The GBP/USD pair sustained its decline on Tuesday. Although this movement was somewhat sluggish, at least the price has been moving downwards for two weeks. We believe that the reasons for the decline are its overbought condition, the upcoming rate cuts by the Bank of England, and the unreasonable growth shown in the last three months. We have repeatedly mentioned how it was illogical for the pair to rise, and perhaps now is the time for justice to be restored.

There was no macroeconomic background in the UK yesterday, while in the U.S., only one report, the JOLTs, was published. Moreover, the pair started to decline before the release of this report. Therefore, technical sales likely resumed during the U.S. trading session. On Monday, the price failed to break through the Kijun-sen line in the 24-hour time frame, so a prolonged and strong pound decline is still in question. However, this week, we might theoretically get an answer to the question, "Can the pound fall another 300-400 pips?"

Today, the Federal Reserve will announce the results of its latest meeting. Although no one expects a rate cut from the U.S. central bank, and no one expects Fed Chair Jerome Powell to make statements about readiness to start lowering rates in September, the market may extract certain theses out of context that it finds favorable. In other words, the market might react strongly, even if no solid grounds exist.

The same applies to the BoE meeting on Thursday. If the British central bank lowers the key interest rate, as most market participants expect, it will be a reason to sell the pound now and continue selling it for a long time. If the BoE does not lower the rate on August 1st, it will be a great reason for the market to start buying the pound again, something it has enjoyed doing in recent months.

On Friday, we are expecting U.S. reports on non-farm payrolls and unemployment. It's probably needless to say that these reports could provoke another dollar collapse if the actual figures are even slightly below forecasts. Therefore, the last three days of the week could be quite "fiery," but which currency will ultimately appreciate is uncertain, as no one knows what Powell will tell the market, what decision the BoE will make regarding the rate, and what the U.S. reports will be like.

Unfortunately, there are often situations in the market where the price can move in any direction, making it simply impossible to predict its movement. We still lean towards a decline in the GBP/USD pair, so it makes sense to consider short positions, from which we will need to exit quickly if the incoming information does not favor the dollar. The British currency has a huge potential to fall, even if the current movement is a correction before a new round of the upward trend. The price could quickly drop to 1.2578 (the Senkou Span B line) on the daily time frame.

