Thanks to a booming economy, the most stable Labour government in five years, and the Bank of England's deliberate pace, the GBP/USD pair has climbed to yearly highs. However, when Bloomberg revealed that inflation in the UK's services sector is slowing more than official data suggests, the chances of a rate cut in August sharply increased, leading to a wave of pound sell-offs. Its position no longer appears as solid as before, especially amid deteriorating global risk appetite.

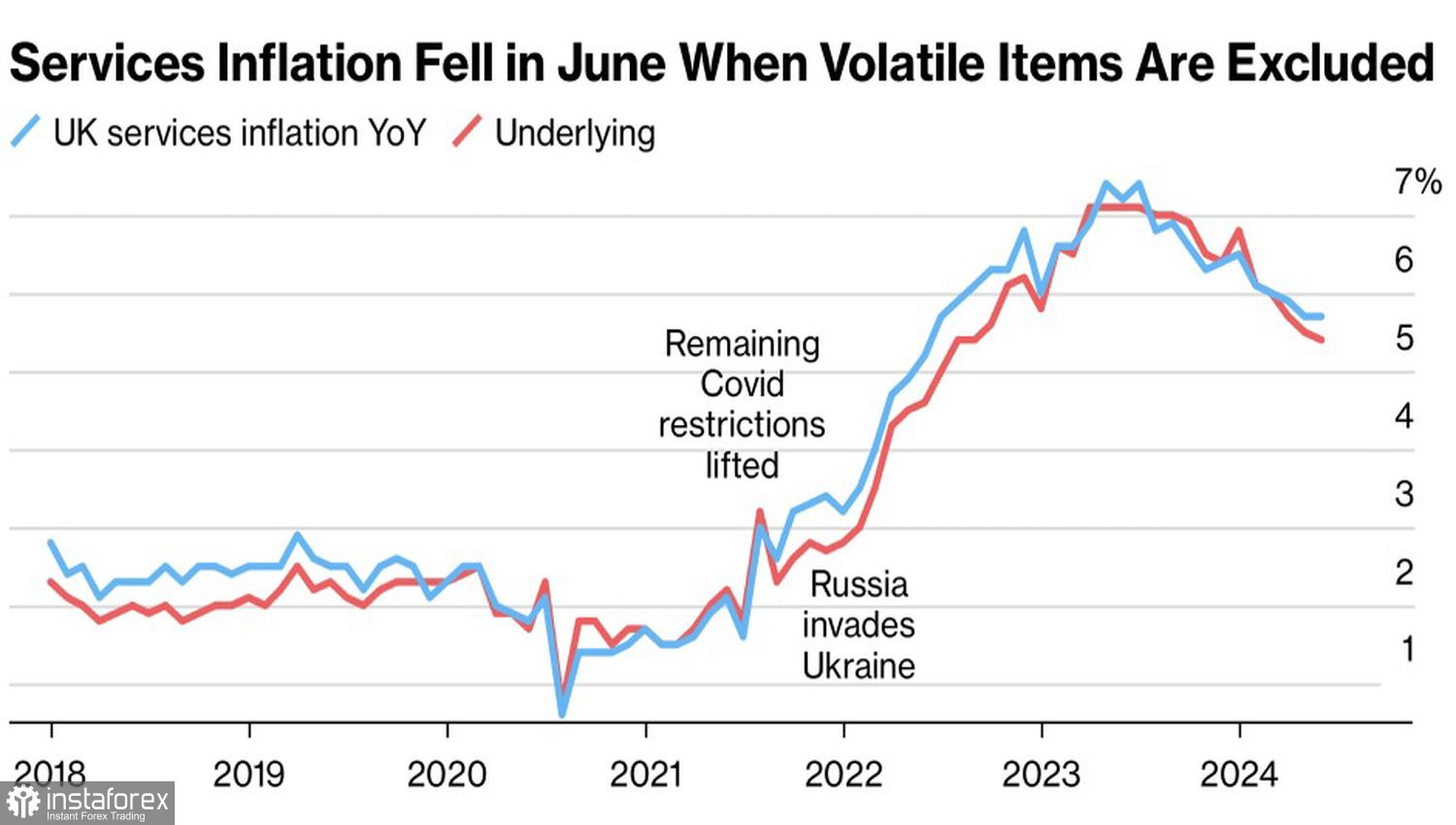

Dynamics of Inflation in the UK Services Sector

High service prices and wage growth rates have been strong arguments for keeping the bank rate at 5.25% at the BoE meeting on August 1. However, a Bloomberg study showed that, excluding volatile elements and the Taylor Swift concert, inflation in the services sector has slowed more than official data indicates. After this, the futures market raised the chances of the BoE starting monetary policy easing from 45% to 50% at the next meeting.

