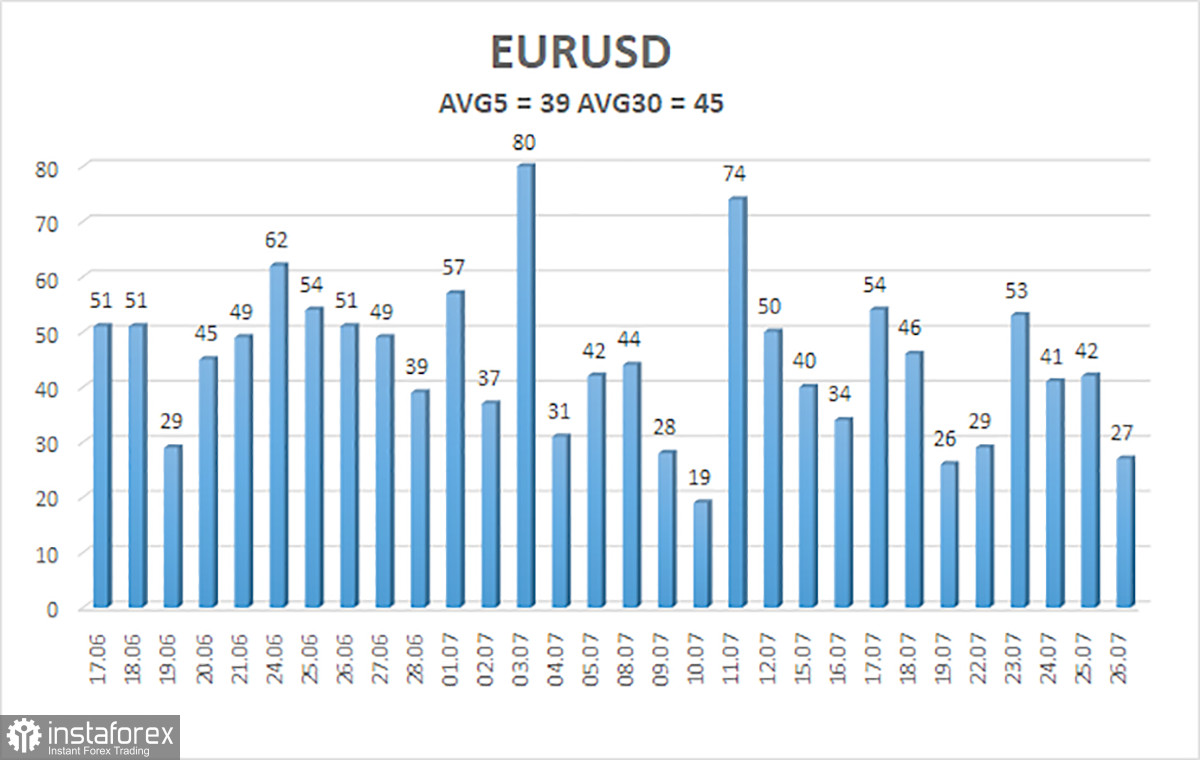

EUR/USD once again showed ultra-low volatility on Friday. The pair was practically immobilized despite at least three reports published during the US trading session that could have served as drivers. However, this did not happen. Recall that the US released important data a day earlier, even more significant than on Friday. In particular, the GDP data for the second quarter and durable goods orders were released. Both reports were highly impactful. GDP grew much stronger than expected, while orders plummeted by 6.6% against a forecast of +0.3%. Nevertheless, the overall volatility for the day was only 42 pips.

We have repeatedly discussed the volatility indicator, and in previous (weekly) articles, we established that the EUR/USD pair has been in a flat trend for the entire 2024. On the 4-hour chart, this flat trend naturally looks like a series of short-term trends. However, the price has been between the 6th and 10th levels throughout the current year. What is this, if not a flat trend? Thus, in the grand scheme, it does not matter what data comes from the EU or the US. They do not provoke a strong intraday market reaction and cannot make the market exit the flat trend and resume a trend.

Therefore, the PCE index, personal income and spending of Americans, and the University of Michigan consumer sentiment index initially had no chance of provoking significant movement. What can we expect in the upcoming week?

The key events in Europe will be the GDP data for the second quarter and inflation figures in the EU and Germany. Notably, the Federal Reserve meeting also stands out. There may be many significant events, but we believe absolutely nothing will change. We might see a few small bursts of activity, but no more. What can we expect from European and German inflation? In both cases, experts forecast another slowdown. The European Central Bank has already begun to lower its borrowing costs, and further inflation slowdown will only increase the likelihood of a second rate cut in September. But what significance does this have for the EUR/USD pair if it has been in a flat trend for six months? We might see a drop of 40-50 pips at best, but the overall technical picture will remain unchanged.

The GDP data from Germany and the EU will also fail to provoke significant reactions. The market ignored a much more impactful report on US GDP on Thursday. The European and German economies might show growth of up to 0.3% and 0.1%, respectively, which is significantly weaker than the American figures. Again, we might see a reaction of 20-30 pips, which will have little impact.

The Fed meeting is a separate issue. The market will again be waiting for dovish statements from Fed Chair Jerome Powell, and they will not materialize again. The market firmly believes that the Fed rate will be lowered soon, but in reality, easing might only begin in December. Powell is unlikely to signal any readiness to start easing policy. Most likely, the meeting will be uneventful.