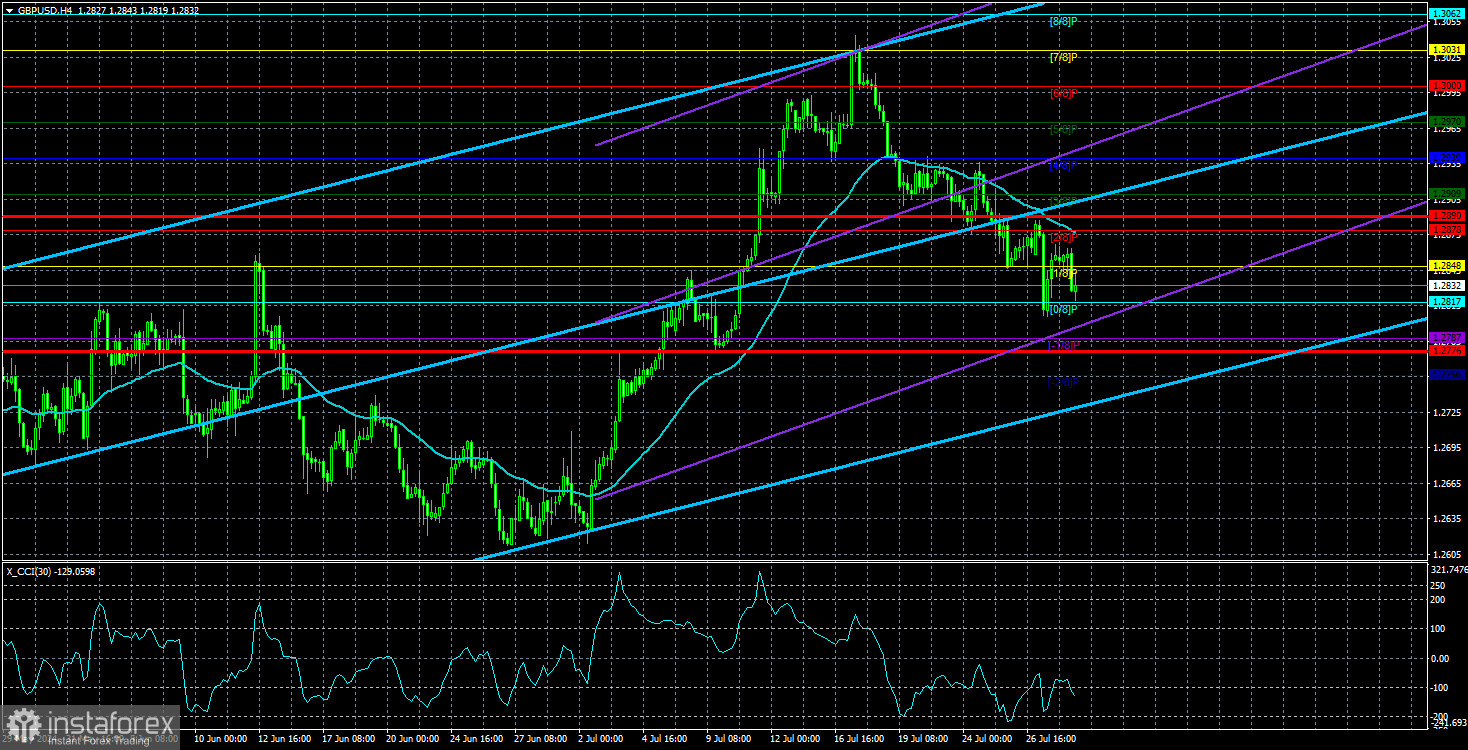

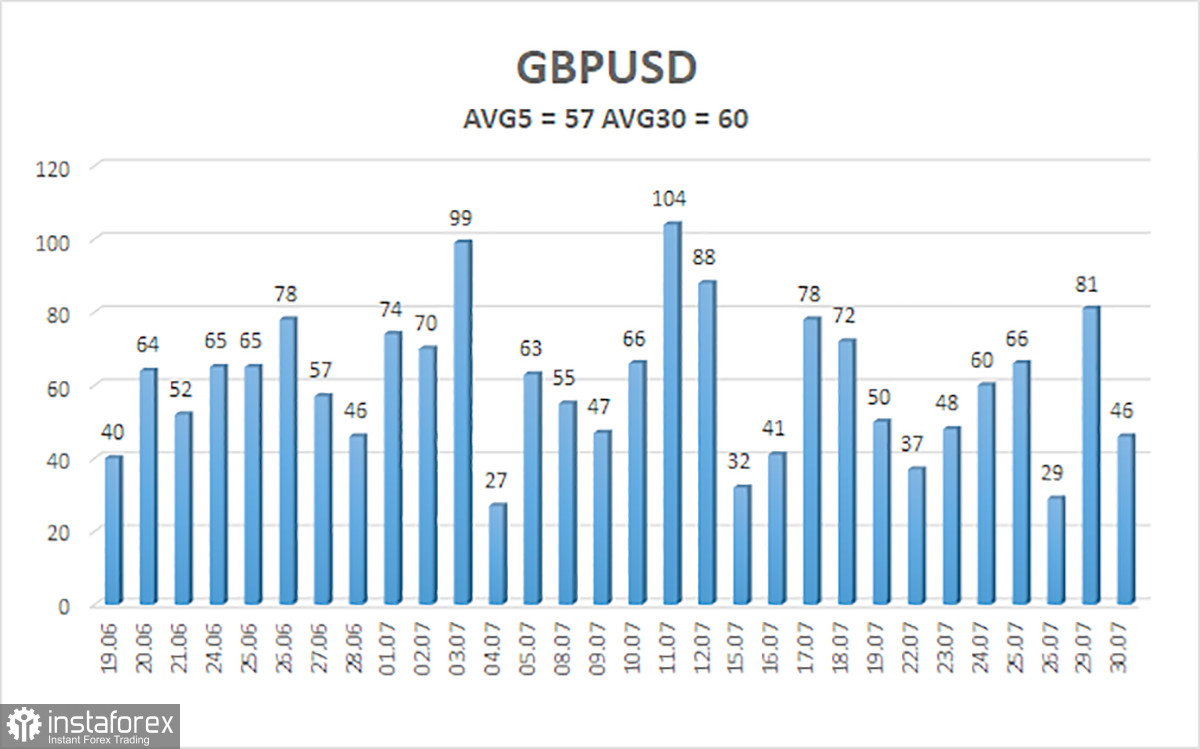

The average volatility of the GBP/USD pair over the last five trading days is 57 pips. This is considered a low value for the pair. On Wednesday, July 31, we expect movement within the range limited by 1.2776 and 1.2890. The higher linear regression channel is directed upwards, signaling the continuation of the upward trend. The CCI indicator has entered the overbought area twice, signaling a potential trend reversal. In addition, a bearish divergence has formed.

Nearest Support Levels:

- S1 – 1.2817

- S2 – 1.2787

- S3 – 1.2756

Nearest Resistance Levels:

- R1 – 1.2848

- R2 – 1.2878

- R3 – 1.2909

Trading Recommendations:

The GBP/USD pair continues to trade below the moving average line and has a real chance for a significant decline. Volatility remains low, but short positions are currently valid, with initial targets at 1.2787 and 1.2776. A bullish correction might occur, after which the decline is expected to resume. We are not considering long positions at the moment, as all the bullish factors for the British currency (which are not much) have already been factored in by the market multiple times. Even if the pound shows a new upward movement, it will not add logic to such a movement.

Explanations for Illustrations:

Linear Regression Channels: help determine the current trend. If both are directed in the same direction, it means the trend is strong.

Moving Average Line (settings 20,0, smoothed): determines the short-term trend and the direction in which trading should be conducted.

Murray Levels: target levels for movements and corrections.

Volatility Levels (red lines): the probable price channel in which the pair will spend the next 24 hours, based on current volatility indicators.

CCI Indicator: Entering the oversold area (below 250) or the overbought area (above +250) means a trend reversal is approaching.