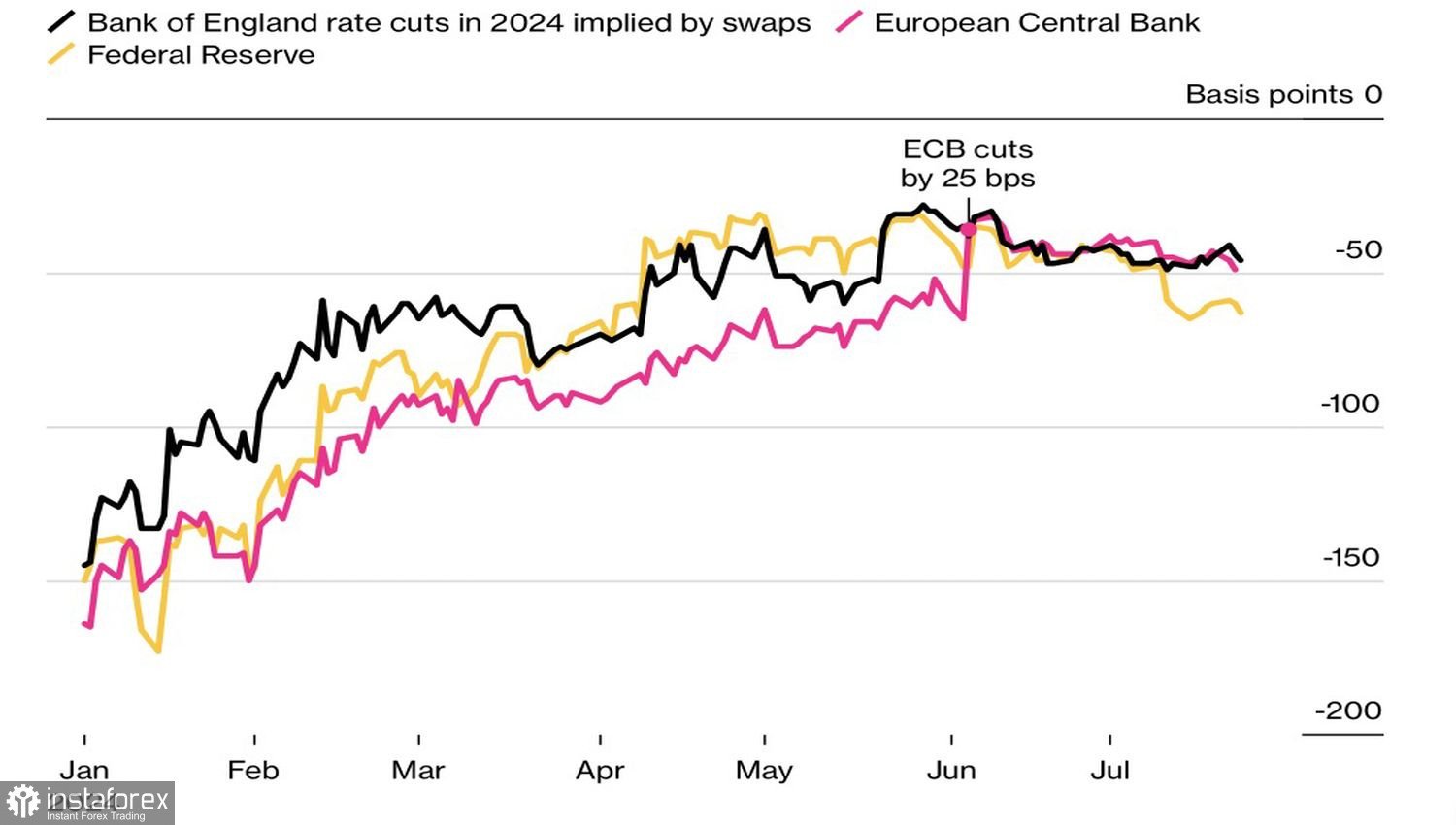

More than 80% of Reuters experts, or 49 out of 60, also believe that the BoE's signals about the upcoming rate cut have ended, and it's time to move from words to actions—lowering rates on August 1. Such a verdict with hints of a continuation of the cycle in 2024 will be a severe blow to GBP/USD. Currently, derivatives expect two rate cuts, fewer than those by the Federal Reserve or European Central Bank. This allows the pound to lead the G10 currency race for now.

Dynamics of Market Expectations for Central Bank Rates

The correction in U.S. stock indices, as well as concerns about Donald Trump's potential return to the White House after the November elections, is exerting pressure on the pound. Trump's protectionist policies risk slowing global economic growth and creating problems for pro-cyclical currencies.