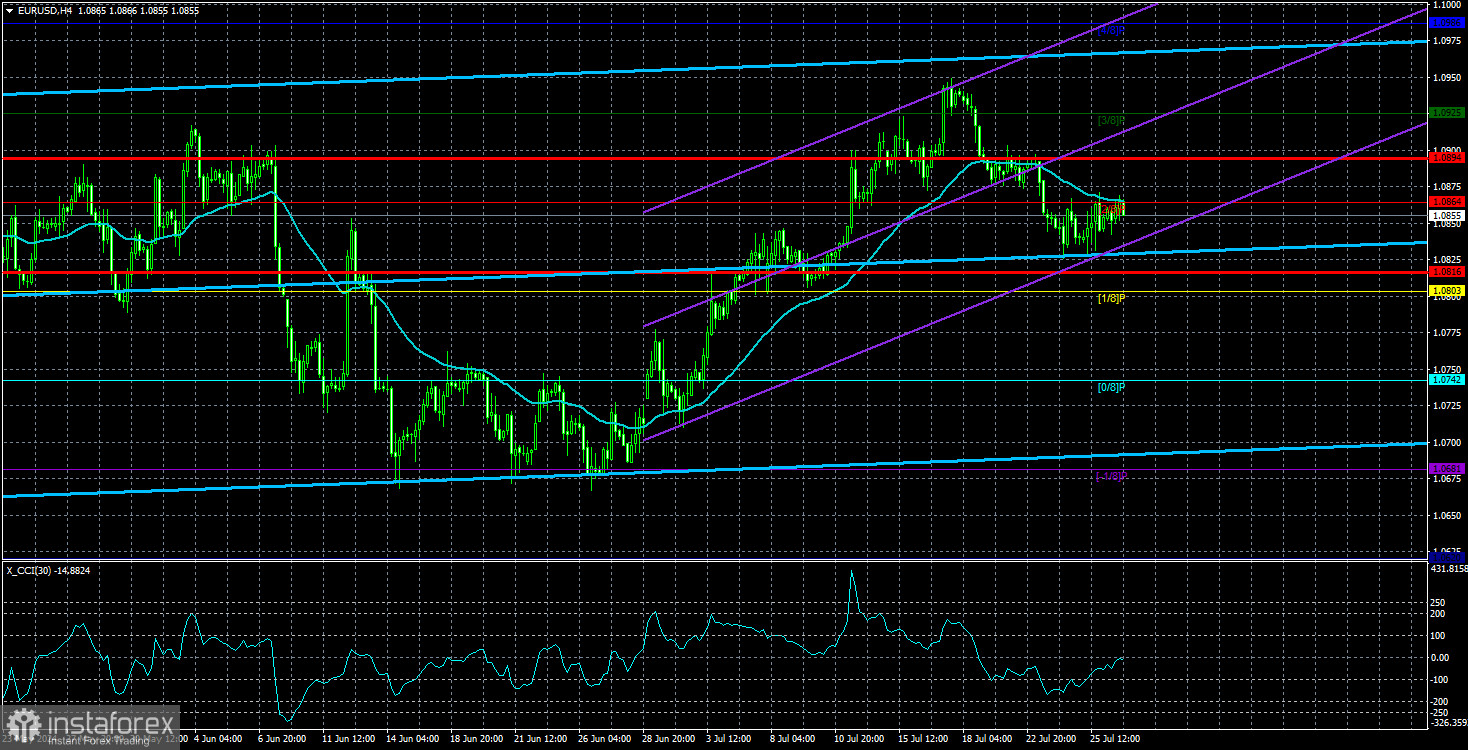

The average volatility of the EUR/USD currency pair over the past five trading days as of July 28 is 39 pips, which is considered low. We expect the pair to move between the levels of 1.0816 and 1.0894. The higher linear regression channel is directed upwards, but the downward trend remains intact overall. The CCI indicator entered the overbought area, the first warning of a potential trend change.

Nearest Support Levels:

- S1 – 1.0803

- S2 – 1.0742

- S3 – 1.0681

Nearest Resistance Levels:

- R1 – 1.0864

- R2 – 1.0925

- R3 – 1.0986

Trading Recommendations:

The EUR/USD pair maintains a global downward trend; a downward movement has also begun in the 4-hour time frame. In previous reviews, we mentioned that we are only expecting the continuation of the global downward trend. We do not believe that the euro can start a new global trend amid the ECB's monetary policy easing, so the pair will likely fluctuate between 1.0650 and 1.1000 for some time. Since the price is currently in the upper part of this range, short positions with targets around the Murray level "-1/8" - 1.0681 are more valid.

Explanations for Illustrations:

Linear Regression Channels – help determine the current trend. If both are directed in the same direction, it means the trend is strong.

Moving Average Line (settings 20,0, smoothed) – determines the short-term trend and the direction in which trading should be conducted.

Murray Levels – target levels for movements and corrections.

Volatility Levels (red lines) – the probable price channel in which the pair will spend the next 24 hours, based on current volatility indicators.

CCI Indicator: Entering the oversold area (below 250) or the overbought area (above +250) means a trend reversal is approaching.