The BoE meeting is far from the only event of the week that could lead to significant fluctuations in GBP/USD. The results of the Fed meeting will be announced on July 31, and data on the U.S. labor market will be released on August 2. The Fed is expected to provide hints about a possible rate cut in September, which would weaken the U.S. dollar against major world currencies. If U.S. employment figures also disappoint, the pound might experience a strong reaction.

If the BoE decides to keep the rate at 5.25%, contrary to Reuters' forecasts, GBP/USD might even be able to restore its upward trend. With so many potential scenarios, the Forex market will be interesting to watch.

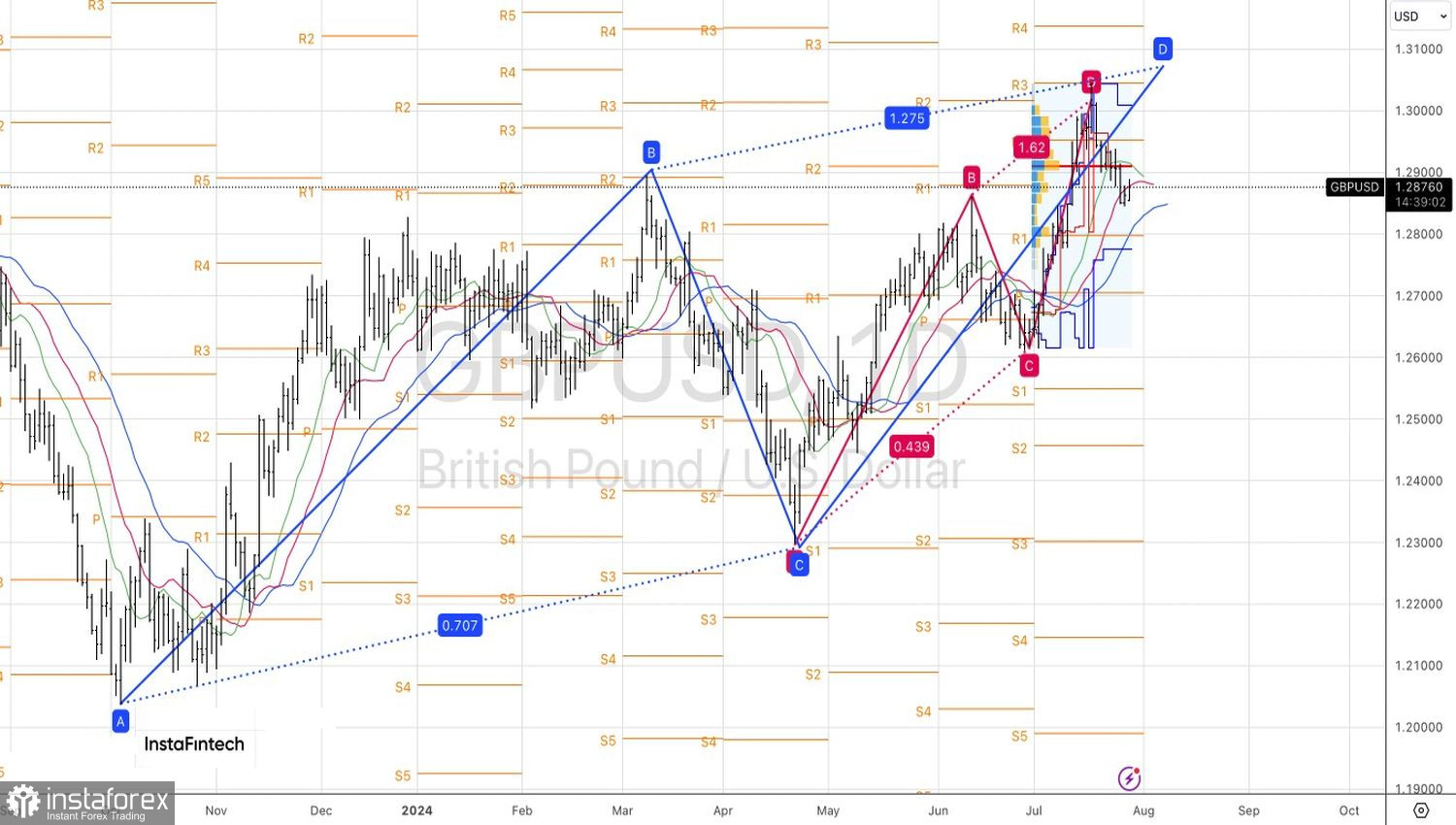

Technically, on the daily chart, GBP/USD shows a pullback to the bullish trend after hitting the target of 161.8% on the AB=CD harmonic trading pattern. Long positions will become valid if the pair returns above the fair value at 1.2910. An aggressive entry into longs - on the breakout of 1.2890 or on the rebound from 1.2800-1.2815.